'Tax nightmare' as grieving families face YEAR LONG WAIT for inherited pensions

Chancellor Rachel Reeves announces changes to wider inheritance tax rules, after controversial measures last year affecting farmers |

GB News

Budget changes will allow administrators to withhold half of pension savings while HMRC calculates tax

Don't Miss

Most Read

Latest

Grieving families could face waits of up to 15 months before they can access half of their loved ones' pension savings under new Budget regulations.

The rules will allow personal representatives to instruct pension administrators to retain as much as 50 per cent of retirement funds while HMRC determines the inheritance tax bill.

The measures follow Rachel Reeves's decision to bring pension wealth within the scope of death duties from April 2027.

The change will place previously exempt retirement savings under inheritance tax at rates reaching 40 per cent.

TRENDING

Stories

Videos

Your Say

Treasury forecasts suggest about 10,500 more households will be drawn into inheritance tax each year once the changes come into force.

Officials said the adjustments will widen the number of estates affected across Britain.

The Chancellor's inaugural Budget last year altered how retirement savings are treated after death.

From April 2027, unspent pension pots will fall within inheritance tax, ending a long-standing exemption.

The shift is expected to bring thousands more estates into the tax net.

The 40 per cent charge will apply to pension wealth above the £325,000 threshold, with an additional £175,000 allowance available to homeowners who pass their main residence to children.

Budget changes will allow administrators to withhold half of pension savings | GETTY

Budget changes will allow administrators to withhold half of pension savings | GETTYMarried couples and civil partners can currently shield up to £1million from inheritance tax.

However, the inclusion of pension funds will reduce the effectiveness of this protection for many families.

The regulations grant personal representatives, usually relatives of the deceased, the authority to ask pension scheme administrators to withhold up to half of available retirement funds.

The intention is to ensure that enough money remains to meet the final tax bill once HMRC completes its assessment.

Personal representatives are legally responsible for paying inheritance tax and distributing estates correctly.

The retention mechanism gives them a safeguard where pension savings form a large part of the overall estate.

