Inflation to hit 4% next month in cost of living blow to Britons, Bank of England warns

WATCH: Bank of England Governor predicts inflation increase to four per cent in September | Bank of England

The central bank shared its prediction for the UK's inflation rate while announcing the latest cut to interest rates

Don't Miss

Most Read

Inflation in the UK is forecast to peak at four per cent next month, according to the latest projection from the Bank of England.

The central bank confirmed the consumer price index (CPI) will jump higher-than-expected for September 2025 during its base rate announcement this afternoon.

Earlier today, the Monetary Policy Committee (MPC) voted to slash interest rates from 4.25 per cent to four per cent in a win for borrowers.

However, the financial institution shared its prediction that inflation will soar past the previously predicted 3.5 per cent for September, which is double the Bank's initial target.

Inflation is predicted to hit four per cent next month

|GETTY

However, the committee members noted that this jump in the inflation rate will only be "temporary".

In the MPC's latest report, the Bank of England stated: "CPI inflation is forecast to increase slightly further to peak at four per cent in September.

"Inflation is expected to fall back thereafter towards the two per cent target, although the Committee remains alert to the risk that this temporary increase in inflation could put additional upward pressure on the wage and price-setting process.

"Overall, the MPC judges that the upside risks around medium-term inflationary pressures have moved slightly higher since May."

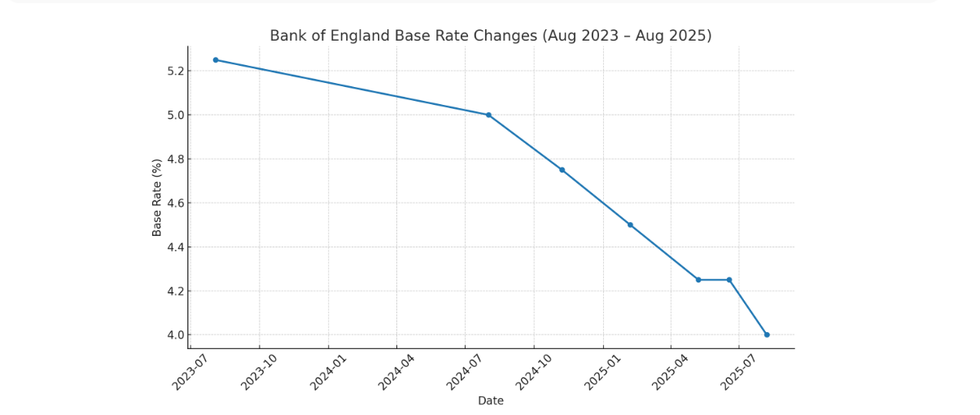

How has the UK base rate changed over the last two years? | CHAT GPT

How has the UK base rate changed over the last two years? | CHAT GPT Despite the Bank's inflation prediction, economists noted today's rate cut is a positive move for the British economyu.

On this afternoon’s MPC decision, Scottish Friendly savings expert Kevin Brown said: "The Monetary Policy Committee didn’t disappoint, cutting rates to four per cent as expected.

"The move came in spite of inflation hitting 3.6 per cent in June, significantly ahead of the Committee’s target of two per cent.

“The cut suggests policymakers believe that a slowing labour market and lacklustre economic growth will combine to bring inflation under control over the next few months.

"The Committee has previously said it would be willing to cut rates if the job market showed signs of weakening. Employment data earlier in July showed signs of rising unemployment and slowing wage growth.

"There remain concerns over the persistency of price rises, particularly in areas such as food, energy and labour costs. Nevertheless, prices are expected to drop in the latter half of 2025 and into 2026.

LATEST DEVELOPMENTS:

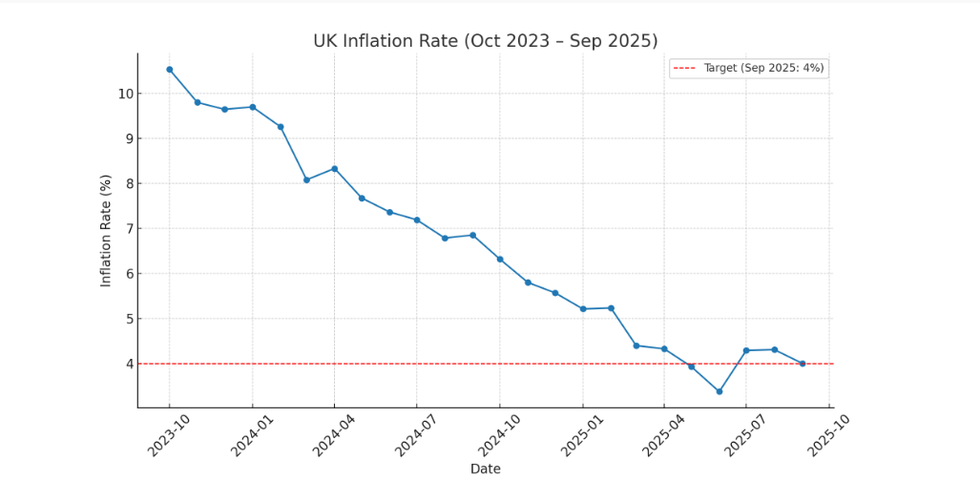

How has inflation changed in recent years?

|CHAT GPT

"The interest rate cut had been widely anticipated and is therefore likely to be reflected in Government bond markets already.

As it stands, the next inflation figures for July 2025 will be published by the Office for National Statistics (ONS) on August 20, 2025.

Households should not expect a CPI rate figure for September 2025 to be confirmed until October of this year.

More From GB News