Inheritance tax bills hit £14.5 BILLION as frozen thresholds push families into the net

Government receipts set to hit £14.5billion by 2030/31 as rising asset values widen impact of the levy

Don't Miss

Most Read

Stealth taxes are set to hit twice as many estates over the next five years after Rachel Reeves froze inheritance-tax thresholds in the budget, amounting to a major raid on British families.

Official projections show annual receipts will increase from £8.3billion to £14.5billion by 2030/31.

Treasury figures reveal that the tax is set to reach a significantly larger proportion of British families.

At present, around one in 20 estates is liable for inheritance tax.

Approximately 32,200 estates are expected to be taxable this year.

TRENDING

Stories

Videos

Your Say

Forecasts indicate that by 2030/31 around 63,100 estates will face a bill.

This shift means nearly one in eleven deaths will result in an inheritance tax charge.

The number of families affected by the levy will almost double within five years.

Rob Morgan, chief investment analyst at Charles Stanley, said: "Once a tax reserved only for the nation's wealthiest families, IHT has now planted its flag firmly in Middle Britain".

The main forces behind the expansion are the long-standing freeze on thresholds and rising asset values.

Britain’s nil rate band has remained at £325,000 since 2009.

Treasury figures reveal that the tax is set to reach a significantly larger proportion of British families

|GETTY

During that time, consumer prices have risen by around 60 per cent and typical house prices have increased by seventy-three per cent.

Investment portfolios comprising shares and bonds have grown by around 139 per cent over the same period.

James Scott-Hopkins, founder of wealth management firm EXE Capital Management, said: "Receipts are already at record highs because of decades of house price rises and the insidious freezing of the NRB threshold, which has been stuck at £325,000 since 2009".

Rish Sareen, chief executive of probate platform Trustestate, described to GB News the threshold freeze as a "stealth tax" that will continue to be used to generate additional revenue.

He said: "Asset contributions will climb as a result of this. The number of people dragged into the threshold could double by 2030."

Further financial pressure is expected as Budget changes announced last year take effect.

From 2027, unused defined contribution pension pots will be included in estates for inheritance tax purposes.

LATEST DEVELOPMENTS

GETTY

Madeleine Beresford, partner at TWM Solicitors, said: "The pensions point is hugely significant, not only because of the tax on the pension itself, but the fact it takes many people over the £2m threshold for the residence nil rate band".

Estates that exceed the £2million threshold face the withdrawal of the residence nil rate band at a rate of £1 for every £2 above that point.

The tapering mechanism can push effective tax rates to as high as eighty-seven per cent.

Mr Sareen warned that pension administrators may not be fully prepared for the changes. He said: "This move will create more complexity. I do worry that pension administrators won’t be ready for this change."

He added that the reforms will introduce more administrative burdens for personal representatives: "Probate is already complex and stressful, particularly for people who are bereaved. Adding pensions into scope risks exacerbating those pain points."

Restrictions to Agricultural and Business Property Relief are also on the horizon.

From April 2026, relief will be capped.

Mr Sareen said: "People will need to think carefully — potentially setting up trusts or selling land. The measure will discourage expansion of larger estates. In fact, some families may decide against growing their estates at all."

He welcomed new rules allowing unused APR/BPR to be transferred between spouses, calling them "a good change that creates more flexibility, even though the cap remains."

Mr Sareen urged the Chancellor to simplify inheritance tax processes rather than adding further complexity. He said: "I don’t see or understand the need for added complexity. She should prioritise making IHT easier to access for the population."

Several legitimate approaches remain open to families seeking to reduce future inheritance tax exposure.

Gifting is one option, with individuals able to give up to £3,000 each year without incurring tax.

They can also give £250 to any number of additional recipients.

Wedding gifts of up to £5,000 for children and £2,500 for grandchildren are also exempt.

Larger gifts become fully exempt if the donor survives for seven years, with taper relief reducing potential tax after three years.

Charitable legacies provide another route, as leaving at least ten per cent of an estate to charity lowers the rate on the remainder from 40 per cent to 36 per cent.

Trusts may be suitable for those wanting additional control over how and when assets are distributed.

Experts note that gifting should be considered carefully to ensure donors retain sufficient resources.

Rachael Griffin, tax and financial planning expert at Quilter, said: "While gifting can be a powerful tool when it comes to reducing any eventual IHT bill, it is important you don't leave yourself short-changed in life".

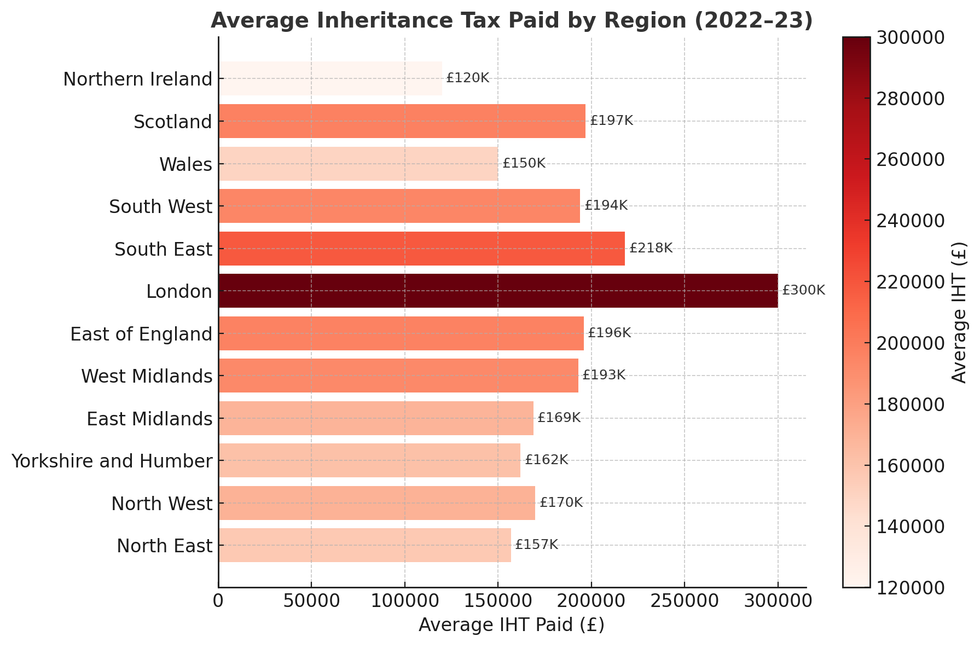

Average Inheritance tax paid by region | CHATGPT/ONS

Average Inheritance tax paid by region | CHATGPT/ONSMr Morgan cautioned that transferring large sums may reduce funds needed for care, emergencies or retirement.

He said: "It's great to help your family out and see them enjoy the money, but if in doubt, always think about the airline cabin crew advice of ensuring you fit your own life vest before helping others".

Mr Sareen highlighted that targeted exemptions can improve fairness, pointing to the infected blood compensation carve‑out: "This move reduces unintended financial burden and shows how reform can ease pressure on families."

He also shared a recent case where frozen thresholds and pension inclusion pushed a family into unexpected liability: "They were shocked to find themselves over the limit. We helped them navigate the rules, saving thousands in fees and ensuring clarity at a difficult time."

Advisers recommend seeking regulated financial guidance due to the complexity of the rules.

More From GB News