Inheritance tax: Gifting rules explained as retirees rush to tie the knot before Rachel Reeves's pension grab

Married couples and civil partners benefit from spousal exemption

Don't Miss

Most Read

Retirees across Britain are rushing to wed before Rachel Reeves's inheritance tax overhaul takes effect in April 2027, with family lawyers reporting a notable uptick in enquiries from long-term cohabiting couples.

The Chancellor's October 2024 Budget announcement that pension pots would be included in inheritance tax calculations has prompted many unmarried partners to reconsider their status.

Under current rules, married couples and civil partners benefit from spousal exemption, allowing them to share tax-free allowances and potentially transfer up to £1million to the next generation without triggering the 40 per cent levy.

For an unmarried partner inheriting a £100,000 pension, tying the knot could mean avoiding a £40,000 tax bill entirely.

Steve Jenner, 69, and Shirley Stepney, 74, from Hampshire, are among those who have taken the plunge after nearly three decades together.

Having both experienced failed marriages previously, the couple had seen little reason to formalise their relationship until a meeting with their financial adviser in February changed everything.

"All of a sudden, he said, 'You realise, Steve, you've got a big inheritance tax problem,'" Mr Jenner recalled.

His final salary pension, the adviser explained, would expose them to the 40 per cent charge once the new rules came into force.

Inheritance tax can be reduced by giving gifts - but rules do apply | GETTY

Inheritance tax can be reduced by giving gifts - but rules do apply | GETTY"And at this point he virtually proposed to my now-wife on my behalf," Mr Jenner said. "At the end of the conversation I put the phone down and turned to my wife and said, 'will you marry me?' And she said, 'If I have to!'"

The pair eloped in September with just two friends as witnesses.

"We thought that was the easiest thing to do. The wedding was quite relaxed and low-key," Mr Jenner added. "The registrar said, 'you'd be amazed how many older people we are marrying now.'"

Legal professionals confirm this pattern is widespread. Elliot Lewis of Thackray Williams said: "We're talking to more older unmarried clients who are considering getting married to protect their pension pots to ensure their partners will have a secure financial future when they pass. We expect marriages among retirees to increase through 2026 ahead of the 2027 tax changes."

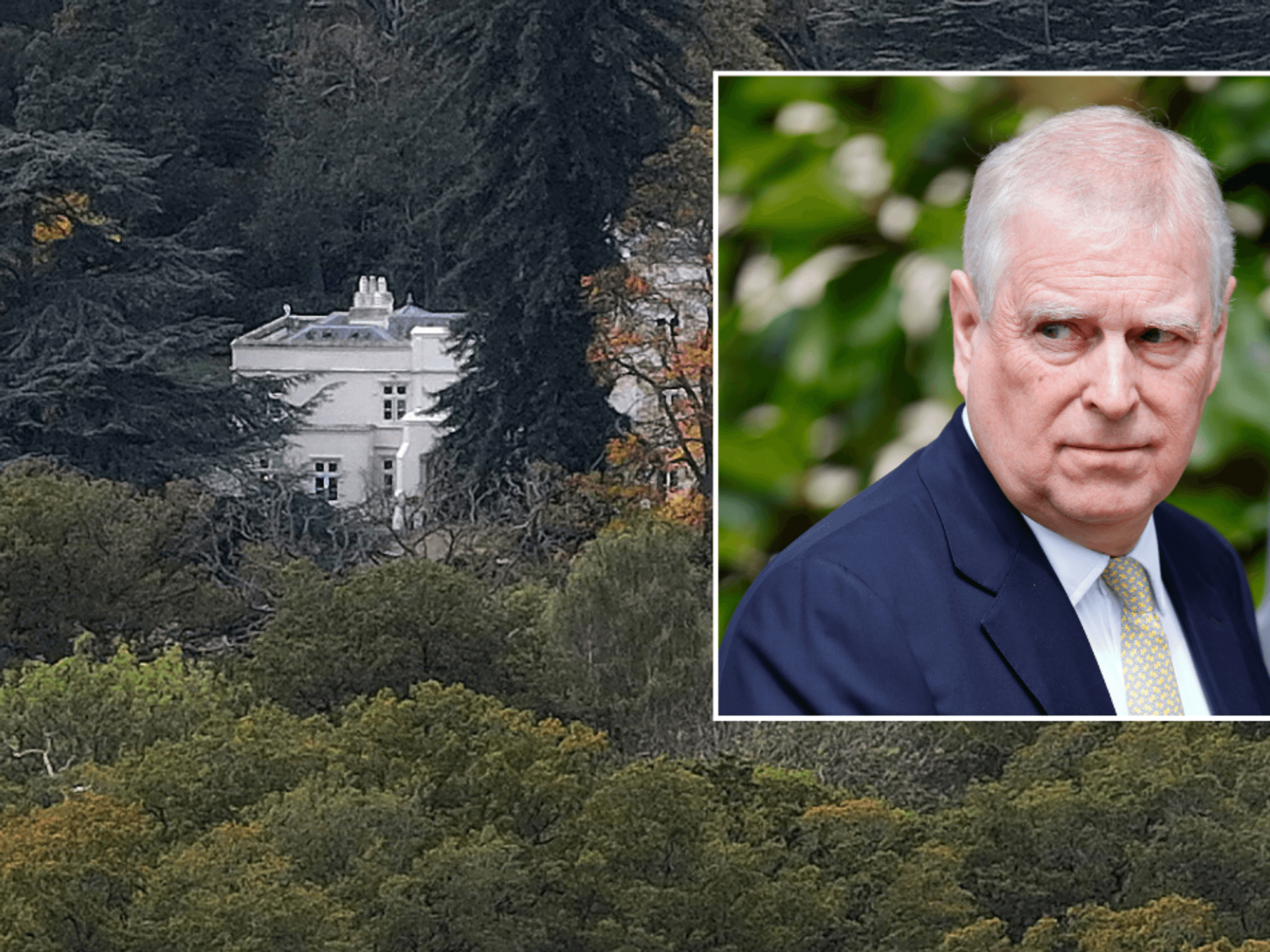

There has been an increase in the number of older couples choosing to marry

| GETTYJudit Kerese of Stowe Family Law noted: "We're seeing a marked increase in older couples choosing to marry, especially after significant periods of living together unmarried, not purely for romantic reasons, but for tax certainty."

Ms Kerese recently drafted a prenuptial agreement for a 60-year-old client with substantial property holdings and £100,000 in pension savings who was marrying specifically to reduce their inheritance tax exposure.

Inheritance tax is charged at 40 per cent on estates above £325,000, with homeowners able to access an additional £175,000 residence nil-rate band when leaving their main home to direct descendants.

These allowances can be combined between spouses, allowing married couples or civil partners to pass on up to £1 million tax-free, with no inheritance tax due on the first death if the estate is left entirely to the surviving partner.

Experts are warning that families could face a wave of new inheritance tax bills in the coming years unless they act now | GETTY

Experts are warning that families could face a wave of new inheritance tax bills in the coming years unless they act now | GETTY Unused allowances can also be transferred between spouses, but this protection does not apply if assets are left to other beneficiaries, such as siblings or unmarried partners, which can significantly reduce the available tax-free amount.

The Treasury estimates recent pension reforms will draw tens of thousands more families into the inheritance tax net by 2030.

Lifetime gifts, particularly non-cash assets like property or shares, may also trigger Capital Gains Tax, meaning professional advice is often needed to avoid unexpected tax bills.

Receipts from the levy are forecast to climb from £8.3billion in 2024-25 to £14.5billion by 2030-31.