Millions of savers to face £1,200 tax bill under new ISA reforms — Will you be one of them?

Rachel Reeves announces Labour will increase the rate of tax on property, savings and dividend income |

GB News

Chancellor Rachel Reeves’ changes to savings will increase liabilities for basic and higher-rate taxpayers

Don't Miss

Most Read

Latest

British savers face increased tax liabilities after Chancellor Rachel Reeves announced major reforms to ISA allowances and savings income rules in the Budget.

The Treasury’s measures alter both the annual cash ISA limit and the taxation of savings interest, creating higher future costs for basic and higher-rate taxpayers.

Research from investment platform InvestEngine shows around two million people who paid into cash ISAs during the 2022/23 financial year deposited more than £12,000.

These savers may now need to place money above the new threshold into standard savings accounts, where any interest earned will be taxed.

TRENDING

Stories

Videos

Your Say

The changes mark a significant shift in the Government’s approach to savings policy and will affect nearly 1.5 million basic-rate taxpayers and 462,000 higher-rate taxpayers who previously maximised their ISA contributions.

Under the Chancellor’s plans, the cash ISA contribution limit will fall from £20,000 to £12,000 from April 2027.

Alongside this reduction, new tax rates on savings income will begin next tax year.

Basic-rate taxpayers will face a 22 per cent levy on interest, while higher-rate taxpayers will face a 42 per cent rate.

This combination will create financial pressure for those who regularly saved up to the previous limit.

The £8,000 difference between the current and future cash ISA allowances will have to be held elsewhere, usually in taxable savings accounts.

Andrew Prosser, head of investments at InvestEngine, said: "Our analysis shows that millions of savers regularly deposit more than £12,000 a year into cash ISAs.

"This cut to the allowance could push many into paying unnecessary tax on their savings interest".

