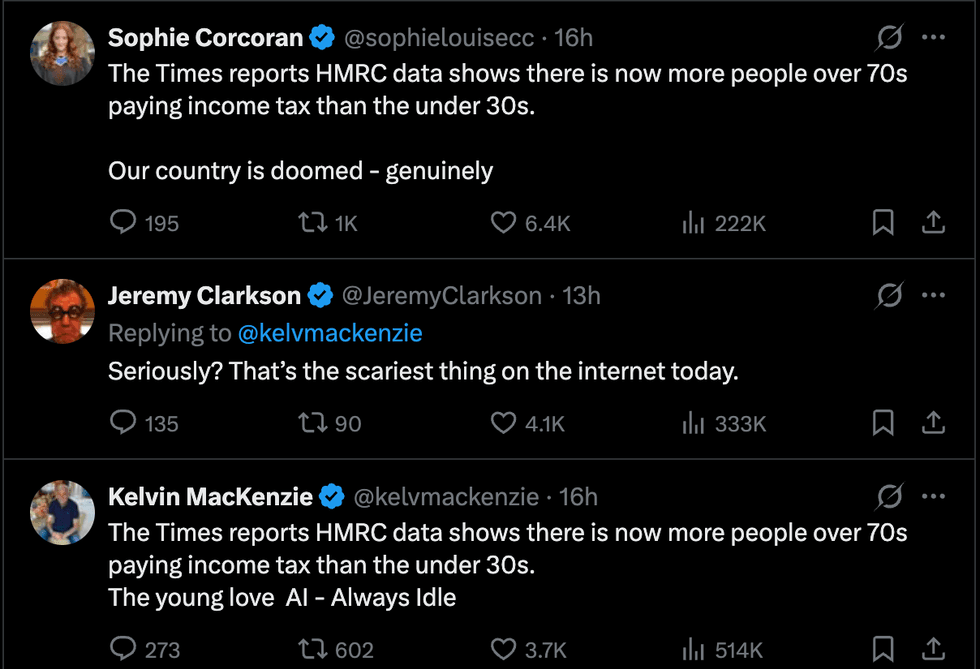

HMRC figures show more over-70s pay income tax than under-30s in Britain: 'Our country is doomed'

Record numbers are working beyond state pension age

Don't Miss

Most Read

Latest

HM Revenue and Customs (HMRC) data from the 2022-23 financial year shows that 5.45 million over-70s paid income tax, compared with just 5.23 million people aged below 30.

More than two million Britons aged 66 and over remained in work during the 2024-2025 tax year, according to new HMRC data.

The figures challenge the long‑held assumption that reaching state pension age marks the end of working life for most people. HMRC data shows 2.12 million pensioners continued earning wages during the period.

The trend has reignited debate over the national insurance exemption available to workers once they reach state pension age.

Former pensions minister Steve Webb said the exemption is worth around £1.1billion a year to the Treasury.

TRENDING

Stories

Videos

Your Say

Workers stop paying national insurance once they reach state pension age, although they continue to pay income tax.

National insurance is currently charged at eight per cent on earnings between £12,570 and £50,270, and two per cent on income above that threshold.

The exemption has historical roots, with national insurance originally designed as a contribution towards an individual’s future state pension. Many older workers therefore, view their decades of payments as fulfilling their obligations to the system.

The structure of the UK workforce has shifted significantly since the early 2000s. In 2000, around 467,000 people aged 65 and over were in employment.

Today, 1.56 million pensioners are on company payrolls, a 12 per cent rise from the 1.39 million recorded in the 2020 to 2021 tax year.

Record numbers are working beyond state pension age

|GETTY

Self‑employment among pensioners has also increased, rising eight per cent over five years to 562,000.

Debate around fairness has intensified as younger workers face higher combined tax burdens.

Economist Paul Johnson said in December that a graduate in their late twenties earning £30,000 faces a marginal tax rate of 37 per cent once income tax, national insurance and student loan repayments are included.

A worker in their late sixties earning the same amount pays around 20 per cent.

“That’s all. And they’ll have a £12k state pension,” Mr Johnson said.

LATEST DEVELOPMENTS:

Jeremy Clarkson wade in on X, saying it was the 'scariest thing on the internet today'

|X

The difference creates a substantial gap in take‑home pay. A younger worker typically retains around £25,000 after deductions, while a pensioner on the same salary may take home roughly £36,000 once the tax‑free personal allowance is applied — a difference of around £11,000 a year.

Toby Whelton, from the Intergenerational Foundation, said the system was fuelling frustration among younger workers. “We have a whole generation that feels they have been forgotten about,” Mr Whelton said.

