Rachel Reeves 'hammering' working Britons with tax raids while 'protecting pensioners'

The Chancellor's decision to freeze tax allowances will result in millions of working-age people paying more to HMRC

Don't Miss

Most Read

Chancellor Rachel Reeves stands accused of "hammering" working people through stealth taxation while simultaneously boosting incomes for pensioners and benefit claimants, according to fresh analysis from the Centre for Policy Studies (CPS).

The centre-right think tank examined the impact of extending the freeze on income tax and National Insurance thresholds through to 2031, a policy that pulls earners into higher tax brackets as their wages rise over time.

Using Office for Budget Responsibility (OBR) projections for inflation and wage growth, the CPS concluded that employees will find themselves financially worse off by the end of the decade compared to those receiving state income.

The analysis reveals that an individual currently earning £50,000 annually will be £505 poorer in real terms by 2030-31, even though their pay packet is projected to grow by more than £6,000 over the same period.

The Chancellor has been accused of 'hammering' working-age Britons with stealth taxes

|GETTY

This phenomenon, known as fiscal drag, occurs when tax thresholds remain static while salaries climb, gradually pushing workers into higher tax bands without any formal rate increase.

The CPS described this as taxation "through the back door," noting that weak wage growth forecasts combined with frozen thresholds create conditions where "many workers will be worse off by 2030 than they are today".

Analysts from the think tank found that the picture looks considerably brighter for those dependent on state income, namely pensioners and benefit claimants.

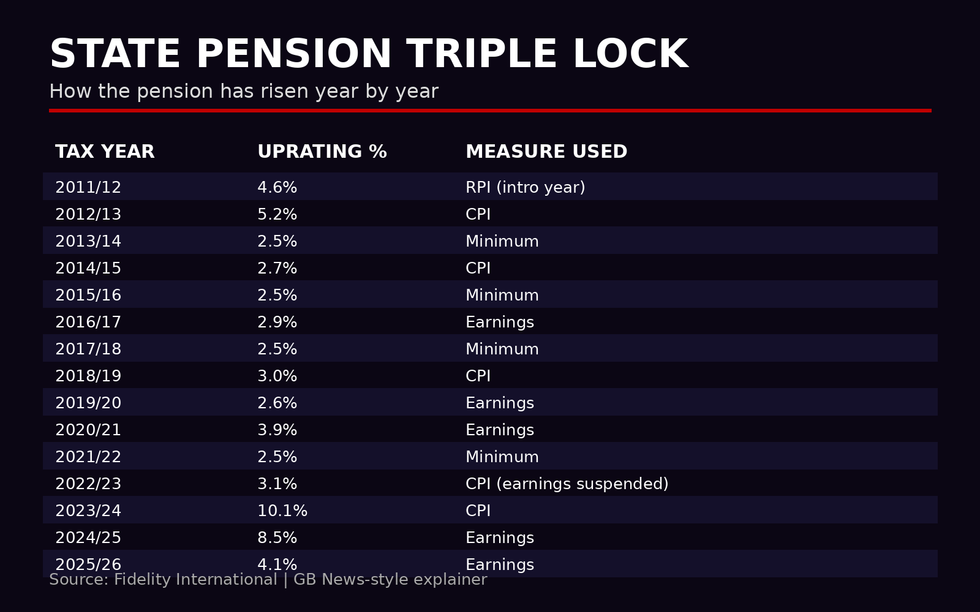

Pensioners stand to gain between £306 and £537 in real terms by 2030-31, protected by the triple lock mechanism that guarantees annual increases matching inflation, earnings growth, or 2.5 percent.

