Economy alert: UK debt to smash £3.5TRILLION as borrowing costs rocket to £140billion

'Economy on its knees!' Lizzie Cundy tells Rachel Reeves it is 'time to RESIGN' over tax hikes and national debt |

GB News

OBR warns UK faces one of the worst debt spirals in the developed world as taxes climb to record levels

Don't Miss

Most Read

Britain’s public debt burden is projected to exceed £3.5trillion by the 2030–31 financial year, according to new forecasts from the Office for Budget Responsibility (OBR).

Annual interest costs are expected to climb to £140billion, matching the combined spending on education and defence.

The national debt currently stands at £2.8trillion and is forecast to pass £3trillion next year.

The OBR said the pace of debt accumulation places the UK among the worst-performing advanced economies over the past two decades.

TRENDING

Stories

Videos

Your Say

Richard Hughes, chairman of the watchdog, warned that Britain has “experienced one of the largest increases in government debt of any advanced economy”, with the burden almost tripling as a share of GDP.

The OBR’s latest assessment shows the UK’s debt-to-GDP ratio will reach 96 per cent by the end of the decade.

This is double the average level across advanced economies and represents a two percentage point increase on projections made in March.

The watchdog highlighted the structural pressures within the public finances.

It noted that productivity growth has been revised down to 1.0 per cent, 0.3 percentage points below earlier forecasts.

Public sector net debt is expected to rise from 95 per cent of GDP this year to 97 per cent in 2028–29.

OBR warns UK risks deepening debt spiral amid record-high tax burden

|PA/ONS/OBR/CoPilot

A slight fall is pencilled in afterwards, reflecting Chancellor Rachel Reeves’ adherence to her fiscal rules and an estimated £22billion of headroom.

Borrowing is forecast to fall from 4.5 per cent of GDP in 2025–26 to 1.9 per cent in 2030–31.

This relies on the Government achieving ambitious revenue targets during a period of weak economic growth.

Budget documents show that pre-measures spending will exceed forecasts by £22billion in 2029–30.

The rise is driven by higher spending pressures from local authorities, welfare programmes and mounting debt interest.

The current budget is forecast to return to balance in 2029–30.

