Economy alert: US 'prepared to do what is necessary' to save Javier Milei's Argentina amid market chaos

4 Are Trump’s Tariffs a Threat to the Economy or a Master Negotiation Tactic? |

GB NEWS

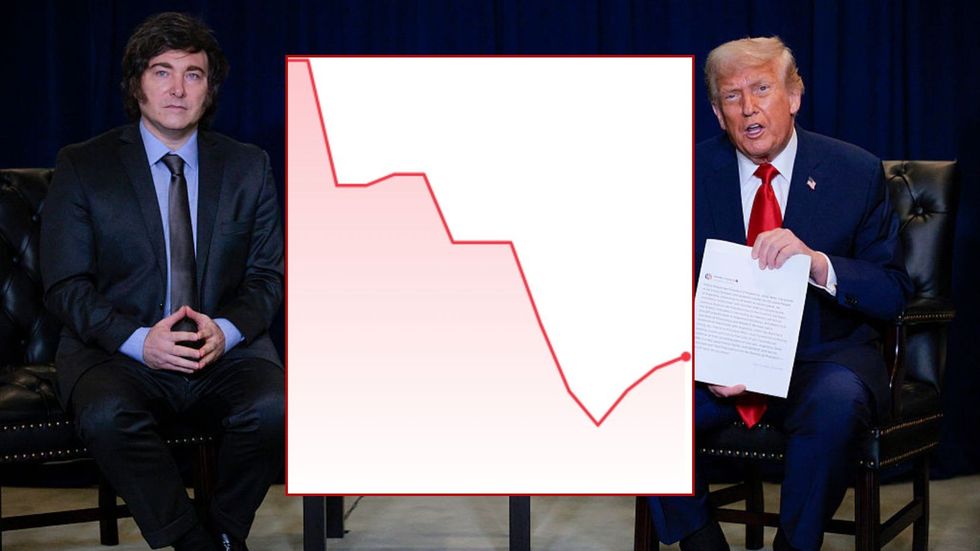

Rising unemployment and recession concerns have spooked markets despite Javier Milei's attempts to bolster Argentina's economy

Don't Miss

Most Read

The United States is attempting to save Argentina's economy as part of a $20billion (£14.8billion) swap line between the central banks of both nations.

