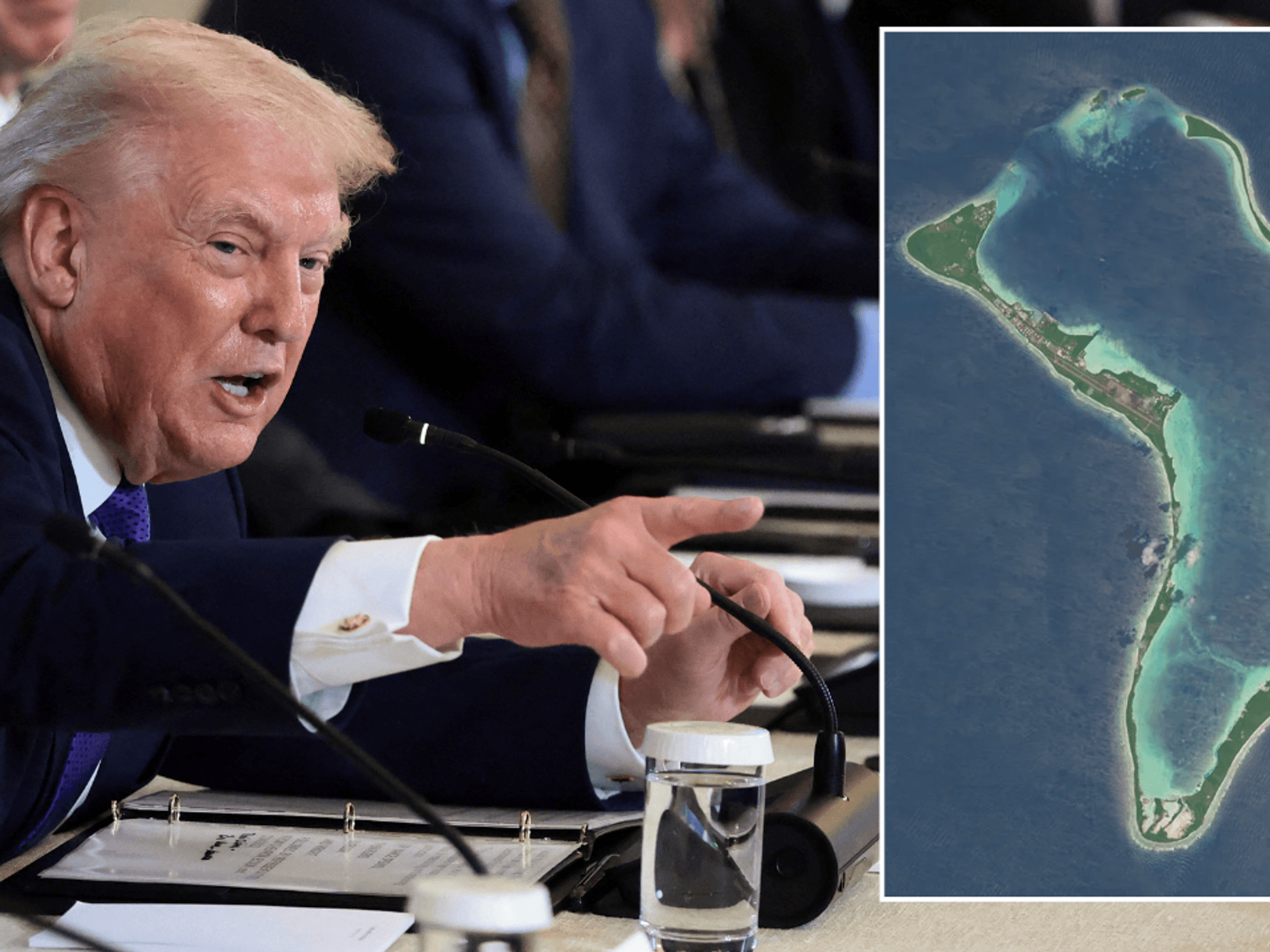

HMRC warning as new rules increase late filing penalty to £200

The number of penalty points needed before a fine is issued depends on how often someone is required to submit their tax returns

Don't Miss

Most Read

Latest

HMRC has issued a warning to taxpayers as new late-filing rules come into force this month.

The changes mean missing tax deadlines could now result in a £200 penalty instead of the long-standing £100 fine.

HMRC is changing how it penalises late self-assessment tax returns, moving away from automatic fines and introducing a points-based system instead.

The aim is to target repeat offenders while giving more leeway to people who miss the occasional deadline.

The new system is being launched this month as a pilot involving 100 taxpayers who are part of the Making Tax Digital programme.

HMRC said the rules will eventually apply to everyone who files a tax return.

Under the current system, taxpayers are hit with an immediate £100 fine if their return is late. Under the new rules, each missed deadline earns a penalty point, with fines only applied once a set number of points is reached.

For those who remain on the traditional self-assessment system, missing two annual deadlines within a two-year period will trigger a £200 penalty.

The rules are different for taxpayers signed up to Making Tax Digital, who are required to submit updates every quarter.

Missing two annual deadlines within a two-year period will trigger a £200 penalty

| GETTYBecause quarterly filers report more often, they would need to miss four deadlines over two years before facing the same £200 charge.

The number of penalty points needed before a fine is issued depends on how often someone is required to submit their tax returns.

As part of the trial, participants were given amnesty for any late or missed submissions until January, giving them time to adjust without facing immediate penalties.

From April, landlords and self-employed workers earning more than £50,000 a year will be required to move onto Making Tax Digital. This means reporting their income four times a year instead of submitting a single annual tax return.

The change is expected to affect close to one million people who currently use the traditional self-assessment system

| GETTYThe change is expected to affect close to one million people who currently use the traditional self-assessment system.

The rollout will widen further in 2028, when landlords and freelancers earning £20,000 or more a year will also be moved onto quarterly reporting.

Those earning below the £20,000 threshold will remain on the existing self-assessment framework for the foreseeable future, creating a period where HMRC must manage multiple overlapping filing schemes simultaneously during the graduated implementation.

Liam Coulter, tax director at Wilson Nesbitt, described the changes as "a fairer alternative to the automatic fines administered previously, with the new system designed to penalise persistent offenders rather than those who have made honest mistakes."

Self-employed individuals need to file their tax returns | GETTY

Self-employed individuals need to file their tax returns | GETTYHowever, he cautioned that the transition would bring considerable challenges.

"Making Tax Digital comes into force for many self-employed individuals and landlords from April 6, 2026, bringing in more administrative burden, cost and stress," Mr Coulter said.

HMRC has confirmed that penalty points will not apply during the first year, offering taxpayers breathing room to familiarise themselves with the new technology and quarterly reporting requirements.

An HMRC spokesman stated: "We're committed to helping customers get their tax right to avoid fines altogether."

More From GB News