LATEST DEVELOPMENTS

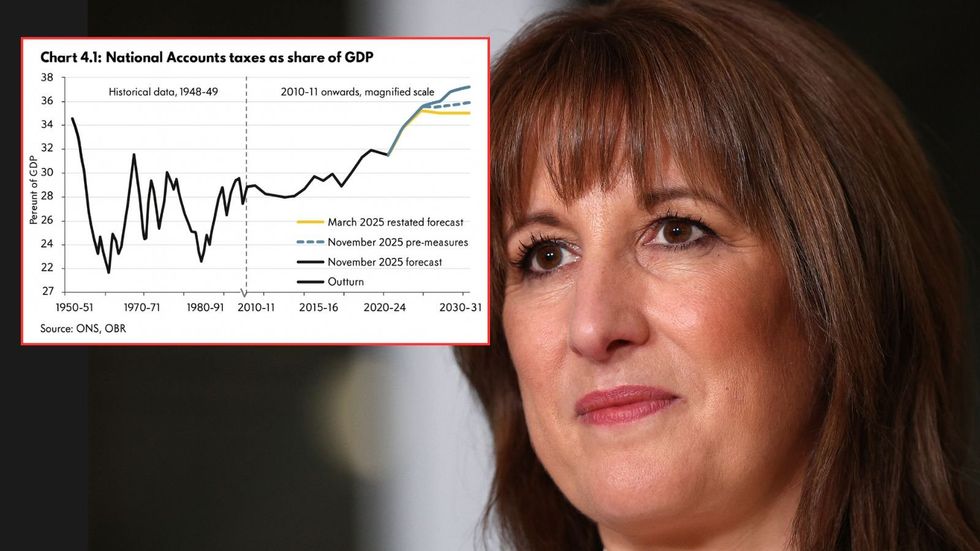

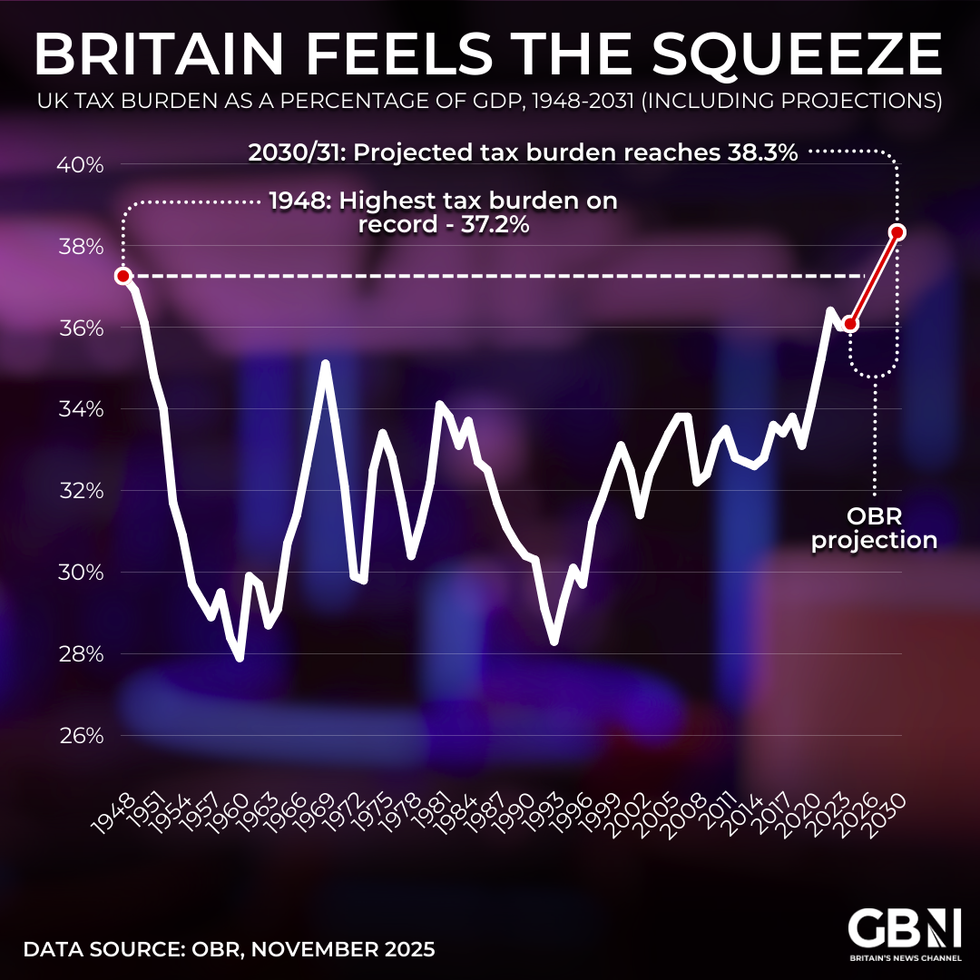

£26billion in tax raids has seen the UK's tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR | GB NEWS/OBR

£26billion in tax raids has seen the UK's tax burden projected to rise to a post-war record 38 per cent of GDP by 2030, according to the OBR | GB NEWS/OBRHowever, the margin has narrowed significantly from previous projections, reflecting intensifying strain across Whitehall departments.

The tax burden is set to hit its highest level since records began.

The OBR expects taxes to rise to 38 per cent of GDP by 2030–31 as frozen thresholds and smaller revenue-raising policies feed through the system.

These measures are calculated to raise a further £26billion by 2029–30.

Budget policies will also increase government spending by £11billion that year, largely due to the reversal of welfare cuts and the removal of the two-child limit for universal credit.

Gilt issuance has been raised from £299.1billion to £304.7billion this year.

The OBR attributed the increase to “higher spending pressures, in particular from local authorities and on welfare”.

Britain’s reliance on debt markets continues to rise as spending outstrips revenues.

About a quarter of the national debt is held by overseas investors, exposing public finances to sudden movements in global sentiment.

This dependence carries risks of capital flight if confidence weakens, a concern underscored by recent volatility when borrowing costs spiked following Budget leaks attributed to an OBR insider.

Andrew Wishart, economist at investment bank Berenberg, said: “In the near-term, the Government will spend and borrow more than previously planned.”

U.K 10 year Gilt as of Nov 27, 2025 5:00p.m. GMT

|Marketwatch

He noted that the Treasury is increasingly using gilt sales to fund the gap between spending commitments and tax receipts.

Gilts function as government IOUs sold to pension funds, insurers and other financial institutions, which receive interest in return.

The system relies on stable investor confidence, making the UK vulnerable as its debt ratio climbs above international norms.

With debt levels set to remain significantly higher than those of comparable economies, the UK enters the next decade heavily reliant on bond markets for fiscal stability.

More From GB News