Inheritance tax raid from Rachel Reeves 'cannot be ruled out' as Budget speculation ramps up

Nigel Farage explodes at 'direct attack on thrift' as Rachel Reeves mulls tax on pensioners |

GB NEWS

Britons are concerned more changes to inheritance tax will be unveiled in this year's Autumn Budget

Don't Miss

Most Read

Pressure mounts on Chancellor Rachel Reeves ahead of this year's Autumn Budget, as wealthy individuals prepare to face potential tax increases in the months ahead

The Treasury's decision to delay the Budget has sparked widespread speculation regarding potential reforms to inheritance tax (IHT), after confirming pension pots would be made liable for the levy by 2027 in last year's fiscal statement.

The Chancellor faces growing pressure to stabilise public finances and foster economic growth; the latter being a key pledge of the Labour Government since returning to power last year.

According to Rathbones Group, one of the UK’s leading wealth management firms, there have been growing numbers of clients seeking advice on inheritance tax and estate planning.

Could the Chancellor target inheritance tax again in her upcoming Budget?

| GETTYThere is also speculation surrounding the Government’s plan to cap lifetime gifts, extend the seven-year survival period to ten years and tighten taper relief.

In light of the impending Budget, Simon Bashorun, the head of Advice at Rathbones Private Office, said: “With the Budget not expected until late November, we face a prolonged period of speculation.

"The reluctance - or perhaps inability - for the Treasury to quash rumours, is a bane to financial planning.

"Clients are understandably keen to get ahead of any potential changes, particularly around inheritance tax, gifting and retirement planning.”

The standard inheritance tax rate is 40 per cent above the £325,000 threshold | GETTY

The standard inheritance tax rate is 40 per cent above the £325,000 threshold | GETTYFollowing the significant changes to inheritance tax in the previous Budget, Mr Bashorun stated that clients are keen to reassess their long term financial plans.

With the Chancellor being advised that she must raise tax to cover an estimated £30billion "black hole" in the public finances, Mr Bashorun also advised that the possibility of increased taxation cannot be dismissed.

The financial expert said: “With an estimated £5.5trillion expected to pass between generations over the coming decades, it’s likely that Governments will seek to claim a greater share.

“A tightening of current gifting rules cannot be ruled out.

“Good inheritance tax planning starts with understanding what you can afford to give away. That means having a robust lifetime cashflow plan to assess your capacity to part with capital or income.

“From there, making use of current allowances and reliefs is sensible. Tax changes are rarely retrospective, so action taken today—with proper documentation - could be future-proof.

“There’s no one-size-fits-all solution. Effective IHT planning often involves a blend of outright gifts, trusts, qualifying investments, and insurance. Diversifying your approach not only balances control and tax efficiency, but also helps hedge against future rule changes.”

When managing finances, Mr Bashorun has urged clients to refrain from reacting too quickly to Budget rumours, make full use of tax-free allowances, review their personal finances and seek professional guidance.

LATEST DEVELOPMENTS:

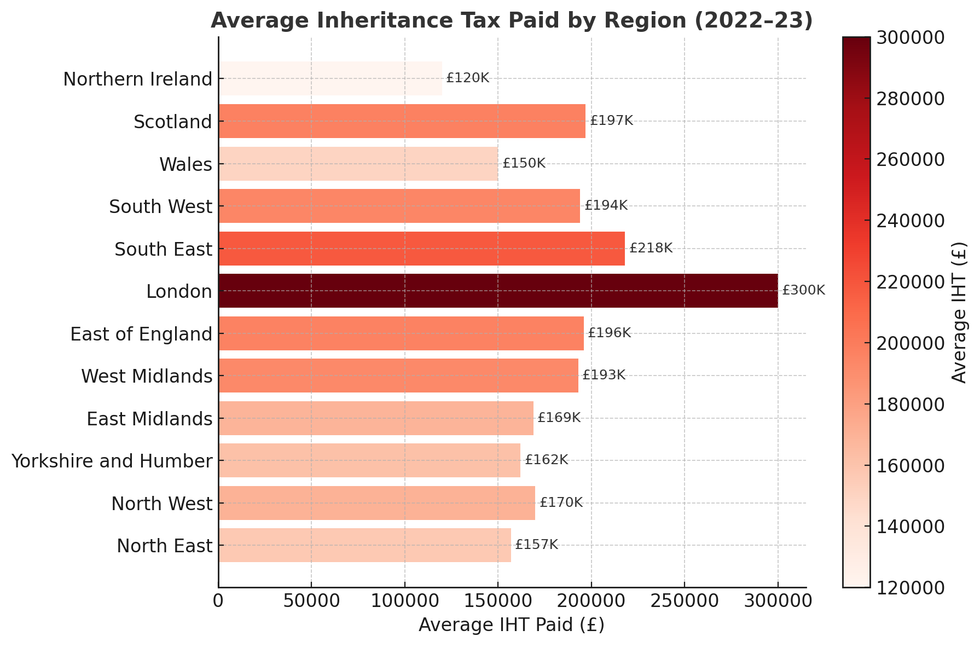

How much is London paying in inheritance tax compared to the rest of the country | GETTY

How much is London paying in inheritance tax compared to the rest of the country | GETTY Earlier this month, the Chancellor of the Exchequer, announced that the Autumn Budget is set to take place on November 26 - the latest Budget date in over 10 years.

With borrowing costs recently reaching their highest level in 27 years, many speculate that Reeves chose to delay the budget in hopes that the bond markets will stabilise.

In an interview with the BBC, Ms Reeves emphasised that the second Budget would prioritise investing into the economy, alongside ensuring that working people have a better standard of living.

She said: “Do I accept that we need to do more to turn the economy around so that working people have the tools and the training and the opportunities to fulfil their potential? Absolutely we do."

Please write at least 4 paragraphs

Please write at least 4 paragraphs

More From GB News