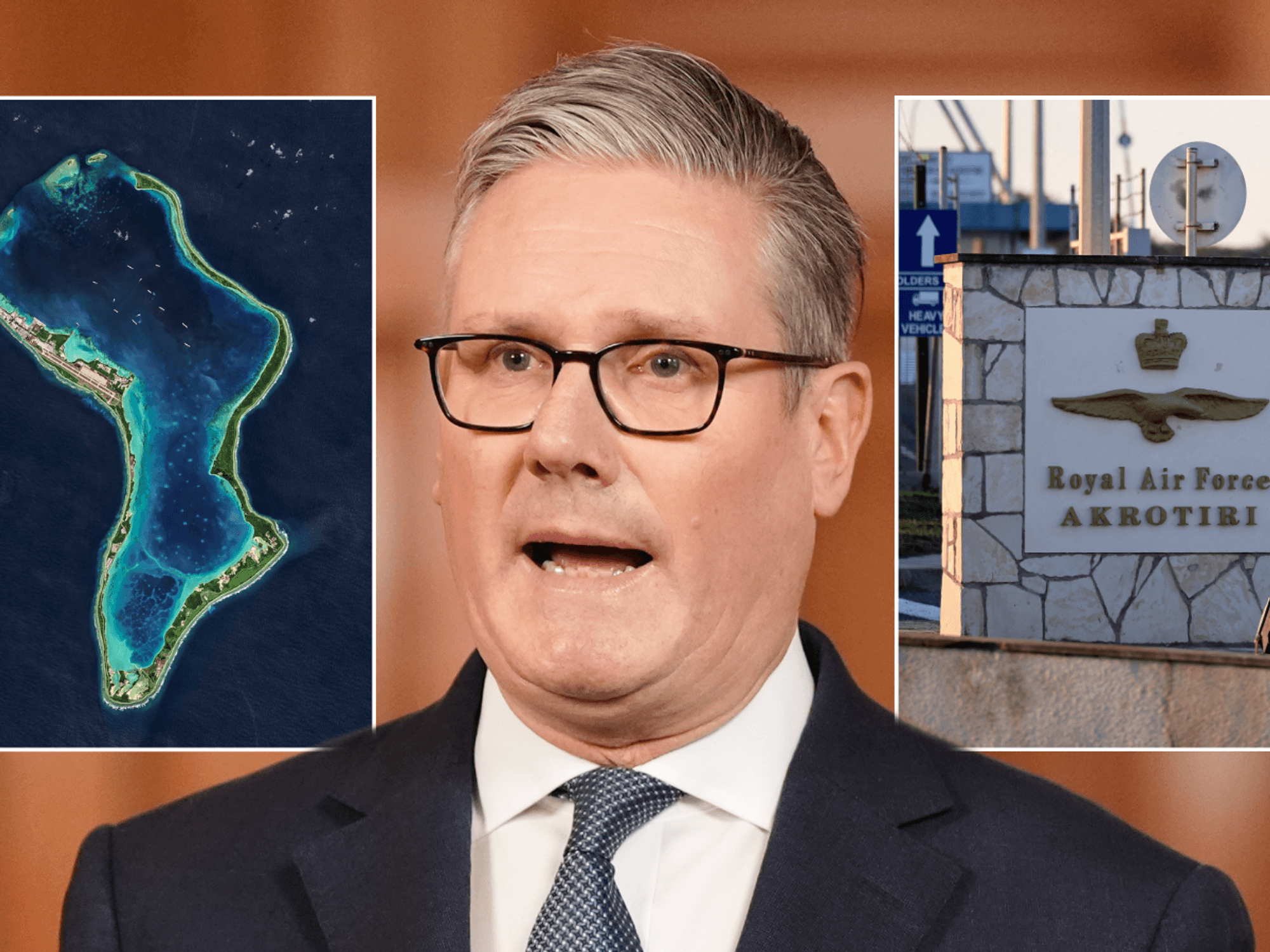

Despite being hailed for bringing down Government spending and easing inflationary concerns, Argentina's President Javier Milei has been forced to contend with extreme market volatility as unemployment and recession concerns grow.

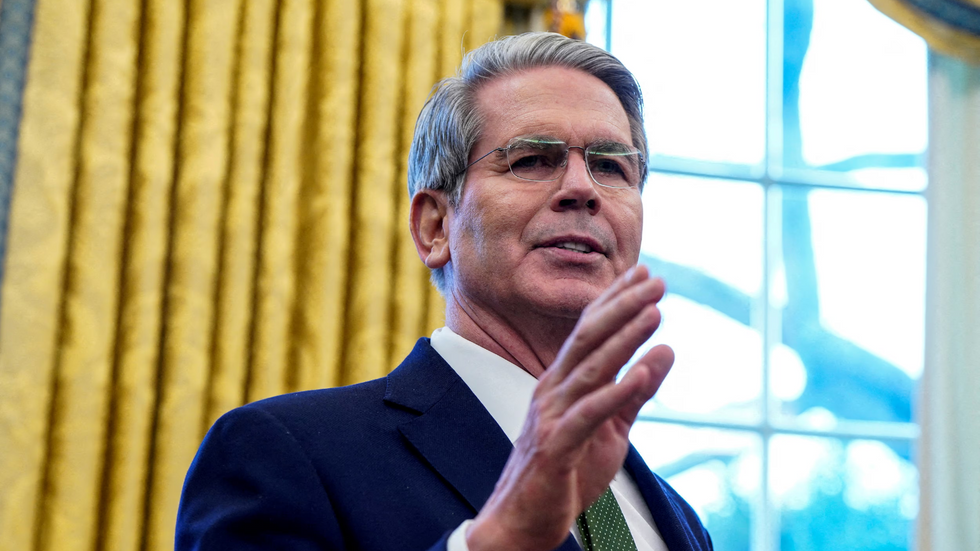

US Treasury Secretary Scott Bessent confirmed the US is set to purchase Argentina’s US dollar-denominated bonds and will do so as conditions warrant.

Furthermore, the United States is preparing to offer a lifeline via significant standby credit through Exchange Stabilization Fund.

US is 'prepared to do what is necessary' to save Argentina's economy

|GETTY / TRADING VIEW

Mr Bessent said: "Argentina has the tools to defeat speculators, including those who seek to destabilize Argentina's markets for political objectives.

"I will be watching developments closely and the Treasury remains fully prepared to do what is necessary."

The former hedge fund executive also confirmed that the United States is preparing to buy secondary or primary Government debt.

It is also working with Mr Milei's Government to stop the tax holiday for commodity producers converting foreign exchange.

Milei has often expressed admiration for Margaret Thatcher | GETTY

Milei has often expressed admiration for Margaret Thatcher | GETTYSpeaking to Fox News Business, Mr Bessent cited the importance of US support for Argentina and Mr Milei, whose libertarian fiscal policy has been supported by certain sections of the MAGA movement.

The Treasury Secretary asserted that he did not think the market had lost confidence in the Argentine leader, but was remembering past fiscal crisis.

He added: "We are not going to let a disequilibrium in the market ... cause a backup in his substantial economic reforms.

"I think the market is looking in the rear-view mirror and is looking at decades, if not a century, of terrible Argentinian mismanagement."

US Treasury Secretary Scott Bessent is negotiating on behalf of the Trump administration | REUTERS

US Treasury Secretary Scott Bessent is negotiating on behalf of the Trump administration | REUTERSTrading activity intensified as investors digested the implications of potential US financial backing for Argentina's economy.

These measures would supposedly provide Argentina with crucial foreign currency reserves to meet its international obligations and support monetary stability.

Argentina's economy expanded by 2.9 per cent year-on-year in July, according to government statistics released on Wednesday.

The growth figure for Latin America's third-largest economy fell short of market expectations, with analysts surveyed by Reuters having forecast a 3.3 per cent increase.

LATEST DEVELOPMENTS:

Argentine President Javier Milei | Reuters

Argentine President Javier Milei | ReutersThe latest economic data arrives as Argentina continues to grapple with persistent inflation and fiscal challenges under President Milei's reform agenda.

Critics have claimed Mr Milei’s austerity measures have been extremely aggressive, including cutting subsidies, slashing spending, deregulating, and liberalising prices.

Ahead of upcoming midterm elections in Argentina, investors are concerned over potential political and social backlash, which could result in the Government reversing course.

Argentina's unemployment rate rose to 7.9 per cent in the first quarter of 2025 with the economy contracting by 0.1 per cent in the second quarter.

More From GB News