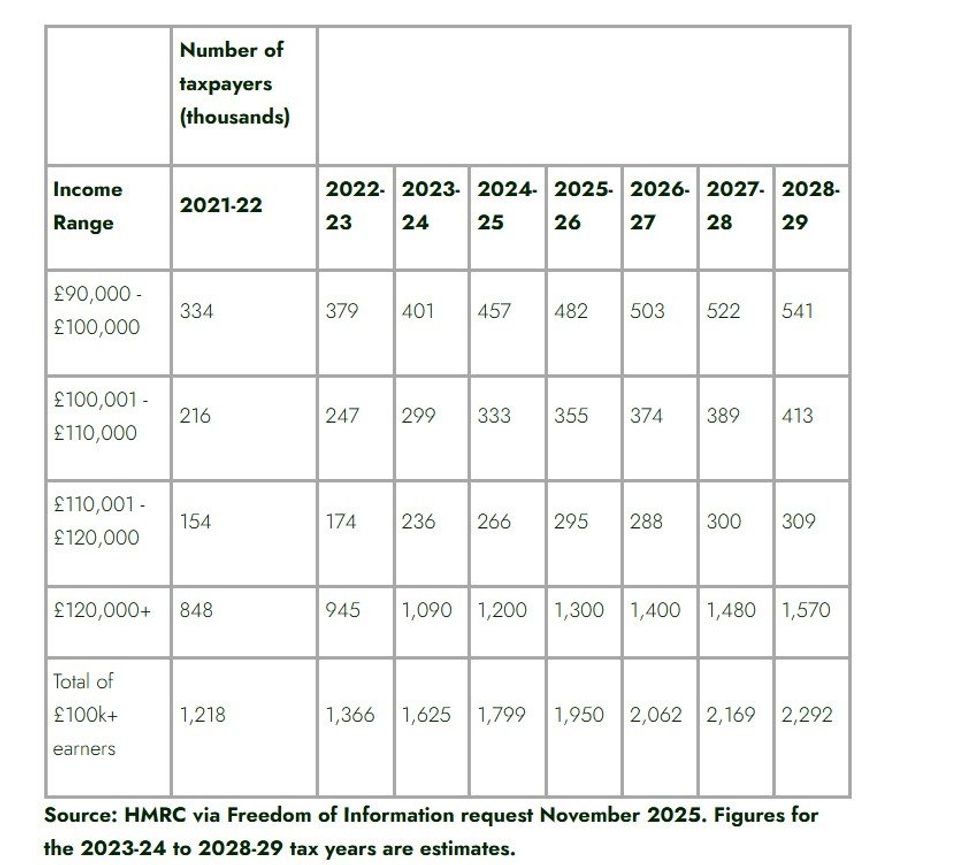

How many people will be pulled into higher tax brackets? | RATHBONDES / HMRC

How many people will be pulled into higher tax brackets? | RATHBONDES / HMRC Should the Chancellor follow through on indications she will shield state pension recipients from income tax once payments exceed the personal allowance, the higher figure applies.

Universal credit claimants on the standard rate can expect to be £290 better off.

Daniel Herring, CPS head of economic and fiscal policy, said: "Labour's tax policy is quietly hammering workers while protecting pensioners and benefit recipients."

He added: "Freezing the personal allowance for income tax will hit everyone, but it's those who are dragged into higher tax bands who will really suffer, to the point where a worker on £50,000 today is set to actually be poorer in five years' time, despite getting pay rises."

The threshold freeze is projected to generate approximately £23billion for Treasury coffers by 2030-31.

Defending the policy, a Treasury spokesman pointed to Budget measures including increases to the national living wage and minimum wage, £150 reductions on energy bills, and frozen prescription charges, fuel duty and rail fares.

The spokesman stated these "fair and necessary decisions" would enable delivery on priorities including cutting NHS waiting lists and reducing debt.

Business leaders have previously warned that the Chancellor's decision to freeze tax thresholds, while raising National Insurance paid by employers, is "chocking the job market".

How much has the state pension risen by thanks to the triple lock? | GB NEWS / FIDELITY INTERNATIONAL

How much has the state pension risen by thanks to the triple lock? | GB NEWS / FIDELITY INTERNATIONAL Frances Li, the founder and director of Biscuit Recruitment, said: "Tax rates haven’t risen, but many people will be paying more tax than ever.

"The threshold freeze has already acted as an invisible pay cut, and now that it’s been extended to 2030, it could discourage more workers from moving jobs or seeking promotion.

“Fiscal drag doesn’t just affect individuals — it affects the economy,” she explains. “When people delay promotions or stay in roles longer than planned, employers struggle to hire, sectors struggle to grow, and innovation slows. Skilled candidates are becoming more hesitant, and that’s creating friction across the talent pipeline.

“We’re hearing more professionals ask: What’s the point of progressing if most of it goes to tax? That hesitation is becoming common, especially among skilled workers approaching the next tax bracket."