Inheritance tax update: Rachel Reeves to push record number of estates into £1million bill

Pension inclusion and reduced agricultural and business reliefs expected to push thousands more estates into inheritance tax

Don't Miss

Most Read

Rachel Reeves's inheritance tax overhaul is expected to push the number of families facing tax bills above £1million to record levels.

The Chancellor’s reforms will bring pensions into inheritance tax calculations from 2027.

They will also reduce reliefs for agricultural and business assets from April 2026.

Interactive Investor obtained official estimates which show around 121,000 estates are projected to face increased inheritance tax liabilities between 2027 and 2030.

In 2022-23, estates valued above £2million totalled 3,620. These estates generated average inheritance tax bills of £941,000.

The figure has risen 23 per cent since 2020-21. Rising property prices account for part of that increase.

Inheritance tax is charged at 40 per cent on estate values that exceed the £325,000 nil-rate band.

The charge is applied to total assets at death minus debts such as mortgages.

Rachel Reeves’s inheritance tax overhaul set to drive families with bills over £1million to record highs

|GETTY

People leaving their main home to children can claim an additional £175,000 residence allowance. Married couples and civil partners can combine allowances to protect up to £1million.

Estates above £2million see the residence allowance tapered. It reduces by £1 for every £2 above the threshold.

A single person's allowance disappears entirely once their estate reaches £2.35million, while couples lose both bands once their estate exceeds £2.7million.

These thresholds will remain frozen until at least 2028.

LATEST DEVELOPMENTS

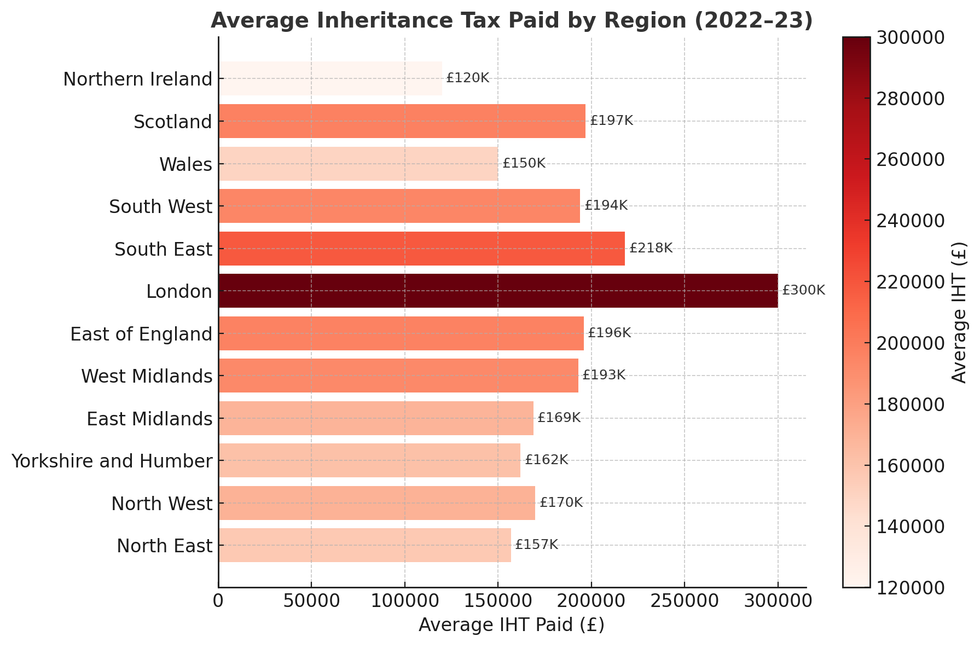

Average Inheritance tax paid by region | CHATGPT/ONS

Average Inheritance tax paid by region | CHATGPT/ONSSavills data shows the number of homes valued at more than £1million has increased 34 per cent in five years to 702,580.

Interactive investor’s analysis suggests around 31,000 estates will become liable for inheritance tax for the first time.

Ian Dyall, head of estate planning at wealth manager Evelyn Partners said: "Many of the wealthier estates have preserved significant sums in pensions based on the expectation that they would be exempt from inheritance tax on death".

He said industry figures indicate that some pension holders are beginning to withdraw and gift funds to reduce future liabilities, and that such planning requires time to avoid triggering high income tax bills.

A married couple with a £1.5million home and £1.5million in combined pension savings could face a tax bill close to £940,000 once pensions are included in the calculation.

Agricultural and business assets will be affected from April 2026.

Currently, many farms and family businesses qualify for full exemption from inheritance tax.

Under the new system, only the first £1million of qualifying assets will receive full relief.

Amounts above that will be taxed at 20 per cent.

Sean McCann of NFU Mutual said: "The continuing rise in house prices and the inclusion of pensions in the inheritance tax calculation from 2027 together with the long-term freeze in the tax-free thresholds means we are likely to see more families facing huge inheritance tax bills".

The changes involving pensions will push more estates above the £2million taper threshold. The Government claims around 500 farms will be affected.

Farming unions say the number is likely to be higher due to the scale of qualifying agricultural property.

Analysts warn that asset-rich but cash-poor landowners may be required to sell part of their land or business interests to meet inheritance tax demands.

Figures from NFU Mutual show the potential scale of the impact. A family inheriting a £3million business, £1million in pension savings, a £1million property and £650,000 in investments would currently pay around £400,000.

Analysts warn asset‑rich cash‑poor landowners may need to sell land or business stakes to meet inheritance tax demands

| GETTYUnder the 2027 rules, the bill would exceed £1million.

Mr Dyall said estates paying seven-figure sums are "likely to increase significantly in the 2026-27 tax year" because wealthier estates frequently hold agricultural land or owner-managed businesses eligible for relief.

A Treasury spokesman said: "More than 90 per cent of estates each year will continue to pay no inheritance tax at all after our reforms".

Government forecasts show the changes generating £14billion annually by 2030-31, which the Treasury says will help fund hospitals, schools and public services.