Rachel Reeves appears to confirm plans to hike income tax in chilling letter to OBR

WATCH: GB News Political Correspondent Olivia Utley explains what taxes Rachel Reeves may raise in the upcoming budget and the political impact of it on the Labour Government.

|GB NEWS

Levying 'working people' will be among Ms Reeves's 'major measures' on November 26, she told the watchdog

Don't Miss

Most Read

Rachel Reeves is said to have now told the OBR she plans to raise income tax. Last night, it was revealed the Chancellor had formally told the Office for Budget Responsibility (OBR) that hiking the levy would be among the "major measures" announced on November 26.

After poring over Ms Reeves's letter, the OBR will inform the Treasury of its impact assessment of the measure on Monday - the penultimate round of forecasts before the Budget.

It is possible the Chancellor, as The Times reported, could still step back from the edge and not raise income tax. But the hike's inclusion on her OBR letter marks the clearest sign so far that Labour will commit to breaking its manifesto and formally raise taxes on working people.

This move in the upcoming Autumn Budget would make Ms Reeves the first Chancellor in half a century to increase the basic rate of income tax - reportedly by two per cent.

Rachel Reeves has now told the OBR she plans to raise income tax

|GETTY

She is also set to be mulling over a National Insurance cut to earnings below £50,270 - reducing the rate from eight per cent to six per cent. Earnings over that threshold would still be subject to a two per cent rate. That two-up, two-down income tax/NI switch is set to shift the impact onto pensioners and landlords.

It forms part of Labour's long-held pledge that those with the "broadest shoulders" should bear the heaviest burden. Economists believe the move could raise more than £6billion a year - only a fifth of the approximately £30billion-valued "black hole" facing down Britain's economy.

Though that number is up for debate, with the influential National Institute of Economic and Social Research (NIESR) warning it is actually worth £50billion, with the Resolution Foundation claiming it is lower at £26billion.

Earlier this week, the Chancellor gave a pre-Budget statement to address outlining her economic outlook but stopped short of confirming an income tax hike was on the cards.

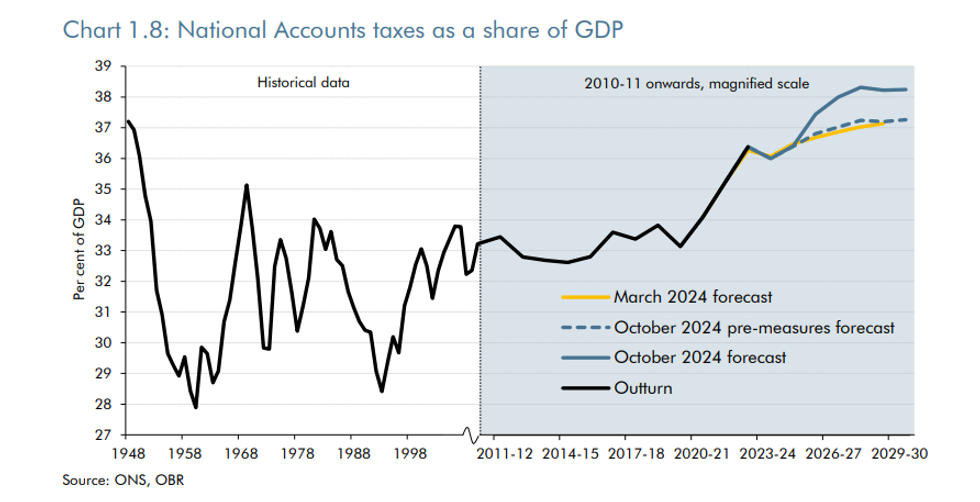

Taxes as a share of GDP | OBR

Taxes as a share of GDP | OBRThat did not the sterling falling against the euro and dollar, with the Ftse falling into the red amid growing investor anxiety over the Treasury's decision-making when it comes to the economy.

Richard Potts, an economist at Bondford, noted: "Perhaps the most significant takeaway from the speech was what was not ruled out. Reeves’ outright refusal to recommit to Labour’s election pledges not to raise income tax, VAT or national insurance spoke volumes.

