Mortgage hack could help homeowners 'avoid early payment charges' but majority unaware of low rate deal

New data reveals most borrowers have never explored transferring their mortgage when moving home

Don't Miss

Most Read

Recent increases in fixed-rate mortgage products from major banks including Santander and HSBC have intensified concerns for property owners planning to relocate.

The rising borrowing costs pose a challenge for those hoping to move whilst retaining their existing mortgage arrangements.

Fresh research from David Wilson Homes shows that most property owners remain unaware of options that could shield them from escalating rates.

The findings highlight a knowledge gap at a time when autumn traditionally brings higher levels of housing market activity.

Many households are reluctant to move due to losing previously secured low interest rates

|GETTY

For many households, the prospect of abandoning favourable interest rates secured in previous years represents a major obstacle to moving home.

The research reveals that 78 per cent of British homeowners have never investigated whether they can transfer their mortgage to a new property.

Despite this lack of awareness, 68 per cent of respondents said they would prefer to maintain their existing mortgage arrangements when relocating.

Terry Higgins, managing director at the New Homes Group, said: "If you secured favourable interest rates on your previous home, porting your mortgage could be a smart move. It allows you to continue benefiting from your current rates and avoid Early Repayment Charges, which can run into the thousands."

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The findings suggest that many homeowners may be accepting higher borrowing costs unnecessarily - unaware that transferring existing mortgage terms remains an option with most UK lenders.

Mortgage porting allows borrowers to transfer an existing loan agreement to a new property, retaining their original interest rate and terms.

The process also helps avoid substantial early repayment penalties, which typically range between one per cent and five per cent of the total loan value.

Mr Higgins explained: "Porting a mortgage means transferring your existing mortgage product to your new property, allowing you to keep the same repayments and retain the original interest rate you agreed to."

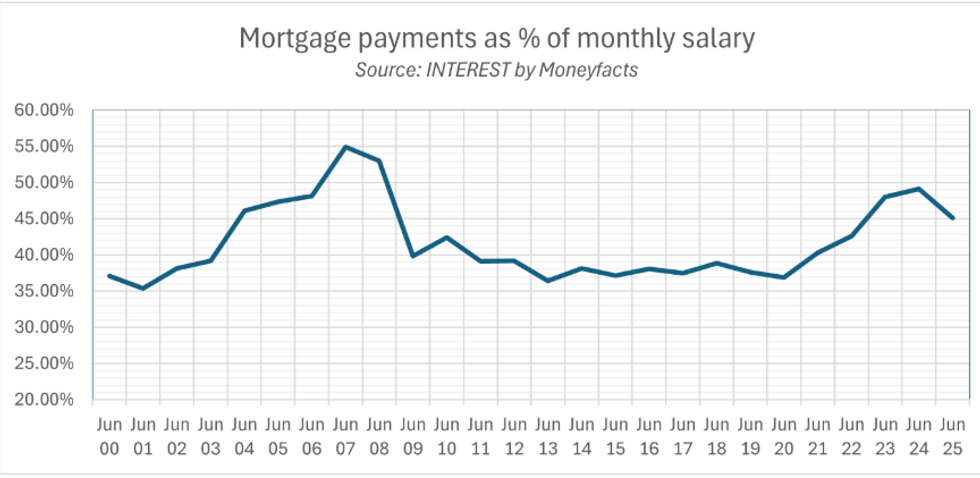

Analysis shows mortgage repayments now swallow nearly half of average earnings. | INTEREST BY MONEYFACTS

Analysis shows mortgage repayments now swallow nearly half of average earnings. | INTEREST BY MONEYFACTSFor higher-value properties, borrowers must secure additional financing to cover the price difference, though the original mortgage terms usually remain intact for the transferred portion.

Those downsizing to less expensive homes can still transfer their rate, although repayment fees may apply to the untransferred balance.

The porting process begins with confirmation from a lender or independent broker about eligibility.

Applicants must undergo full financial reassessment, as lenders require complete reapplication regardless of existing customer status.

The documentation mirrors that of an initial mortgage application, including identification, income verification and address confirmation. Financial changes such as altered earnings, credit history or household circumstances can significantly impact approval.

Borrowers considering more expensive properties must calculate revised repayments for the additional loan amount. Independent brokers can support applications once property reservations are in place.

Mr Higgins noted: "Even though you're an existing customer, you'll still need to reapply to prove you can afford the new mortgage."

Several factors may make mortgage porting unsuitable, according to the mortgage expert.

LATEST DEVELOPMENTS:

Financial changes such as altered earnings, credit history or household circumstances can significantly impact approval

| BOSHHH | GETTY IMAGESChanges in personal finances since the original loan approval could result in rejection, as lenders reassess income, credit and household details.

Mr Higgins warned: "A loss of income, a lower credit score, or even life changes such as having children could lead to your application being declined."

Market conditions may also offer more competitive rates than older arrangements, meaning retention of previous terms is not always beneficial.

Borrowers moving to more expensive properties can also face complexity with additional loans.

Mr Higgins explained: "The extra loan may be on a separate deal from your existing mortgage. This could mean having two different fixed rate end dates, which might be harder to manage over time."

More From GB News