“They are never going to amass the property wealth their parents did and work is no longer the means to hitting typical milestones.”

Some working pensioners argue the exemption reflects decades of contributions. Danielle Barbereau, a 67‑year‑old self‑employed divorce coach from Northumberland, said she has worked since the age of 18.

“It’s a long stretch of contributing to the system,” Ms Barbereau said. “I have never objected to paying national insurance but why should I keep paying it now?”

Dennis Reed, from campaign group Silver Voices, said many pensioners continue working out of financial necessity, with some finding the state pension alone is not enough to cover daily living costs.

The Intergenerational Foundation said longer working lives are positive but has called for the national insurance exemption to be reviewed.

Ahead of last year’s Budget, Chancellor Rachel Reeves reportedly examined proposals to increase income tax by two pence while reducing national insurance by the same amount.

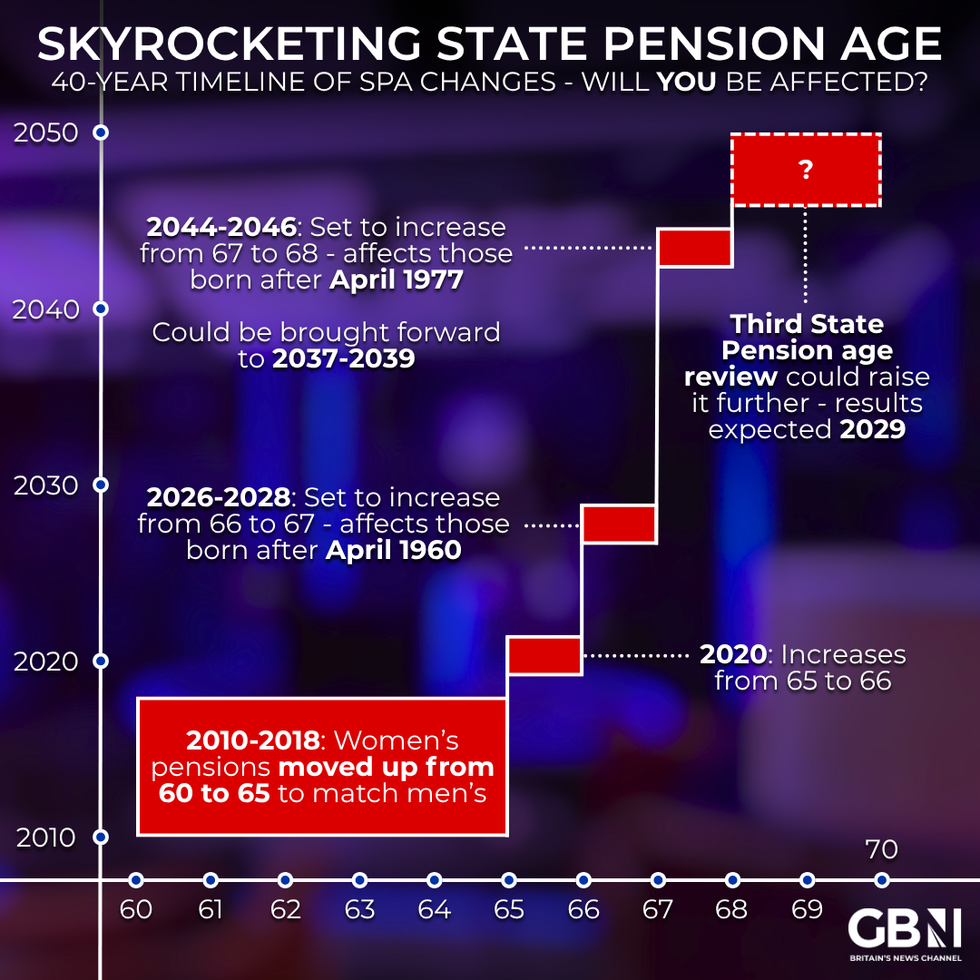

Skyrocketing state pension age - will you be affected? | GB News

Skyrocketing state pension age - will you be affected? | GB NewsSuch a change would have left working‑age taxpayers broadly unaffected but increased the tax burden on employed pensioners.

Some analysts have warned that removing the exemption could push older workers out of the labour market, reducing income tax receipts.

People aged over 70 paid £19.1billion in income tax during the 2022 to 2023 tax year.

Andrea Barry, from the Centre for Ageing Better, urged caution, saying: “More needs to be done to understand the impact of ending it before it is hastily removed.”

More From GB News