'Silver is having a golden moment and you can make money from it!' Jasmine Birtles tells all

Money expert Jasmine Birtles breaks down why silver's rally 'isn't just a spike'

Don't Miss

Most Read

If you’ve been watching gold and it seems too expensive to buy, now is the time to look at silver instead. The metal isn’t just having a moment, it’s in the middle of what many analysts are calling a ‘physical supply squeeze’, especially in London.

In other words, demand is far outstripping supply which is good news for investors looking for growth. Silver has been surprisingly cheap for a few years but in recent months it has started to surge.

Historically, you used to be able buy an ounce of gold with an average of around 54061 ounces of silver but it’s now hovering at around 78-80, which makes it a buy opportunity.

At least it’s a buy if you can find some. In London —the centre of the global physical silver trade — vault inventories have plunged by nearly 40 per cent since 2021, according to London Bullion Market Association (LBMA) data.

Jasmine Birtles is the founder of MoneyMagpie.com. Get their free investing newsletter here.

Jasmine Birtles is sharing her expertise on finance, pensions and retirement questions in an exclusive Q&A for GB News members

| JASMINE BIRTLES | GETTYMeanwhile lease rates, which is the cost to borrow real silver, exploded to an astonishing 39 per cent annualised for a one-month loan in early October 2025.

That’s not just paper-market stress. It’s a real, deliverable shortage. Traders have even been chartering planes to fly silver bars from New York to London to meet demand.

This explains much of the recent increase in value. Spot prices have leapt more than 80 per cent in dollar terms, according to market-watchers as we find that the world is running out of silver that can be delivered now..

Part of the reason is that silver is being used around the world, not just stored. Unlike gold which is primarily a store of value, silver has many industrial uses which will make it popular for years to come.

Investors are flocking to silver

|GETTY

For example, silver is used in solar panels, electronics, and electric vehicles — all sectors exploding in growth. Meanwhile, production of silver can’t quickly rise to match demand.

There is also simply an increased interest by investors who are looking to money metals generally as safe havens for their money. With inflation worries, currency uncertainty, and rising geopolitical risk, investors are turning to silver as both a hedge and a speculative play.

ETFs backed by real silver are sucking up supply which is further tightening the physical market. Currently, the silver spot price hovers around $38 an ounce.

However, the Bank of America recently raised its silver price target to $65 an ounce in 2026, citing the “state of seizure” in the London physical market.

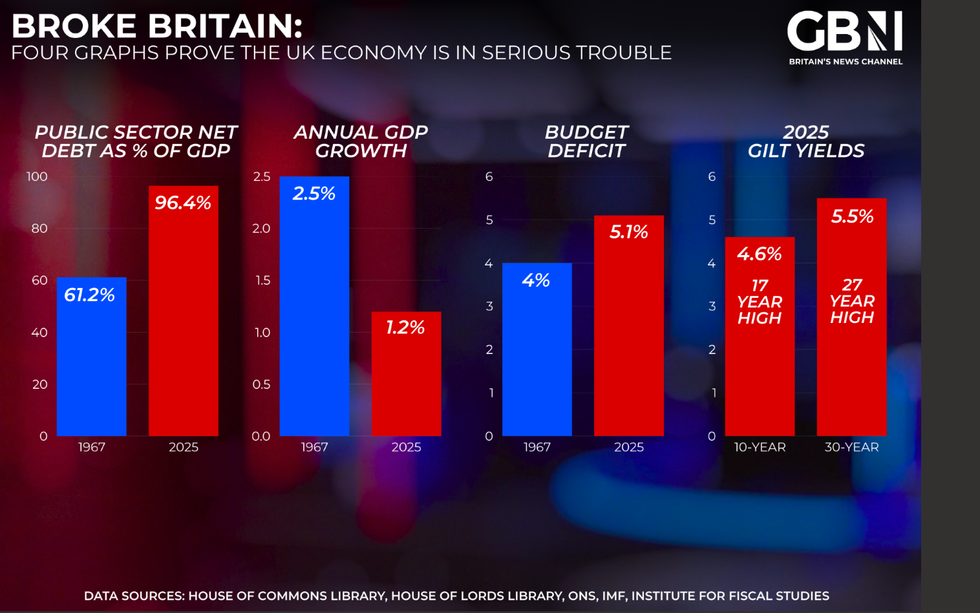

Four graphs prove the UK economy is in serious trouble | GB NEWS

Four graphs prove the UK economy is in serious trouble | GB NEWSSo how can you invest in silver?

If you’re convinced by this setup, here are four practical ways to invest in silver Here are the pros and cons.

Buy actual bars or coins

You can buy bars and coins (although right now you might have to wait weeks to receive them) from the Royal Mint and from various dealers such as ATS near the Savoy in London.

Pros: You own the metal; there’s no counterparty risk; and they are great for long-term stacking.

Cons: you need to store the silver safely and cover the insurance. They are easy to steal.

Allocated vaulting

This is where you buy the silver online and it is stored in a vault for you.Bullionvault.com is one to check out for this. You never actually see the silver (or gold) unless you want it sent to you. You buy it online and you can sell it online at any point.

Pros: Fully backed metal, secure, doesn’t require physical possession. Easy and no fuss.

Cons: They charge monthly vaulting fees, it’s a somewhat less liquid form of owning the metal than wholesale coins.

LATEST DEVELOPMENTS

Silver-backed ETFs

Products like silver ETFs (Exchange-Traded Funds) allow exposure to silver prices without storing bars. Look for silver and gold ETFs on your investment platform like AJ Bell, Interactive Investor or XTB.

Pros: Highly liquid; easy to buy/sell like shares and you can hold them in an ISA, also you don’t have to store or insure your silver.

Cons: You don’t own the physical silver outright, and during a squeeze there may be redemption risk or delivery delays. You also need to be very sure that the ETF company really does have the silver they say they have.

Silver mining stocks or funds

By investing in mining companies or mining funds, you get leverage to silver price movements. If silver is as in demand as it seems to be, mining companies are in a great position for the near future.

Pros: Potential for high returns if silver shoots higher. Also,,you can hold these shares in an ISA and buy and sell like other shares.

Cons: Mining risks (costs, geopolitics) and company-specific risk are a concern. It’s not the same as holding the actual metal. Mining companies are traditionally highly risky so you really need to know what you are doing to pick the right ones.

Gold has bee

| GETTYOf course, though, silver is not risk-free. It’s volatile: A big rally could be met with sharp corrections. Already in 2025, after touching highs near $54.50, prices have had pullbacks.

There is also physical delivery risk: With the London market under strain, getting real metal could be difficult or expensive. As well as this, buying coins or bars carries a premium, and storage/insurance adds ongoing costs.

When it comes the risk of tariffs and heightened regulation, global flows have shifted recently due to U.S. tariff concerns, which could re-emerge. Despite this, silver’s rally in 2025 isn’t just a spike.

It’s grounded in a real, physical shortage. When combined with surging industrial demand and a supply chain that’s struggling to respond, the current backdrop could fuel further gains for savvy investors.

More From GB News