Interest rate cuts PAUSED for US economy as inflation 'remains elevated' in blow to Donald Trump

President Trump has called on the US central bank to cut interest rates faster and to a lower level

Don't Miss

Most Read

The US Federal Reserve has announced the country's base rate will remain at its current level in a blow to President Donald Trump's economic agenda amid his ongoing feud with the financial institution's chairman, Jerome Powell.

Interest rates have been hiked globally by central banks, including the Bank of England, in an effort to ease inflation; however, the cost of borrowing has begun to be come down over the past year.

After three consecutive cuts last year, the Federal Open Market Committee (FOMC) has set the US base rate to a range of 3.50 per cent to 3.75 per cent, and will remain at this level.

The Trump administration has singalled its desire to bring down interest rates in an effort to bolster the US economy, however experts have warned this could be inflationary.

The Fed has refused to cut interest rates in a blow to Donald Trump's economic agenda

|GETTY

In a ten-to-two vote, the FOMC's members voted to keep the base rate at its current range, noting that inflation in the US "remains elevated". In the 12 months to December 2025, the consumer price index (CPI) inflation rate came to 2.6 per cent.

On today's announcement from the Fed, MHA's economic adviser Joe Nellis shared:m "The US Fed’s decision to hold interest rates unchanged sends a clear message to the President, consumers, markets and businesses: inflation risks are easing, but at 2.7 per cent the job is not yet finished.

"The decision reflects growing confidence that disinflation and sustainable growth are gradually becoming embedded. The IMF has recently raised its growth forecast for the US to 2.4 per cent this year, labour markets are cooling gradually, and wage pressures are becoming more consistent with the Fed’s two per cent inflation target.

"Holding rates steady allows these trends to continue working through the system.The Fed’s decision to hold is good news for business leaders. Stability in interest rates reduces uncertainty around financing costs, investment planning, and balance-sheet management.

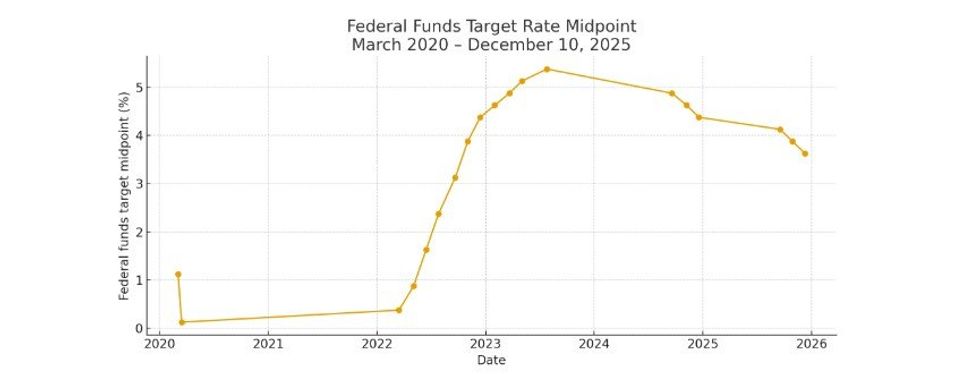

How has the Federal Funds Rate changed? | Federal Reserve / Chat GPT

How has the Federal Funds Rate changed? | Federal Reserve / Chat GPT LATEST DEVELOPMENTS

"While borrowing costs remain above pre-pandemic rates, the absence of further tightening lowers the risk of a sharp credit squeeze in 2026. That should support capital expenditure decisions, particularly in sectors sensitive to interest rates such as construction, manufacturing, and technology investment.

"However, this is not yet an ‘all-clear’ signal. The Fed has frequently stressed that rate cuts are not guaranteed or imminent. Policy remains restrictive, and companies should not expect a rapid return to ultra-cheap money.

"Instead, 2026 is shaping up as a year of renewed growth, where productivity, pricing power, and cost discipline matter more than leverage.In short, today’s decision is good news — but measured news.

"It reduces downside risk to the US economy in 2026 without reopening the inflation chapter the Fed is keen to close after a challenging post-pandemic period.For businesses, the message is simple: plan for stability, not stimulus, and treat predictability as the quiet competitive advantage it really is.

Donald Trump has called for interest rates to be cut to a lower level

| REUTERSInvestors are preparing for President Trump's pick to be the next Fed chair, which is expected to be announced imminently, after Mr Powell's term comes to an end in May.

Under the Trump administration, the Justice Department has launched a criminal investigation into the current Federal Reserve chairman, which focuses on testimony he gave last summer on renovations at the Fed headquarters, which has gone over budget.

The President alleges Mr Powell committed fraud, however the Fed chair has said that the renovations were necessary safety upgrades to decades-old buildings.

More From GB News