Inheritance tax rakes in £5.2bn for Treasury in 2025 as Britons brace for pensions raid

Expert Steve Bish explains ways to reduce inheritance tax |

GB NEWS

The tax will soon be applied to peoples' pension pots under changes introduced by Chancellor Rachel Reeves

Don't Miss

Most Read

Latest

Treasury coffers have swelled with inheritance tax (IHT) contributions totalling £5.2 billion during the initial seven months of the current financial year, based on new Government data.

The latest figures from HM Revenue and Customs (HMRC) show an increase of £200million compared with the corresponding period in the previous year.

This uptick maintains a pattern of growth in death duties that has persisted for twenty years, with collections continuing their steady climb as more estates fall within the tax net.

The data emerges just days before the Chancellor delivers next Wednesday's Budget, where further changes to the inheritance tax system could be announced.

The Treasury has raked in £5.2billion from inheritance tax so far this year

|GETTY

Last year, Rachel Reeves confirmed pension assets would be made liable for inheritance tax by April 2027, which analysts warn could impact peoples' retirement planning.

Stephen Lowe, the director at Just Group, said: "Inheritance Tax remains a goldmine for the Treasury and looks set to offer the Chancellor another bumper year with takings driven by rising asset prices, frozen thresholds and a tightening of the exemption regime announced at the Autumn 2024 Budget."

The wealth management expert highlighted how property values and other asset prices have pushed more families above the tax-free allowances, which have remained static.

Mr Lowe added: "This trend of record-beating receipts looks set to continue given reforms announced at last year's Budget are still to be implemented and rumours abound that the IHT regime will once more be in the Chancellor's revenue-raising Red Box next Wednesday."

Rachel Reeves is preparing her latest Budget statement for November 26 | PA

Rachel Reeves is preparing her latest Budget statement for November 26 | PAFrom April 2027, retirement savings held in pension funds will become subject to death duties for the first time, while reductions to agricultural and business property reliefs take effect from April next year.

Ian Dyall, the head of estate planning at wealth management firm Evelyn Partners, noted: "IHT reforms announced at the last Budget, including bringing unspent pension pots into the scope of IHT from April 2027 and slashing agricultural and business property reliefs from next April, have yet to take effect."

These modifications will significantly expand the number of estates liable for the 40 per cent levy.

The pension changes have prompted wealthy savers to reassess their retirement planning strategies, with many withdrawing funds early to avoid potential double taxation.

Mr Dyall explained: "The forthcoming inclusion of unspent pension assets in estate has caused many big savers to start withdrawing pension cash and either spending it, giving it away or finding alternative tax-efficient homes for it."

He cautioned against hasty decisions: "While in some cases this might make perfect sense, we would always recommend seeking estate planning advice early in retirement and forming a long-term plan around the transfer of wealth."

Mr Lowe emphasised the importance of obtaining current valuations: "In a changing tax environment, it is important that anyone who is uncertain or concerned that their estate may be subject to inheritance tax gets an up-to-date valuation of their estate, including a recent assessment of their property wealth."

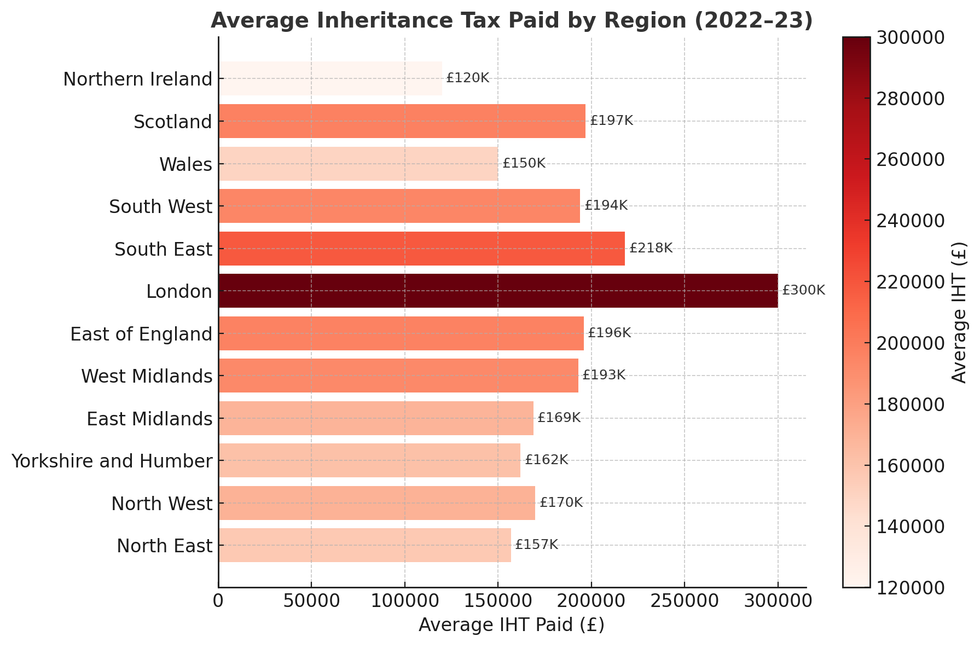

Average Inheritance tax paid by region | CHATGPT/ONS

Average Inheritance tax paid by region | CHATGPT/ONSWhat is inheritance tax?

This HMRC levy is charged on the estates of individuals, which includes their money, estates and property, which are valued above the tax-free threshold.

The tax is applied to the estates of those who pass away and is only charged on the portion of the estate that exceeds the threshold of £325,000.

While the standard rate of inheritance tax is 40 per cent, a reduced rate of 36 per cent may apply if the deceased leaves 10 per cent or more of the net value of their estate to charity.

There is an additional threshold of up to £175,000 is available if a home is left to direct descendants, potentially creating a total tax-free allowance of £500,000 per individual. However, this residence nil-rate band is tapered away for estates worth more than £2million.

More From GB News