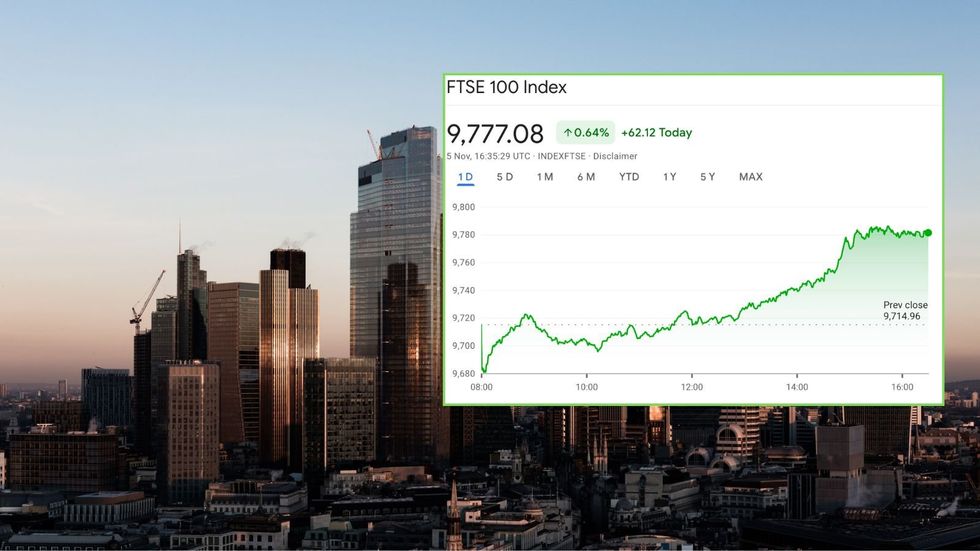

Ftse 100 closes higher as US markets rally following tech drop

Shadow Secretary of State for Science, Innovation and Technology on the new tech deal |

GB News

London markets rise as UK and US economic indicators boost confidence after tech-led sell-off

Don't Miss

Most Read

London’s premier share index recovered on Wednesday, with the Ftse 100 rising 62.12 points to close at 9,777.08, a gain of 0.6 per cent.

The move higher followed volatility in American tech stocks earlier in the week.

Wall Street stabilised after Tuesday’s sharp technology-led decline, with fresh employment figures reassuring investors.

The improvement in US sentiment helped lift confidence in UK trading rooms.

TRENDING

Stories

Videos

Your Say

The FTSE 250 also advanced, up 98.90 points at 22,094.38, an increase of 0.5 per cent.

However, smaller companies struggled, with the AIM All-Share slipping 3.33 points to 756.22.

Traders welcomed positive economic indicators from the UK and the US, which suggested resilience in labour markets despite recent market turbulence.

Economists said the data helped calm nerves after a volatile start to the week for global equities.

Britain’s services sector posted renewed strength in October.

The purchasing managers’ index rose to 52.3 from 50.8 in September, exceeding the flash estimate of 51.1 and marking six months of expansion.

The broader private sector PMI also improved, rising to 52.2 from 50.1.

The figures indicated continued momentum across the economy heading into the final quarter.

London markets rebound as upbeat UK and US data restore confidence after tech-driven slump

|GETTY/Google Finance

Rob Wood, chief UK economist at Pantheon Macroeconomics, noted that companies appeared to be “brushing off the spectacle of months of tax hike rumours and kite-flying from the Treasury”.

Mr Wood forecast quarterly growth of 0.2 per cent, adding that “that’s hardly rip-roaring” but suggesting PMIs often underestimate GDP in uncertain periods.

Across the Atlantic, private sector hiring returned to growth for the first time since July.

ADP reported 42,000 new jobs in October, beating expectations of 32,000 and reversing September’s revised loss of 29,000 positions.

The Institute for Supply Management’s (ISM) services index increased to 52.4 per cent in October from 50 per cent in September.

LATEST DEVELOPMENTS

|

| GETTY

The data reinforced evidence of continued resilience in the American economy.

The updates supported US stocks, with the S&P 500 up 0.5 per cent and the Nasdaq rising 0.8 per cent by the London close.

Improved sentiment fed into UK trading as confidence returned across major index constituents.

Kathleen Brooks at XTB said Tuesday’s sell-off “has failed to develop into something more sinister”.

She added that America’s tech sector “does not look like it is on the cusp of bursting”, though high valuations can amplify declines when selling pressure builds.

Ceres Power topped the FTSE risers, jumping 19 per cent after announcing an expanded manufacturing partnership with Chinese engine group Weichai Power.

The agreement makes Weichai the company’s fourth global manufacturing partner and includes licensing revenue, milestone payments and royalties in line with existing contracts.

Technology-focused investment trusts came under pressure following recent volatility in US tech names.

Polar Capital Technology Trust slipped 0.4 per cent, while Scottish Mortgage Investment Trust dipped 1.6 per cent.

Among blue-chip names, Burberry climbed 36.5 pence to £12.05.

Hospitality groups Whitbread and InterContinental Hotels gained £74 and £242 respectively.

British American Tobacco rose £92 to £41.42, and Coca-Cola Europacific Partners advanced £150 to £68.30.

Investors favoured defensive consumer stocks as markets stabilised.

Marks & Spencer held steady despite a 99% plunge in first-half profit to £3.4m from £391.9m

| GETTY/M&SMarks & Spencer finished unchanged despite reporting a 99 per cent fall in first-half pre-tax profit to £3.4million, down from £391.9million the year before.

The retailer absorbed £101.6million in costs linked to an April cyber incident, with another £34million expected in the second half. Insurance of £100million provided partial relief.

Chief executive Stuart Machin called the period an “extraordinary moment in time for M&S”.

He said the company had shown resilience in managing the disruption.

Housebuilder Barratt Redrow gained 0.9 per cent after maintaining its guidance.

The group said merger synergies had risen to £80million, up from £69million in June.

Trainline surged 5.3 per cent after raising its earnings growth forecast to 10-13 per cent from 6-9 per cent.

Investors welcomed the upgrade as a sign of improving consumer demand in travel services.

More From GB News