Rachel Reeves unveils 'new hurdles' as hiked car taxes cause drivers to give up going electric

EVA England has slammed the new pay-per-mile road taxes coming in 2028 for electric cars

Don't Miss

Most Read

Latest

Chancellor Rachel Reeves has come under fire for unveiling new pay-per-mile charges for electric vehicles, set to begin in April 2028.

The electric vehicle drivers' association EVA England has voiced strong opposition to the move announced at the Autumn Budget this week.

The organisation responded to the new tax system, which confirmed a 3p per mile tax for EVs and 1.5p for plug-in hybrids, warning that the measure could significantly hinder the transition to electric motoring.

The new charge forms part of broader tax changes expected to generate £11billion by 2029, with the mileage levy alone projected to raise £1.4billion.

TRENDING

Stories

Videos

Your Say

The rates will rise annually in line with inflation, according to the Office for Budget Responsibility documents.

EVA England expressed particular concern about the timing of the announcement, given that electric vehicles currently represent just five per cent of cars on UK roads.

Vicky Edmonds, Chief Executive Officer of EVA England, criticised the new tax, labelling it as counterproductive to efforts encouraging electric vehicle uptake.

She stated: "The parallel introduction of a new electric tax in only two years is like putting the brakes on any momentum we have been building to get more and more drivers to switch to electric.

"It is adding extra cost to those reliant on public charging and already paying more to drive an EV, and let's be clear, that is already a huge disincentive to switch to electric."

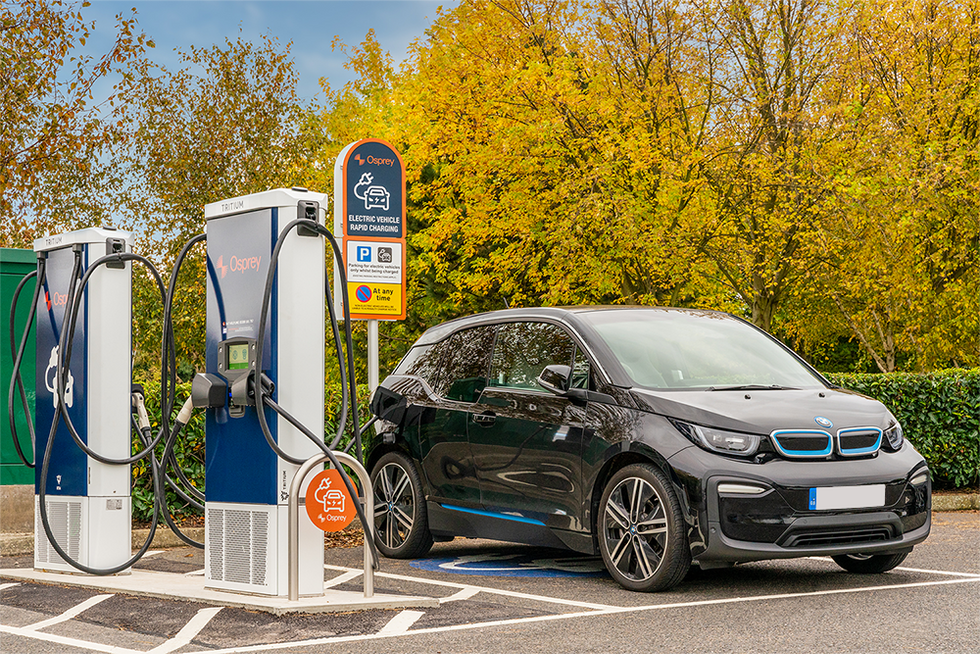

The Autumn Budget announced new car taxes for electric vehicles coming into effect in 2028

| GETTY/PAThe organisation acknowledged that while many members believe EV drivers should contribute fairly to road taxes, the timing of the scheme's introduction was problematic.

EVA England highlighted a significant disparity in the electric vehicle market that the new tax could exacerbate.

The organisation revealed that half of EV owners lacking driveways currently spend more on running their electric vehicles than they would on petrol or diesel alternatives, primarily due to higher public charging costs.

This charging divide represents a major barrier to wider EV adoption.

Households without driveways constitute fewer than 10 per cent of the current electric vehicle driving population, yet they account for nearly 40 per cent of all UK drivers.

The association warned that approximately 40 per cent of motorists believe electric vehicles will never suit their needs, a perception that additional taxation could reinforce.

LATEST DEVELOPMENTS

- Jaguar Land Rover's cyber attack sees UK car production plummet by a third as shutdown cripples sector

- Motorists could see new driving laws and speed limits introduced to tackle key road issue under new proposals

- Jaguar's 'woke' Type 00 electric car wins milestone award one year after controversial rollout

EVA England warned that public charging points remain too expensive to cope with the new road prices

| OSPREY CHARGINGEVA England has now called for motorists' perspectives to be prioritised in forthcoming discussions about implementing the electronic Vehicle Excise Duty scheme.

The association stressed that any support measures must tackle fundamental obstacles preventing wider electric vehicle uptake.

The organisation outlined specific demands for Government action.

These include ensuring the £1.3billion Electric Car Grant enhancement assists lower-income households in accessing EVs and strengthens the second-hand electric vehicle market.

EVA England also urged the Chancellor to extend Benefit-in-Kind rates past 2030 and into the used car sector.

Additionally, the association pressed for swift progress on the public charging review to reduce costs, particularly for those without home charging access.

"These are the points we will be making as we continue our discussions with HM Treasury and the Department for Transport in the coming weeks," Ms Edmonds confirmed.

Electric car owners will be charged three pence per mile | PA

Electric car owners will be charged three pence per mile | PABut the Budget did include an investment in electric vehicle infrastructure, comprising enhancements to the Electric Car Grant and public charging stations.

According to the OBR documents, typical EV drivers travelling 8,500 miles yearly will face charges of approximately £255 from 2028, comparable to the fuel duty burden on conventional vehicles.

Industry figures echoed EVA England's concerns about the scheme's impact.

Asif Ghafoor, CEO of charge point operator Be.EV described the mileage-based charging system as "a new hurdle to adoption" for millions of motorists.

He highlighted existing inequalities between drivers with home charging facilities who benefit from cheaper off-peak rates and those dependent on costlier public infrastructure.

John Cassidy from Close Brothers Motor Finance warned that the scheme could make electric vehicle ownership substantially more expensive than traditional alternatives, particularly for high-mileage drivers.