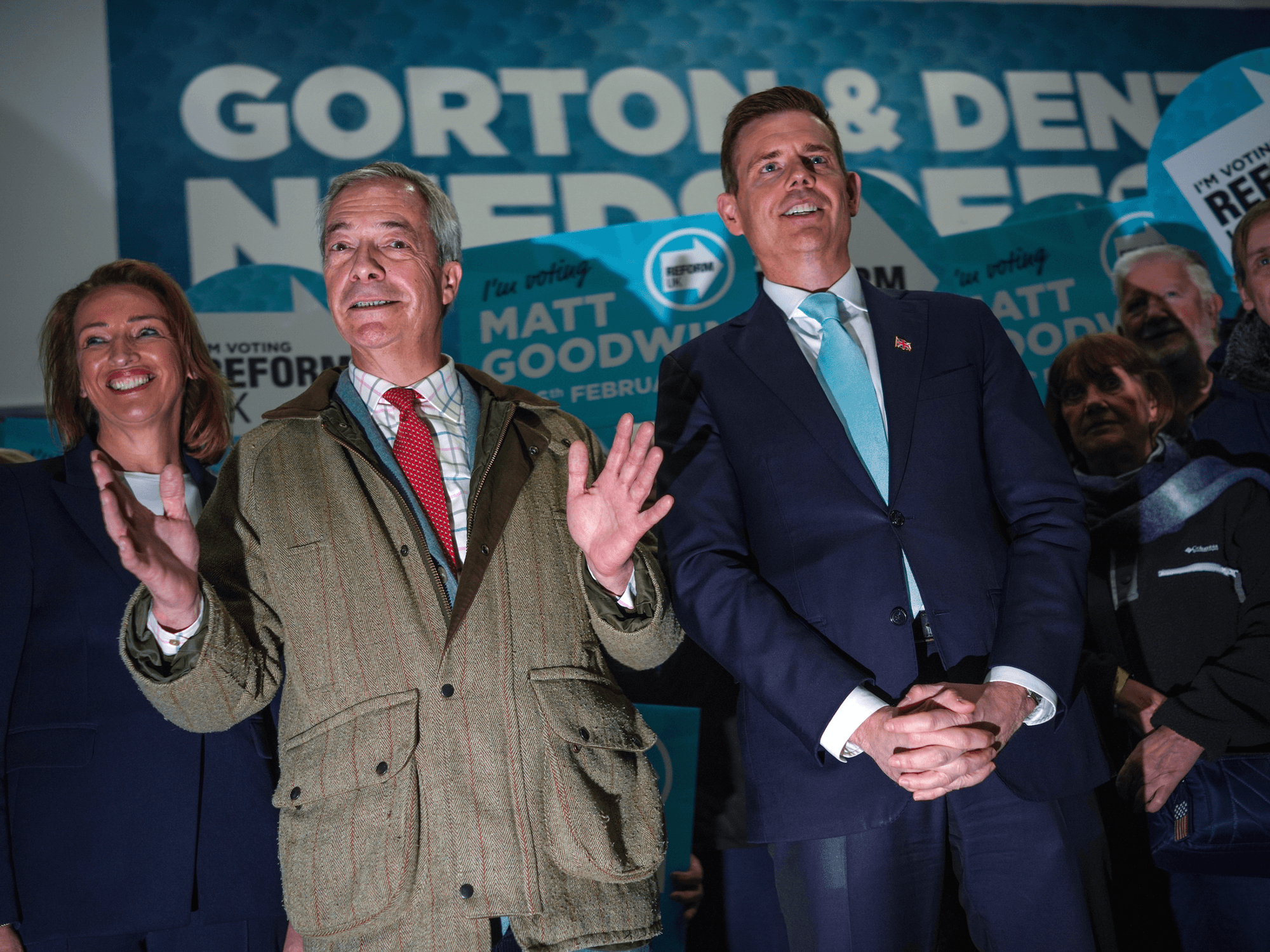

British savers face increased tax after the Chancellor announced major reforms

|GETTY

For basic-rate taxpayers saving £8,000 annually outside an ISA, interest at 4.5 per cent will initially fall within the £1,000 personal savings allowance.

Their first-year return of £360 remains below the threshold.

By the third year, however, savings of £24,000 generate interest of £1,080.

That exceeds the allowance by £80 and results in a tax payment of £18 under the new 22 per cent rate.

By year four the tax liability climbs to £97. In year five it rises again to £176.

Over five years, these savers will pay a total of £290 in tax, despite previously benefiting from tax-free ISA growth.

LATEST DEVELOPMENTS

The same changes create far greater burdens for higher-rate taxpayers

| GETTYWith a personal savings allowance of £500, higher earners exceed their threshold after only two years of saving £8,000 annually in standard accounts.

At 4.5 per cent interest, second-year earnings of £720 exceed the threshold by £220, triggering a £92 tax charge under the new 42 per cent rate.

By the third year, liabilities rise to £244, climbing further to £395 in the fourth and £546 in the fifth. Over five years, this group will face a total tax bill of £1,277.

The calculations highlight how the Treasury’s reforms will have a substantial impact on long-term savers who previously benefited from the full ISA allowance.

Financial experts advise channeling savings over £12,000 into stocks and shares ISAs

| GETTYSome financial experts suggest that savings above £12,000 could instead be placed into stocks and shares ISAs.

Mr Prosser said: "By shifting part of their allowance - anything over £12,000 - into a stocks and shares ISA, savers can preserve the tax benefits of the full £20,000 limit while giving their money a chance to benefit from inflation-beating growth".

However, research from Nottingham Building Society shows only 38 per cent of cash ISA holders would consider switching into investment products.

Harriet Guevara, chief savings officer at Nottingham Building Society, said: "Millions of savers rely on cash ISAs as a low-risk way to build financial stability.

"Two thirds of our cash ISA customers have used the full £20,000 allowance so far this year.

"These are not people with excess wealth, they are individuals and families working hard to save for the future."

Our Standards: The GB News Editorial Charter

More From GB News