"From an economic standpoint, it is sensible not to exclude the broadest and least distortionary revenue sources. Politically, however, the cost could be immense. Trust in the government is already fragile, and voters have long memories when it comes to broken promises.

"Furthermore, markets likely interpreted her insistence that the current fiscal challenges were “unforeseeable” as an unconvincing cop out, and sterling’s immediate dip during the speech reflected that scepticism."

Trade unions are in support of a tax hike with TSSA General Secretary Maryam Eslamdoust calling on Britons with the "deepest pockets" to contribute more to the Treasury's coffers.

She said: "It’s vital that the Budget is true to Labour values and that means the Chancellor doing all she can to help the many millions of people in our society who have been struggling for too long with the cost of living.

“This follows the long Tory years of austerity, a chaotic Brexit and economic ineptitude. So, if taxes are to rise to build the country and get the economy moving, that is no bad thing – but it is those with the deepest pockets who should pay more.

“Any rise in VAT or National Insurance would be counterproductive. Raising income tax on the highest earners, alongside a wealth tax for the richest in the country, is the only way forward. We urge Rachel Reeves to follow that course."

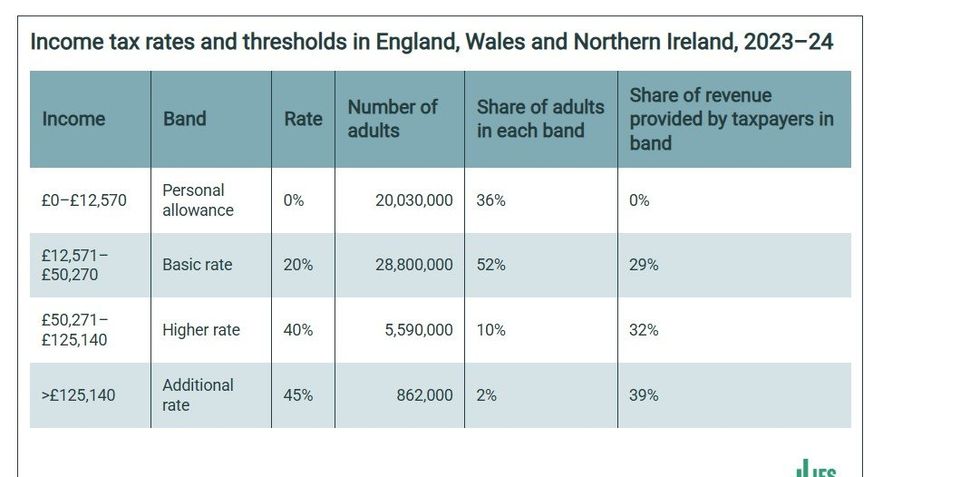

How much are you paying in income tax?

|IFS

Politically, meanwhile, the apparent looming tax rise is already sparking a row at Labour's high table. The party's new deputy leader Lucy Powell has said the Government “should be following through” on its manifesto pledge not to raise income tax, national insurance or VAT.

U-turning, and breaking that promise, could damage “trust in politics”, Ms Powell warned. Then, financially, the Bank of England handed the Chancellor a dire tax warning.

Its monetary policy committee (MPC) said just yesterday that fears of spiralling taxes were undercutting economic growth - another blow to Labour's central economic manifesto pledge.

Both consumer spending and business investment fell in recent weeks as Britain braced for the so-called "nightmare before Christmas" Budget, with businesses steeling themselves through "very high" levels of uncertainty.

"Contacts report that weak demand and elevated uncertainty ahead of the autumn Budget may be causing firms to delay investment," the Bank said. "The proportion of [businesses saying] that the overall level of uncertainty is high or very high has been around its highest level since end-2022."

A Treasury spokesman said: "The Chancellor has set out the context for the Budget, recognising global and long-term economic challenges. It will continue to build the strong foundations to secure Britain’s future and on the priorities of the British people - cutting waiting lists, cutting national debt and cutting the cost of living."

More From GB News