FTSE 100 hits record high as oil and gold prices climb

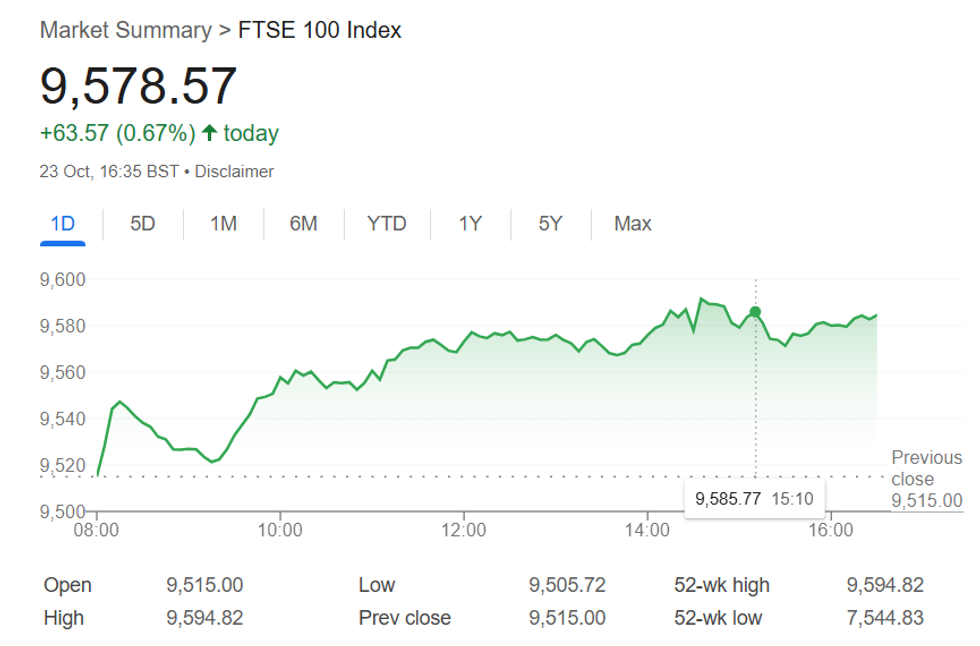

The FTSE 100 hit a record high during trading before closing 0.7 per cent higher

Don't Miss

Most Read

London’s stock market hit a record high on Thursday as rising oil prices and upbeat company results boosted investor confidence.

The FTSE 100 climbed to an all-time peak of 9,594.82 during trading before closing slightly lower at 9,578.57 - up 0.7 per cent on the day.

Energy and mining firms were among the biggest gainers after the US and EU announced new sanctions on Russia’s oil industry, pushing crude prices sharply higher. Strong trading updates from several major companies also helped lift the mood.

The rally wasn’t limited to the top tier - the FTSE 250, which tracks many UK-focused firms, jumped 131.62 points to 22,361.41, while smaller companies on the junior market saw their index rise by one per cent.

Brent crude surged to $65.75 per barrel from Wednesday's $62.61 following the announcement of sanctions against Rosneft and Lukoil. US President Donald Trump described the measures as "tremendous" whilst expressing hope they would be short-lived, adding: "We hope that the war will be settled."

The American leader revealed the penalties came after negotiations with Vladimir Putin "went nowhere". Brussels joined Washington's efforts as part of ongoing attempts to force Moscow to halt its three-and-a-half-year Ukrainian campaign.

Shell shares climbed 2.9 per cent whilst BP advanced 3.7 per cent on the news. Smaller producers recorded even stronger gains, with Tullow Oil jumping 7.4 per cent and Harbour Energy rising 5.1 per cent.

FTSE 100 hits record high

|GETTY

Gold traded at $4,146.49 per ounce on Thursday, recovering from $4,028.64 the previous day. The precious metal experienced significant volatility this week following recent strong advances.

Mining companies benefited from the rally, with Fresnillo gaining 5.3 per cent and Endeavour Mining advancing three per cent. Goldman Sachs analysts maintained their bullish outlook, citing "sticky, structural buying" and forecasting gold could reach $4,900 by end-2026.

Rentokil Initial soared 8.3 per cent after reporting accelerated North American growth. The pest control firm's organic revenue expanded 3.4 per cent in the third quarter, improving from 1.4 per cent in the previous period.

The FTSE 100 climbed to an all-time peak of 9,594.82 during trading before closing

|London Stock Exchange Group jumped 7.2 per cent following upgraded margin guidance and announcing a £1billion share repurchase programme. The company also secured an agreement with 11 major banks for its Post Trade division.

Arne Lohmann Rasmussen from Global Risk Management stated: "These new sanctions are likely to have a real impact."

However, Oxford Economics analyst Bridget Payne anticipated limited oil price strength, expecting the measures to affect Russian revenues rather than global supply.

The consumer goods giant's underlying sales increased 3.9 per cent, beating consensus expectations of 3.7 per cent growth

| GETTYUnilever shares rose 0.8 per cent after maintaining full-year guidance despite difficult market conditions. The consumer goods giant's underlying sales increased 3.9 per cent, beating consensus expectations of 3.7 per cent growth.

Sterling weakened to $1.3323 from Wednesday's $1.3366, whilst European markets posted modest gains. Wall Street indices traded higher at London's close.

Friday's economic calendar features US inflation data, flash PMI readings across major economies, and third-quarter results from NatWest.