Scrapping inheritance tax would be ‘win-win’ situation, claims former Tory minister

Tory ministers have floated the idea of abolishing inheritance tax ahead of the next General Election

Don't Miss

Most Read

Scrapping inheritance tax (IHT) would be a “win-win” for families and the Government, a former Conservative minister has claimed.

Ranil Jayawardena MP said Sweden’s abolition of the levy has led to increased tax revenue for the country.

The parliamentary representative for North East Hampshire made the comments following last week’s Spring Budget announcement from Chancellor Jeremy Hunt.

Based on HM Revenue and Customs (HMRC) figures, estates from less than four perc cent of all deaths in the UK paid IHT in 2020/21, which raised £5.76billion in tax that year.

Inheritance tax is controversial levy on someone’s estate, which includes their money, possessions and property, after they have passed away.

It is charged at a tax rate of 40 per cent on the part of the estate which is valued above the £325,000 threshold. Any estates valued below this amount do not need to pay inheritance tax.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

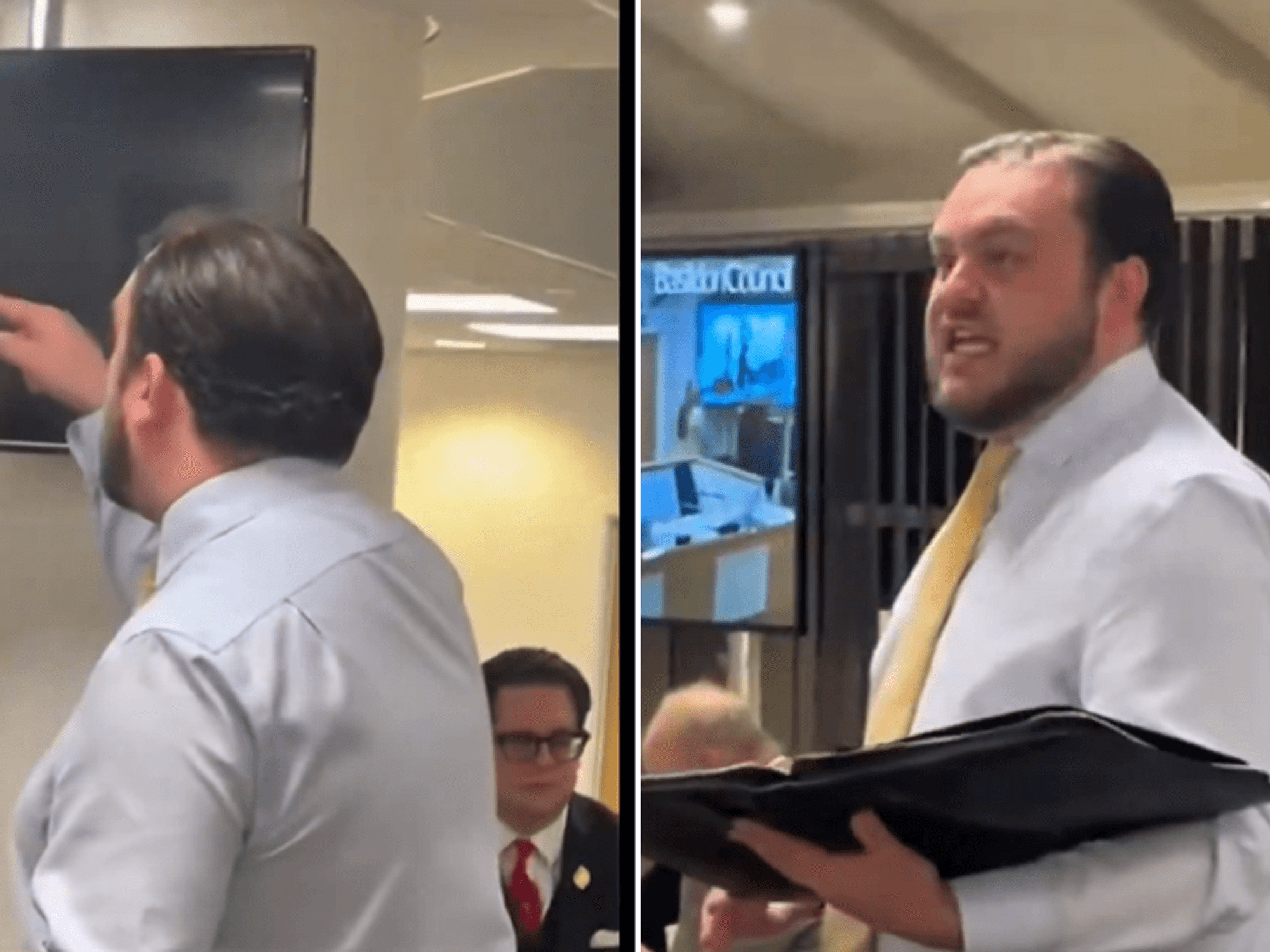

Inheritance tax should be scrapped, according to Tory MPs

|GETTY

There are some exemptions in place to mitigate someone’s liability for IHT, including money transfers between spouses and civil partners.

Speaking in the House of Commons, Jayawardena explained: “Abolishing inheritance tax will grow the economy.

“It would encourage more people to stay and work for longer and it will boost receipts to the Exchequer, and the proof of this is Sweden.

“Sweden’s inheritance tax has raised roughly the same proportion as it does in this country, less than one per cent of all revenue to the Treasury.

“They abolished inheritance tax in 2004, a move that enjoyed cross-party support, and the result was booming entrepreneurship, economic growth and tax revenues that that tax had previously suppressed.”

According to the Tory MP, Sweden’s decision allowed more money to be invested into the nation’s economy which could be replicated in the UK.

He added: “It created a surge in assets actually being transferred, not just between family members but to external owners.

“It was invested in business, capital was being used for innovative reasons and productive uses, and family businesses became more entrepreneurial too, so it was a win-win.

“So, contrary to some briefing that there was from the Treasury ahead of this budget, by abolishing inheritance tax, or at least cutting it significantly, the overall tax revenues can go up and the proof is there.

“And, of course, any action on inheritance tax is non-inflationary which makes it a safe choice as we continue to battle inflation.”

However, the former Conservative minister received pushback from the MPs on the other side of the aisle.

Ian Byrne, the Labour MP for West Byrne, asserted that those who wanted to cut tax were in a vocal minority in the country.

LATEST DEVELOPMENTS:

Ranil Jayawardena MP made the comments in the House of Commons

|GETTY

He also claimed that more spending was needed in public services as a result of the Government’s “brutal austerity”.

Byrne said: “Polling by Ipsos shows that 55 per cent would rather tax more and increase public spending.

“Only 10 per cent of people want to reduce taxes and spend less on public services, so I ask again who is this budget really for?”

“Spending increases for healthcare and education don’t come close to what is needed for our public services after the challenges of Covid-19 and 14 years of brutal austerity.”