Pound plummets after shock inflation fall as Bank of England 'almost certain to cut interest rates'

Analysts are pricing in a base rate reduction from the Bank of England tomorrow

Don't Miss

Most Read

Latest

British sterling has fallen against the US dollar in response to the latest consumer price index (CPI) inflation rate figure from the Office for National Statistics (ONS).

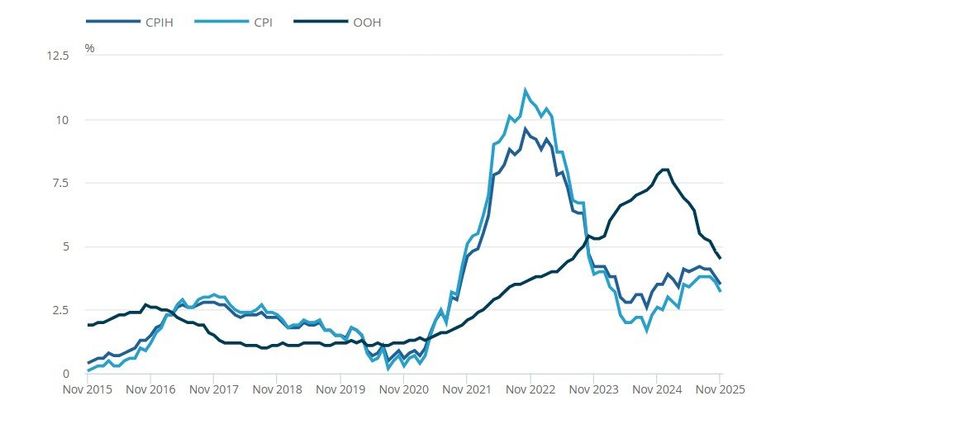

Inflation for the 12 months to November 2025 fell unexpectedly to 3.2 per cent in November, marking its lowest reading in eight months and catching economists off guard.

The figure represented a notable decline from October's 3.6 per cent, with analysts polled by Reuters having anticipated a more modest drop to 3.5 per cent.

The pound responded swiftly to the news, sliding 0.7 per cent against the dollar to reach $1.3343, its weakest position in a week.

The pound slipped in value against the dollar following today's inflation shock

|GETTY / GOOGLE

However, the Ftse 100 moved in the opposite direction, climbing one per cent as investors welcomed the prospect of easier monetary policy ahead.

Core inflation, which strips out volatile food and energy costs, also retreated to 3.2 per cent from 3.4 per cent the previous month.

Samuel Fuller, the director at Financial Markets Online, noted that the CPI rate's fall will likely lead to an interest rate cut from the Bank of England tomorrow at the next Monetary Policy Committee (MPC).

Mr Fuller shared: "Today's sharp fall in UK inflation has opened the door to a flurry of interest rate cuts in the UK.

Rachel Reeves has sought to bolster the UK economy

| PAThe equity market's enthusiasm reflects growing confidence that cheaper borrowing costs will finally breathe life into Britain's sluggish economy.

Mr Fuller noted: "Meanwhile the Ftse is on a tear as investors bet that lower interest rates will finally unblock growth in Britain's flatlining economy."

The divergence between British and European monetary trajectories has become increasingly apparent.

While the Bank of England appears poised for aggressive easing, the European Central Bank finds itself in a markedly different position, having largely tamed inflationary pressures with eurozone prices hovering near its two per cent target for several months.

Neil Wilson, an analyst at Saxo Bank, added: "It's time to ease, ease, ease. Sterling fell after hitting a two-month high yesterday.

Professor Joe Nellis, an economic adviser at accountancy firm MHA, shared: "Inflation in the UK dropped to 3.2 per cent in November, providing a clear indication that the intense price pressures of the recent inflationary cycle are continuing to ease, and making it almost certain that the Bank of England will cut interest rates when the MPC meets tomorrow.

"The decline reflects softer goods inflation, stabilising energy costs and slowing food prices, even as services inflation remains the key area to watch. With the UK currently holding the highest interest rates in the G7, it’s crucial for British exports that this begins to reduce.

"High interest rates strengthen Sterling against other currencies, increasing the price of British exports, and a global environment of trade protectionism only serves to compound this. To make British exports competitive in international markets and boost UK trade, lower interest rates is imperative.

How has the CPI inflation rate changed? | ONS

How has the CPI inflation rate changed? | ONS"For businesses, today’s figure represents a meaningful step toward a more predictable operating environment. Although still above the Bank of England’s two per cent target, year-on-year inflation is now at its lowest since March.

"This signals that the worst of the cost surge has passed, allowing companies to plan with greater confidence and reduced pricing volatility. With wage growth cooling since February, domestic cost pressures are moderating — a trend that should help anchor inflation further over the coming year.

"If the disinflation trend holds, the UK will steadily move to a more stable inflation environment during 2026, laying the groundwork for a more supportive climate in the months ahead.

"That would create space for real wage improvements, better consumer sentiment and a gradual pick-up in investment decisions that have been delayed during the high-inflation period. However, businesses should remain alert to risks: services inflation, global energy uncertainty and geopolitical tensions could still disrupt the inflation trajectory."

More From GB News