Inflation SHOCK as CPI rate remains at 3.8% for third month is a row

How can savers stay ahead of inflation? |

GB NEWS

The CPI inflation rate for September 2025 had been previously been projected to rise to four per cent

Don't Miss

Most Read

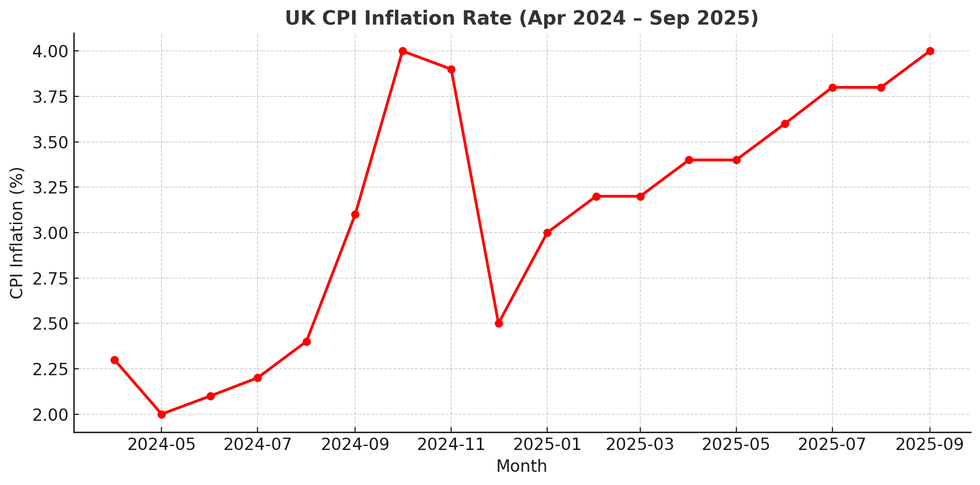

Inflation for the 12 months to September 2025 remained at 3.8 per cent, according to the latest figures from the Office for National Statistics (ONS).

This is the same level reported for the consumer price index (CPI) rate over recent recent months and is nearly double the Bank of England's desired target for inflation.

Previous forecasts had estimated inflation would rise to four per cent, which means today's figures offer slight relief for inflation for Chancellor Rachel Reeves to deal with ahead of November 26's Autumn Budget.

In the wake of the Covidi-19 pandemic, households have been forced to content with inflation-hiked prices for goods and services amid the ongoing cost of living crisis.

Inflation is stuck at 3.8%, nearly double the Bank of England's desired target

|GETTY / CHAT GPT

Economists have warned that a slight hike in the CPI rate could spook the central bank's Monetary Policy Committee (MPC) from cutting interest rates again later this year.

Alastair Douglas, TotallyMoney CEO, said: "While inflation has slowed considerably since the October 2022 peak, it’s still been stubbornly difficult to shake off, consistently driving up the cost of living, squeezing household finances, and piling pressure onto the lives of millions.

"At the same time, the Bank of England has been slow to cut rates, making things more difficult for homeowners.

"And as if it was a co-ordinated, both the Chancellor and the Governor of the Bank of England have blamed Brexit over the past few days – just weeks ahead of the Autumn Budget, and the next Monetary Policy Committee meeting. Now they’ve found a common enemy, let’s hope they can agree on a plan to kickstart the economy."

Inflation had been projected to hit four per cent in September

|CHAT GPT

According to the ONS, transport costs made the largest upward contribution to the monthly change in both CPIH (CPI including housing) and CPI annual rates.

Conversely, recreation and culture, and food and non-alcoholic beverages made the largest offsetting downward contributions.

In the 12 months to September, core CPI (CPI excluding energy, food, alcohol and tobacco) jumped by 3.5 per cent in the 12 months to September 2025, down from 3.6 per cent in the 12 months to August.

However, the CPI goods annual rate rose slightly from 2.8 per cent to 2.9 per cent, while the CPI services annual rate was unchanged in September, at 4.7 per cent.

Chancellor Rachel Reeves will set out the Budget in November | GB NEWS

Chancellor Rachel Reeves will set out the Budget in November | GB NEWSGrant Fitzner, the ONS chief economist, said: "A variety of price movements meant inflation was unchanged overall in September. The largest upward drivers came from petrol prices and airfares, where the fall in prices eased in comparison to last year.

"These were offset by lower prices for a range of recreational and cultural purchases including live events.The cost of food and non-alcoholic drinks also fell for the first time since May last year."

In reaction to today's figures, Chancellor Rachel Reeves said: "I am not satisfied with these numbers. For too long, our economy has felt stuck, with people feeling like they are putting in more and getting less out.

"That needs to change. All of us in government are responsible for supporting the Bank of England in bringing inflation down. I am determined to ensure we support people struggling with higher bills and the cost of living challenges, deliver economic growth and build an economy that works for, and rewards, working people."

LATEST DEVELOPMENTS

Professor Joe Nellis, an economic adviser at accountancy firm MHA, warned: "For the Government, September’s figures have not improved the fiscal arithmetic — while gilts sit at one of their lowest levels this year, persistent high inflation will continue to unsettle the financial markets and keep the cost of servicing the national debt high.

"Although the IMF’s latest World Economic Outlook reports that UK’s inflationary pressures are largely 'temporary,' with the labour market expected to loosen and wage growth to slow, the current trajectory of inflation is unlikely to calm the markets.

"With the Budget just over a month away, the Chancellor faces a classic economic trade-off question — how can she stimulate growth without reigniting inflation?

"Given this tough dilemma, it is likely that she will focus on targeted investment incentives and cost-of-living support rather than sweeping tax cuts. Any hint of fiscal overreach could unsettle financial markets and clash with the Bank’s cautious stance."

More From GB News