Unemployment remains at 4-year high as inflation set to be 'higher for longer' ahead of Rachel Reeves Budget

'Rinsing every drop from the British economy!' Rachel Reeves skewered by GB News guest as Chancellor branded 'desperate' |

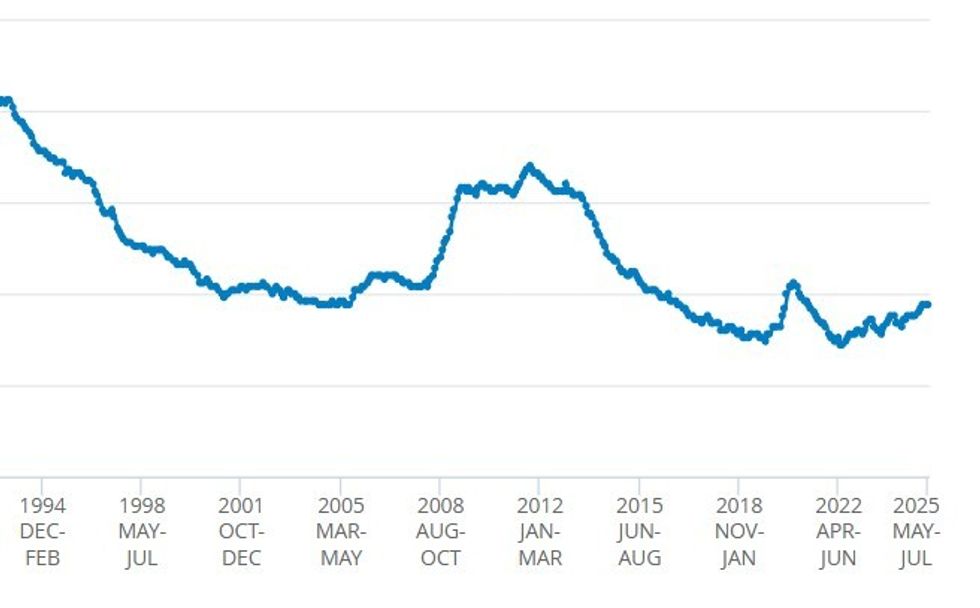

The ONS has confirmed the unemployment rate in the UK remains unchanged at 4.7 per cent

Don't Miss

Most Read

Unemployment in Britain remains at a four-year as cost of living concerns remain a persistent issue, official Government data has found.

Economists warn inflation is set to be "higher for longer" due to persistent wage grown as unemployment in the UK remains unchanged ahead of Chancellor Rachel Reeves's Autumn Budget.

The Office for National Statistics (ONS) has confirmed the rate of UK unemployment stayed at 4.7 per cent in the three months to July, compared with the three months to June.

As well as this, the ONS figures found UK average regular earnings growth fell to 4.8 per cent in the three months to July and was 1.2 per cent higher after factoring in Consumer Prices Index (CPI) inflation.

Rachel Reeves has to contend with the latest unemployment figures

| GETTYLiz McKeown the director of Economic Statistics, ONS, said: "The labour market continues to cool, with the number of people on payroll falling again, while firms also told us there were fewer jobs in the latest period."

The director noted that "the weakness is reflected in a slight increase on the quarter in the unemployment rate" with "the number of vacancies also falling on the quarter, though the rate of decline appears to be slowing".

This rate for the last three-month period the same as the previous quarter, which had been the highest level since June 2021.

Professor Joe Nellis, an economic adviser at accountancy firm MHA, warned that the current average weekly earnings figure remains "higher than the Bank of England would like".

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Unemployment remains at four-year high, according to ONS figures

|ONS

He explained: "Wages are continuing to rise despite vacancy numbers continuing to edge lower. After declining for three years, it was expected that vacancies would bottom out at pre-pandemic levels, but they are continuing to drop below this level.

"This persistence in wage growth could keep services inflation higher for longer, leaving the Bank of England in a holding pattern on interest rates. The Monetary Policy Committee (MPC) is expected to keep rates unchanged on Thursday, waiting for clearer signs that inflation is on a sustained path back to two per cent and wage growth is under control.

"The data also sets the stage for the Autumn Budget, where the Chancellor faces a delicate balancing act — whether to loosen fiscal policy to support growth or hold back to avoid stoking inflation further."

Kevin Brown, a savings expert at Scottish Friendly, added: "Cooling wage growth shows that the labour market slowdown is now feeding through to workers’ pay packets, leaving them less protected against stubbornly high inflation.

MEMBERSHIP:

- Labour accused of rigging debate over Chagos surrender by smuggling in 'killer' clause: 'This is NO democracy'

- Nigel Farage secures crushing victory with FOUR election wins as the Prime Minister is mired in chaos

- Our new Home Secretary's record on crime should be in the welcome pack for small boat arrivals - Carole Malone

- POLL OF THE DAY: Are Britain's schools doing enough to preserve the memory of our Battle of Britain heroes? VOTE NOW

- EXPOSED: Keir Starmer humiliated on eve of Donald Trump visit as bombshell letter threatens 'surrender' deal

"While this is exactly the outcome the Monetary Policy Committee (MPC) will have wanted, it does little to change the path for interest rates. Inflation is still running at close to double the MPC’s 2% target, and policymakers will be wary of cutting rates too soon and adding fuel to the inflation fire.

"For many households, weaker earnings growth result in tighter budgets and a hit to consumer confidence at a time when concerns are mounting over jobs and growth. For the economy, dampened consumer spending will almost certainly mean more sluggish growth.

"Theoretically, softer wage data strengthens the case for another round of rate cuts but in practice, interest rates are likely to be on hold until at least spring next year."

Ben Harrison, the Work Foundation's director at Lancaster University, said: "Concerningly for Ministers seeking to create additional pathways to work, there are now more people looking for fewer available jobs – with 2.3 jobseekers per vacancy. And the risk remains that unemployment rises further in the months ahead.

LATEST DEVELOPMENTS:

Unemployment has remained the same, according to the latest ONS figures | GETTY

Unemployment has remained the same, according to the latest ONS figures | GETTY "The cooling labour market has also impacted wage growth. Nominal wage growth slowed to 4.8%, which is the first time it has dipped below 5% for three years since June 2022.

"Worryingly, this period of consistent pay growth has not fed through to real wages. Workers remain only £24 better off since the start of the Financial Crisis in August 2008.

"Only half of workers (48 per cent) believe wage increases are keeping up with the cost of living and just 43% expect an above inflation pay rise in the next 12 months.

"As the potential for tax rises looms at the upcoming Autumn Budget, Government must ensure it does not increase the pressure on lower income workers who have borne the brunt of this squeeze in recent years.2

More From GB News