Interest rates cut: Recession warning as top economist says Bank of England move falls short - ‘I would have welcomed more’

Patrick Minford says the global economic picture remains 'grim'

Don't Miss

Most Read

Latest

The Bank of England has cut its base rate from 4.5 per cent to 4.25 per cent, but a leading economist has warned this reduction may not be enough to stave off a looming recession.

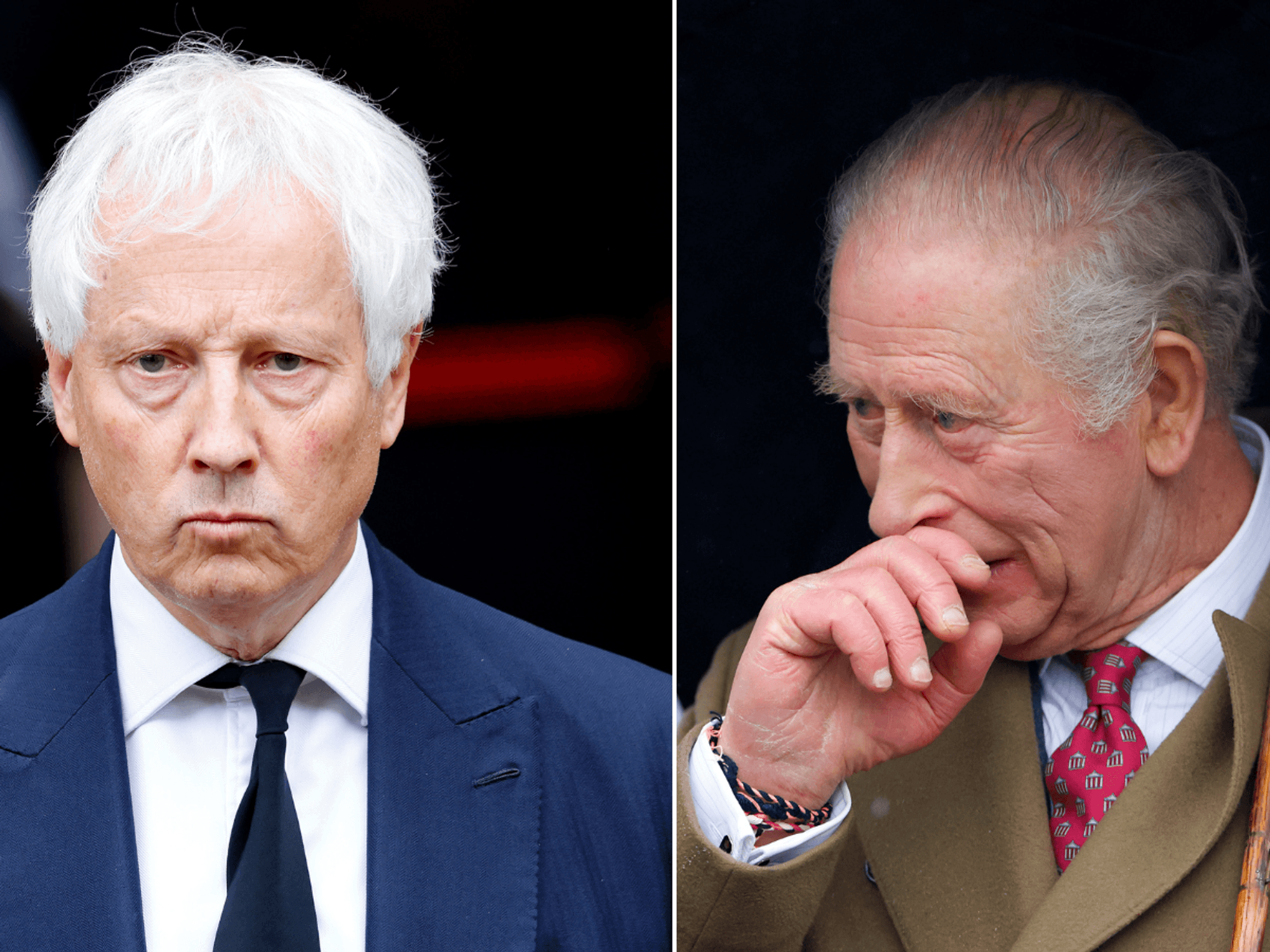

Patrick Minford, who previously advised Margaret Thatcher, believes the central bank should have gone further with its rate cut.

The move comes as economists express growing concerns about the impact of Donald Trump's "Liberation Day" tariffs on global economic growth.

The Bank's decision follows a steady decline in interest rates from their peak of 5.25 per cent in August 2023.

Patrick Minford has delivered his verdict on the interest rates cut

|GB NEWS / PA

Most economists had predicted today's cut, though some had anticipated a larger reduction to four per cent.

Speaking to GB News, Minford said: "I would have welcomed more [of a cut to base rates] actually."

LATEST DEVELOPMENTS

Bank of England interest rate DROPS to 4.25% in win for thousands of homeowners - but inflation pressure mounts

Bank of England interest rate DROPS to 4.25% in win for thousands of homeowners - but inflation pressure mountsHe explained that the Bank of England had "cut the rate of growth, the money supply, very substantially about six months ago" which typically signals a reduction in inflation.

"I think they can be more confident in cutting rates now as a result of what they have done before to correct their previous mistakes," Minford added.

The economist noted that the government would welcome the decision, as "the Bank is in an important position to try and stabilise the economy."

"At the moment, the priority is to try and stop the recession gathering pace," he warned.

Patrick Minford joined Emily Carver and Tom Harwood on GB News

|GB NEWS

Minford expressed particular concern about Trump's tariff policies, stating: "Things are a bit grim with the Trump debacle over Tariffs."

He warned that these tariffs are "causing a recession worldwide and it's driving down the price of oil, gas and energy."

The economist believes this economic downturn is likely to "spill over to us" in the UK.

He described the situation as "an American own goal" and "self-harm by the US," resulting in "rising inflation and rise in output and employment."

These global economic challenges come as the UK-US trade deal was expected to be confirmed today.

The UK's inflation rate fell to 2.6 per cent in March, down from 2.8 per cent in February, but remains above the Bank's two per cent target.

For homeowners, the impact of the rate cut will vary by mortgage type. Those with tracker mortgages will see monthly repayments decrease by around £29.

Standard variable rate mortgage holders must wait to see if lenders pass on the reduction.

The 1.8 million fixed-rate mortgages expiring in 2025 won't be immediately affected.

Savers may see returns diminish in coming weeks. Currently, the best cash ISA rate is 5.07 per cent from Trading 212, while top easy-access accounts from Sidekick and Chip pay 4.76 per cent.