LATEST DEVELOPMENTS

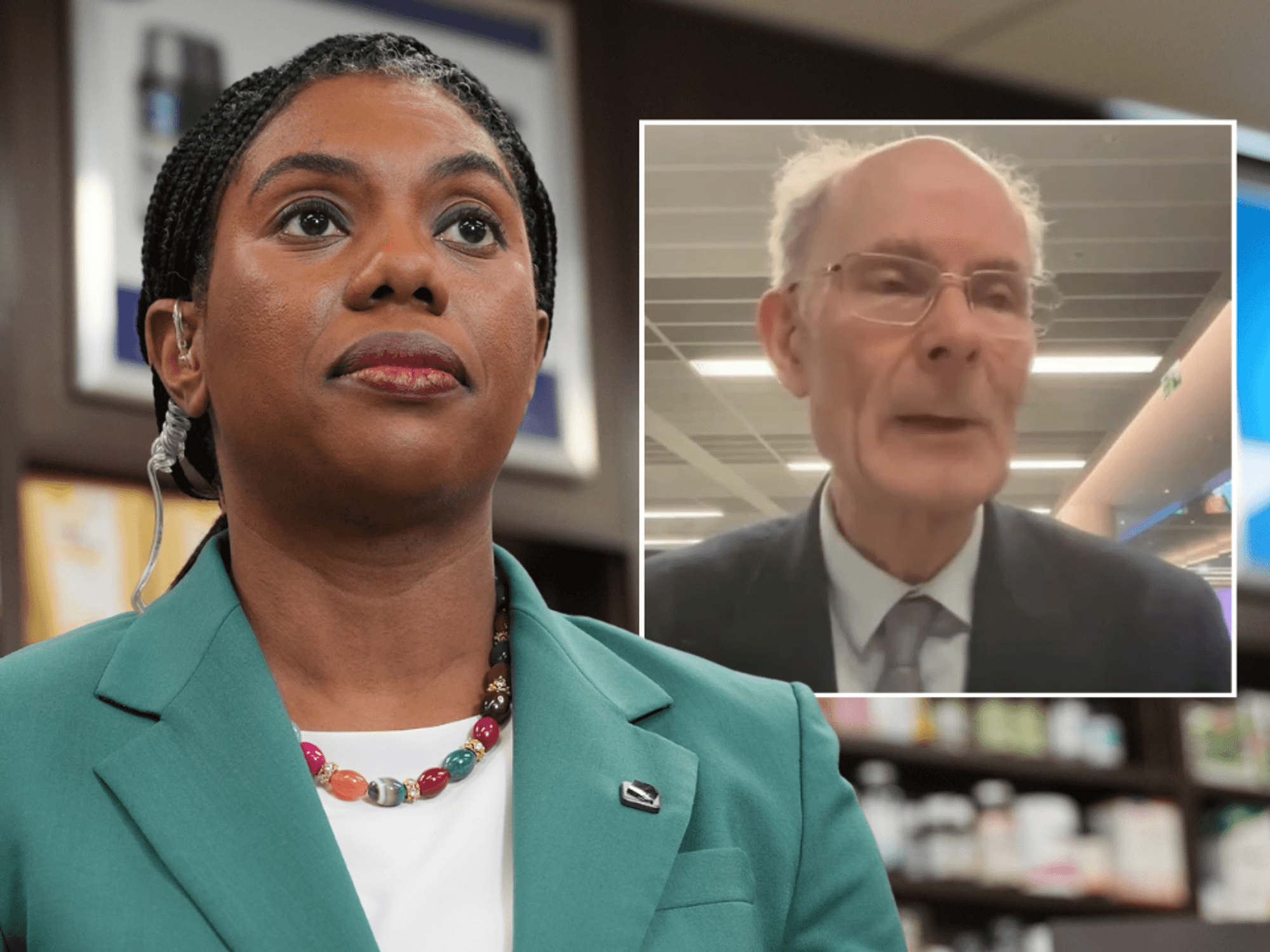

Families could face waits of up to 15 months before they can access half of their loved ones' pension savings | GETTY

Families could face waits of up to 15 months before they can access half of their loved ones' pension savings | GETTYUnder the current system, beneficiaries can access pension funds quickly because these assets sit outside the formal estate.

The new rules will change that arrangement, which may leave families without financial support at a difficult time.

Financial experts have warned the new requirements could create substantial administrative delays.

Andy Butcher, of wealth manager Raymond James, said the change would "create significant issues for some families".

"Funds are readily accessible in the event of death, and can often be a handy way to pass money to beneficiaries without being tied up in a potentially lengthy probate process.

"If this is no longer the case, it may lead to a further erosion of confidence in the pension market".

Rish Sareen, of probate platform Trustestate, said the rules may offer more certainty for those handling estates.

He said the changes provide "greater reassurance" for personal representatives meeting their duties but warned they "may also result in delays for pension beneficiaries".

The Chancellor has frozen inheritance tax thresholds until 2031.

The freeze is forecast to increase the number of estates paying the forty per cent charge from about 32,000 this year to 63,000 by the end of the forecast period.

Rachel Vahey, of AJ Bell, raised concerns about the administrative workload families may face.

"Unless HMRC chooses to change the way inheritance tax is applied to pension funds, thousands of families will in future be faced with a tax admin nightmare of the worst kind, at the worst possible time".

Rachel Reeves unveiled the changes in the Budget

| GB NEWSCritics in the financial services sector have warned that the new rules could create confusion for families during bereavement.

They said the combination of frozen thresholds and the introduction of pension wealth into inheritance tax would increase both costs and delays.

Officials have not indicated whether further adjustments will be made ahead of the April 2027 implementation date.

GB News has approached the Treasury for comment.

More From GB News