Inflation alert: CPI rate rises to 3.4% in cost of living blow

Chancellor Rachel Reeves has attempted to boost the UK economy and address the issue of inflation

Don't Miss

Most Read

Latest

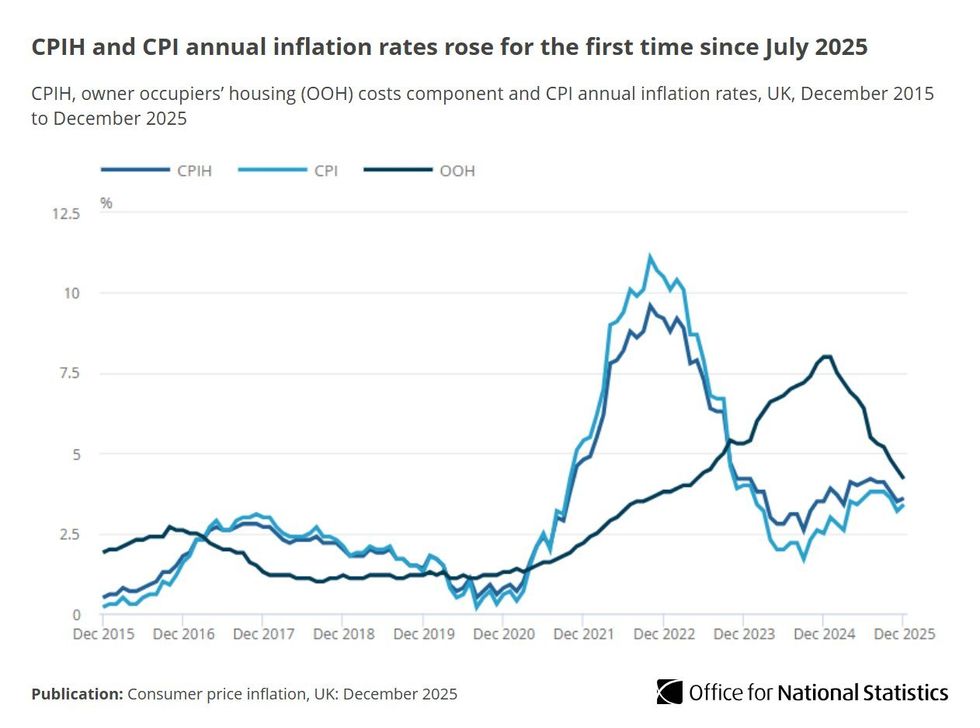

The consumer price index (CPI) rate of inflation jumped to 3.4 per cent in the 12 months to December 2025, according to the latest figures in the Office for National Statistics (ONS).

For the 12 months to November 2025, the CPI rate came in 3.2 per cent, which signaled an easing in inflationary pressures amid the ongoing cost of living crisis.

This comes as another blow to Chancellor Rachel Reeves, who has attempted to bolster the UK economy since Labor returned to Government in July 2024.

Economists previously predicted inflation would have ticked higher last month due to Christmas getaways helped fuel price rises at the end of the year.

The Chancellor has attempted to bolster the economy while reining in inflation

|GETTY

Rob Wood and Elliott Jordan-Doak, economists for Pantheon Macroeconomics, haD previously forecast a shallower CPI rate hike to 3.3 per cent for last month.

A hike to tobacco duties, which was announced at the autumn budget by the Chancelllor in November, is set to have pushed up overall inflation over the period.

ONS chief economist Grant Fitzner said: “Inflation ticked up a little in December, driven partly by higher tobacco prices, following recently introduced excise duty increases.

"Air fares also contributed to the increase with prices rising more than a year ago, likely because of the timing of return flights over the Christmas and new year period. Rising food costs, particularly for bread and cereals, were also an upward driver.

Rachel Reeves delivered the Budget in the Commons on November 26 | PA

Rachel Reeves delivered the Budget in the Commons on November 26 | PALATEST DEVELOPMENTS

How has inflation changed in recent years?

|ONS

"These were partially offset by a fall in rents inflation and lower prices for a range of recreational and cultural purchases." Due to Britain's inflationary pressures, the Bank of England's Monetary Policy Committee (MPC) has voted to raise the base rate to as high as 5.25 per cent in recent years.

This has resulted in higher interest rates for borrowers, however, the Bank has since reduced the base rate to 3.75 per cent as inflation has eased closer to the desired two per cent target. Despite today's figures, analysts claim another interest rate cut from the Bank of England could come sooner than expected.

Following today's ONS datea, the Chancellor promised that 2026 is the "year that Britain turns a corner". She explained: "My number one focus is to cut the cost of living,

"At the budget I announced £150 off energy bills, a freeze to rail fares for the first time in 30 years, a freeze to prescription charges for the second year running, and an increase to the national minimum and living wage. Money off bills and into the pockets of working people is my choice."

Suren Thiru, ICAEW's economics director, said: "The recent easing in the financial squeeze on consumers came to a shuddering halt in December as a Christmas jump in flight and food costs and the higher tobacco duties triggered an awkward acceleration in inflation.

"Though rising services inflation is a warning sign that underlying price pressures remain stubbornly sticky, the intensifying downward pressure from weaker wage growth and rising unemployment should help put it on a more consistent downward path.

"December’s increase is a temporary blip with the near-term trajectory for UK inflation largely locked in, as lower energy bills from April coupled with falling fuel and food costs should pull it back to two per cent by the summer.

"These figures make a February interest rate cut look improbable by reinforcing concerns over persistent price pressures, particularly as policymakers may want to assess the effect of escalating geopolitical tensions before loosening policy again."