FTSE 100 closes third quarter at record high with best gains since 2022

GBNEWS

Sterling’s slump has boosted overseas earnings, helping the FTSE 100 notch its strongest quarter since 2022

Don't Miss

Most Read

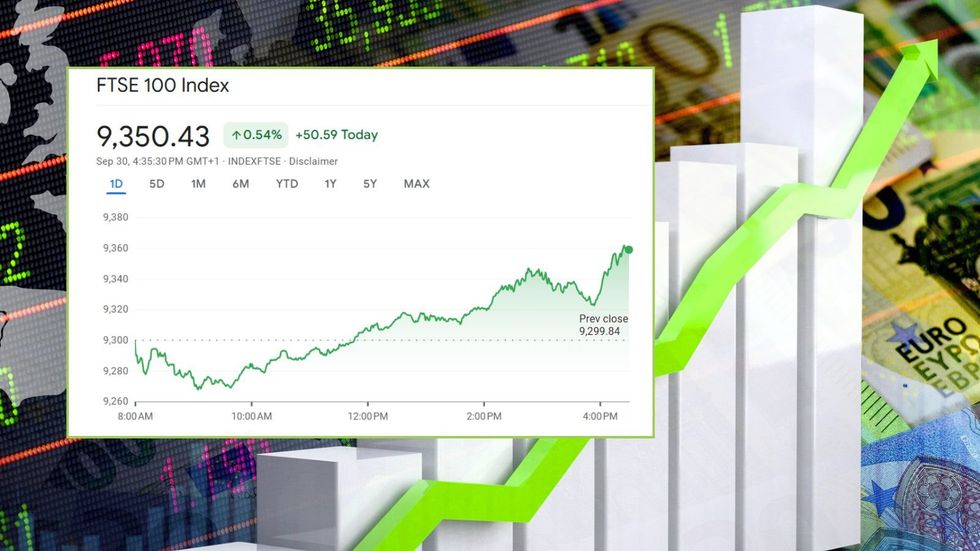

Britain's premier stock index achieved a milestone on Tuesday as the FTSE 100 reached an all-time peak, capping off its strongest three-month period in nearly three years.

The blue-chip index climbed 0.5 per cent to close at 9,350.43 points, whilst the more domestically-oriented FTSE 250 advanced 0.7 per cent.

The FTSE 100 has just delivered its strongest quarter in nearly three years, even as worries mount over Britain’s shaky public finances and the chance of tax rises in November’s Budget.

The blue-chip index hasn’t seen gains like this since October 2022, with its record run helped along by a weaker pound.

That drop in sterling has boosted the overseas earnings of global companies listed in London, giving the index an extra lift.

Michael Brown, a senior research strategist at Pepperstone said: "We've obviously had a marginally weaker pound over the last sort of couple of weeks, which will have been helping."

He also highlighted the index's relative appeal: "Plus, the fact is that for a number of years now the FTSE 100 on various valuation measures compared to peers across the Atlantic still trades very, very cheap, which is probably attracting some bargain hunters."

AJ Bell's head of financial analysis, Danni Hewson, struck an optimistic note about the market's resilience.

She said: "Despite all the doom and gloom about the UK economy and concerns about a US government shutdown, London's FTSE 100 has closed at a fresh record high today."

London's FTSE 100 has closed at a fresh record high today

|Ms Hewson noted that the index "has enjoyed a stellar year so far and is set for its best quarter since 2022."

She suggested the chancellor might view the FTSE's strong performance as validation that efforts to attract UK investment are bearing fruit.

Defence companies emerged as Tuesday's standout performers, providing the strongest uplift to the main index.

Aerospace and defence firm Melrose surged more than two per cent, whilst engine manufacturer Rolls-Royce also climbed above two per cent.

Both companies benefited from upgraded price targets by investment bank UBS, which boosted investor sentiment across the sector.

FTSE 100 closes third quarter at record high

| GETTYThe defence industry's strong showing contributed significantly to pushing the FTSE 100 to its record close, with the sector index recording notable gains amid broader market optimism.

The pound's depreciation has provided a tailwind for companies generating substantial revenues abroad, enhancing their sterling-denominated profits.

Despite Britain's challenging economic landscape, including stagnant growth and stubborn inflation, the FTSE 100's comparatively low valuations versus American markets continue to attract investors seeking value opportunities.

The domestically-focused mid-cap index has recorded more modest quarterly gains than its large-cap counterpart, reflecting investor wariness about the UK's fiscal challenges.

Market participants remain cautious ahead of potential tax rises as the government seeks solutions to address gaps in public spending

| GETTYMarket participants remain cautious ahead of potential tax rises as the government seeks solutions to address gaps in public spending.

Individual sectors displayed divergent trends, with telecommunications firm Airtel Africa achieving new heights after its share price more than doubled since January's opening.

The company reached unprecedented levels on Tuesday, bolstered by rising customer numbers and its May partnership with SpaceX to distribute Starlink internet services.

Conversely, online fashion retailer ASOS tumbled 4.7 per cent after cautioning that yearly revenues would miss market forecasts due to sluggish consumer spending.

Gaming companies faced pressure amid speculation about potential tax increases, with Evoke dropping 2.6 per cent, whilst BT Group declined 1.1 per cent following a downgrade from New Street Research.