Borrowing costs plummet and Ftse 100 surges as 'volatile markets settle' after Rachel Reeves's Budget

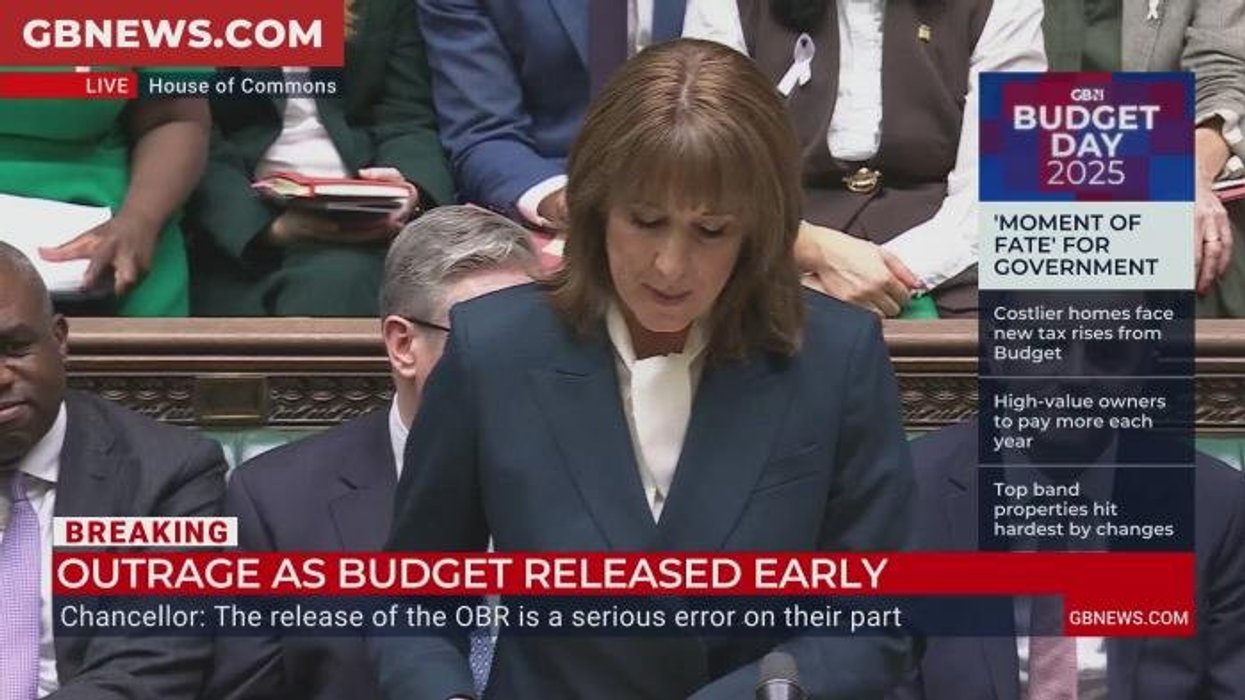

'Britain has defied the forecasts!' Chancellor Rachel Reeves discusses the OBR's latest economic report, as it increases its forecast for economic growth this year |

GB NEWS

The Chancellor has previously promised to bring down Britain's debt burden ahead of her fiscal statement

Don't Miss

Most Read

Latest

Borrowing costs have plummeted and the Ftse 100 has soared in the hours after Chancellor Rachel Reeves's Budget; the contents of which were accidentally leaked by the Office for Budget Responsibility (OBR).

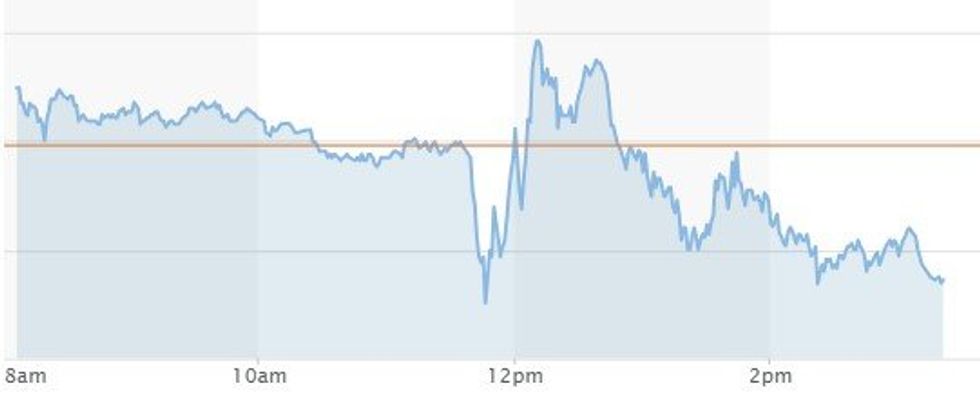

The 10-year gilt dived to 4.438 per cent at around 3:15pm, while longer-term 30-year borrowing costs fell to 5.232 per cent as markets reacted to the tax threshold freeze, cut to the ISA tax-free allowance and the two-child benefit cap's axe.

Over the same period, the Ftse 100's surged nearly 0.8 per cent, alongside European stocks and early trading in the US. This comes after weeks of speculation that the Labour Government would break its manifesto pledge to raise tax on "working people" to bolster the Treasury's coffers.

It's widely expected Ms Reeves will extend the existing freeze on HM Revenue and Customs (HMRC) thresholds until at least 2030 in what many consider to be a stealth tax.

10-year gilt yields, which are used the benchmark for the return the Treasury promises to buyers of its debt, jumped slightly in early bond market trading prior the statement.

This adds further pressure to the Chancellor, who has previously cited that £1 in every £10 of taxpayer money is spent on paying interest payments on UK debt.

Ahead of Ms Reeves's statement, Darren Jones, the chief secretary to the Prime Minister, claimed the Budget will "help tackle the cost of living", slash NHS waiting list times and reduce Britain's debt burden.

However, Mr Jones admitted that the UK's benefit expenditure at its current level was no longer sustainable for the Government.

Rachel Reeves steps out of No11 with red box ahead as Britons face Budget tax raid

|GB News

Figures from the Office for National Statistics (ONS) found public borrowing came to £17.4billion in October 2025, which is the difference between public spending and income.

While this was £1.8billion, or 9.6 per cent, less than October 2024, it represents the third-highest October borrowing since monthly records began in 1993, after those of 2024 and 2020.

Overall borrowing in the financial year to October 2025 was £116.8billion which was £9billion more than in the same seven-month period of 2024 and the second-highest April to October borrowing on record.

Michiel Tukker and Benjamin Schroeder, ING’s rates strategists, said: "Gilt markets have been quite volatile in the run-up to the budget and more price swings are possible as the details emerge."

LATEST DEVELOPMENTS

James Bentley, the financial director of Financial Markets Online, added: "The Chancellor has gone about the economy with the column-filling zeal of a trainee accountant, rather than the vision needed from the CFO of UK Plc.

"It’s telling that the final flourish of her speech wasn’t a policy announcement - but a flex about inflation forecasts falling. Welcome, but hardly something she can take credit for.

"After seesawing wildly following the pre-Budget leak and during the Chancellor’s speech, the markets have begun to settle. The news that the Chancellor has more fiscal headroom than expected has soothed the bond markets so far, and the day has been an odd mixture of competence and chaos.

"This was a Budget that mentioned fairness much more than growth, but it will make both harder to achieve."

10-year borrowing costs have fallen in response to the Chancellor's reforms

|MARKETWATCH

More From GB News