Mortgage 'comeback' for Britain as interest rates could drop 'sub-3%' next year

The Bank of England is expected to cut interest rates once more in 2026

Don't Miss

Most Read

Mortgage brokers are forecasting that rates could dip beneath three per cent during the coming year, with industry experts declaring that 2026 appears poised for a significant turnaround in home lending.

Following inflation's unexpected decline to 3.2% earlier this month, advisers anticipate sub-3.5 per cent deals will emerge imminently as competition between lenders heats up.

The British housing market is expected to enter the new year on strong footing as banks intensify their battle for customers with interest rates widely expect to plummet.

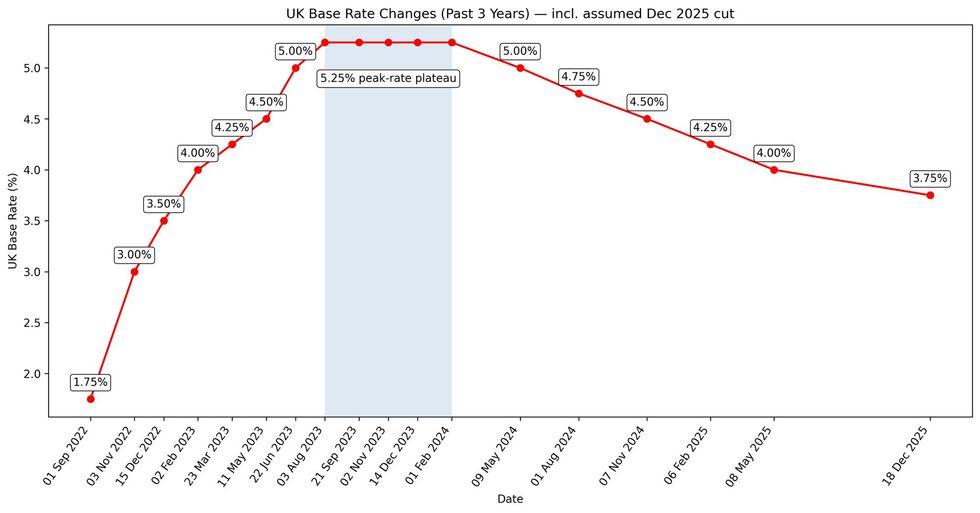

In recent years, mortgage holders have been forced to grapple with interest-hiked repayments as a result of the Bank of England Monetary Policy Committee's (MPC) wave of base rate hikes

Mortgage rates could drop 'sub-3%' next year

| GETTYThe central bank has opted to raise the cost of borrowing following the Covid-19 pandemic in an effort to ease the consumer price index (CPI) rate of inflation.

With inflation cooling down, the Bank has slashed rates from a previous high of 5.25 per cent to 3.75 per cent over the past year, which is being passed down to lenders.

Ranald Mitchell, director at Norwich-based Charwin Mortgages, told Newspage: "2026 has a mortgage comeback written all over it. We could genuinely see sub-three per cent headline deals for prime, low loan-to-value borrowers as lenders go to war for the best business."

Mr Mitchell emphasised that lending criteria improvements represent an equally significant development for the market.

Bank of England interest rate cuts to slow | GETTY

Bank of England interest rate cuts to slow | GETTYHe added: "But the bigger story is criteria. Smarter affordability, better recognition of real-world incomes and more pragmatic credit policy could bring thousands back into the market who have been locked out in recent years."

Ben Perks, the managing director at Stourbridge-based Orchard Financial Advisers, believes rates could enter the twos, particularly for lower-risk lending with smaller loan-to-value ratios.

He said: "Rates may well dip into the twos, especially for low loan-to-value, 'safer' lending. But I think banks will be reluctant to go too low."

Mr Perks cautioned that lenders and regulators would prioritise stability, noting that borrowers have previously struggled when transitioning from ultra-low fixed rates.

He continued: "I think lenders and the regulator will move more towards stability, as the last thing anyone wants to see is a borrower getting hammered by overnight rate increases when their fixed rate product ends."

Samuel Mather-Holgate, the managing Director at Swindon-based Mather and Murray Financial, noted that inflation is trending towards the Bank of England's two per cent target.

He said: "Are we seeing the return of the last decade with super low interest rates? Not really, but they are still declining and set for another one per cent fall over 2026. Eventually they might settle at about 2.5 per cent which is still significantly lower than the pre-financial crisis benchmark."

The Bank of England has made changes to the base rate in recent years | CHAT GPT

The Bank of England has made changes to the base rate in recent years | CHAT GPT Not all brokers share the optimism about rates falling so dramatically, however.

Justin Moy, Managing Director at Chelmsford-based EHF Mortgages, said: "I doubt rates will fall that low in 2026 for the majority of borrowers. There is already the odd buy-to-let deal or retention product below three per cent but with a nose-bleed of a product fee, it makes it difficult to stomach at the moment."

Mr Moy predicted the base rate would find equilibrium between 3.25 per cent and 3.5 per cent, with mortgage rates settling just above three per cent.

The stakes are considerable, with 1.9 million mortgages set to mature during 2026, requiring significant financial decisions from homeowners across the country.

More From GB News