Ftse 100 FALLS as Donald Trump threatens to slap British businesses with 25% tariffs

President Trump's threats to annex Greenland could significantly harm the UK economy

Don't Miss

Most Read

The Ftse 100 and other global stock markets plummeted this morning as US President Donald Trump ramped up his aggressive efforts to take over Greenland from Denmark.

Investors appear spooked by the Trump administration's threats to levy tariffs on European countries, including the UK, in a move that could significantly damage British businesses.

Chancellor Rachel Reeves withdrew her scheduled appearance at the London Stock Exchange for when markets opened today, in order to appear at Prime Minister Keir Starmer's address to the nation regarding the crisis.

The UK's primary stock market index slipped nearly 50 points as Mr Starmer called for diplomacy between the White House and the European Union, with the French Cac 40 and German Dax falling around two per cent 1.35 per cent, respectively.

The Ftse 100 has fallen due to Trump's actions

|GETTY

Mr Trump has claimed the US will slap countries with an an initial 10 per cent tariff on nations which do not recognise his illegal annexation of Greenland. This would be raised to 25 per cent on June 1.

EU official are understood to be preparing to launch a large set of retaliatory tariffs worth €93billion ($107.71billion) following President Trump’s warnings over the weekend.

The International Monetary Fund (IMF) has sounded the alarm over escalating geopolitical tensions and the Trump administration's continuing threats of tariffs on allied nations.

According to the IMF, trade tensions between the US and Europe could hurt growth forecasts for the global economy by "prolonging uncertainty and weighing more heavily on activity".

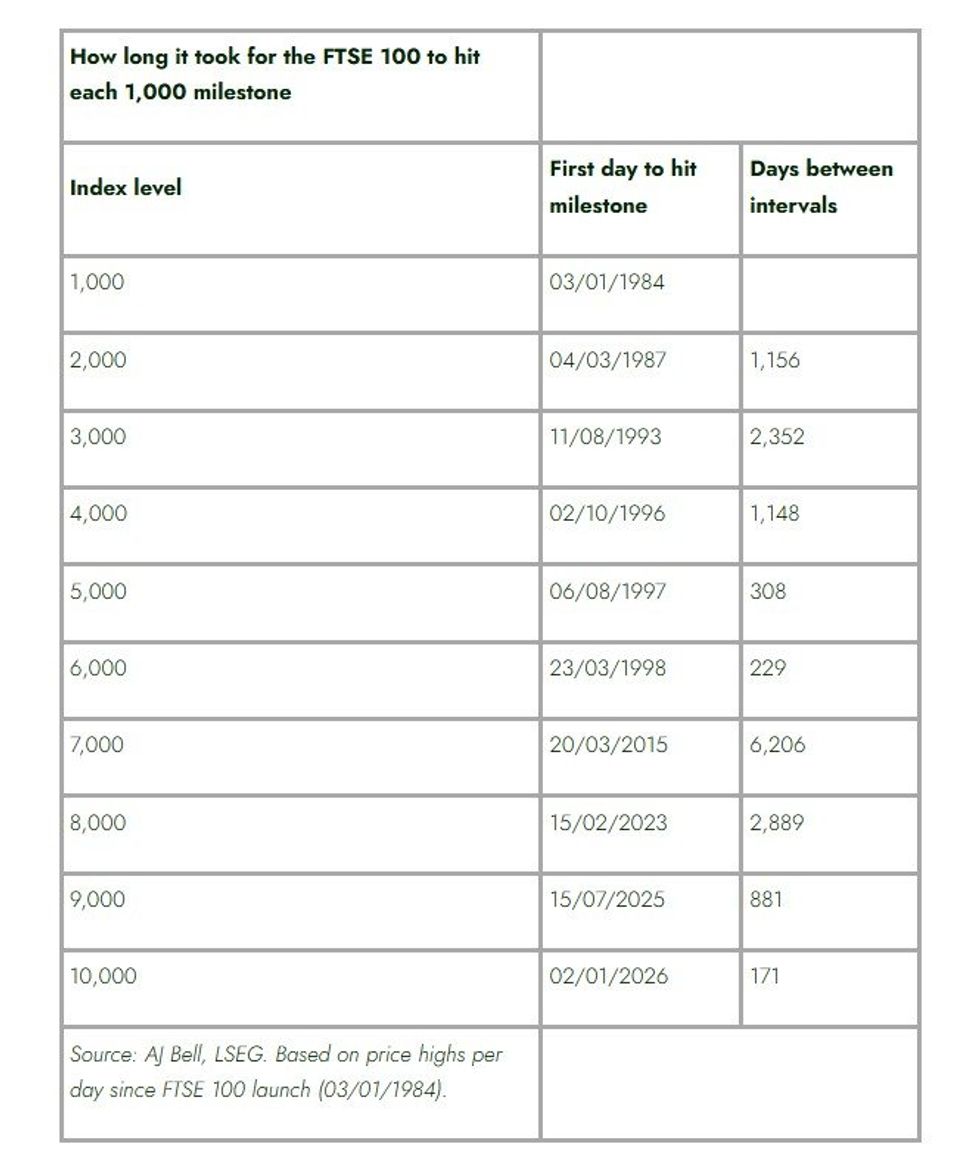

How long has it taken for the Ftse to reach every 1,000 mark? | AJ BELL

How long has it taken for the Ftse to reach every 1,000 mark? | AJ BELLThe international trade association claimed "introducing new layers of uncertainty and disrupting the global economy through their impact on financial markets, supply chains, and commodity prices".

Susannah Streeter, Chief Investment Strategist, Wealth Club, said: "Just when there appeared to be a lull in the tariff storm, President Trump has whipped up fresh economic chaos.

"He’s meting out punishment to European countries opposing the administration’s demand that Greenland becomes part of the US, either through purchase or invasion. This is the President’s modus operandi – unleash uncertainty and threats of more onerous measures, to coerce nations to acquiesce to his demands.

"Given how entrenched both sides are in their positions regarding Greenland’s future, it looks likely that the 10 per cent tariff is here to stay for a considerable time, with an increase to 25 per cent highly possible in June.

LATEST DEVELOPMENTS

"This is a migraine inducing development for politicians who have already had to go through tortuous negotiations to reach the first tranche of tariff deals, winning exemptions for certain sectors.

"For companies selling into the United States, and their customers this move creates another layer of difficult decision making. Already they’ve had to try and absorb the current tariffs, there will be little room to soak up any more, so this new tranche of duties is likely to end up being passed onto American customers.

"Many will baulk at paying higher prices, leading to lower sales, hurting exporters. Some importers of crucial goods may eye up the threat of a 25 per cent tariff from June, and bring forward sales, which could provide an initial bump, but then are likely to look elsewhere for a longer-term cheaper supplier.

"Plot out the timeline of policy announcements since Trump returned to the White House and it’s longer than the Bayeux Tapestry,” Dan Coatsworth, head of Markets at AJ Bell added.

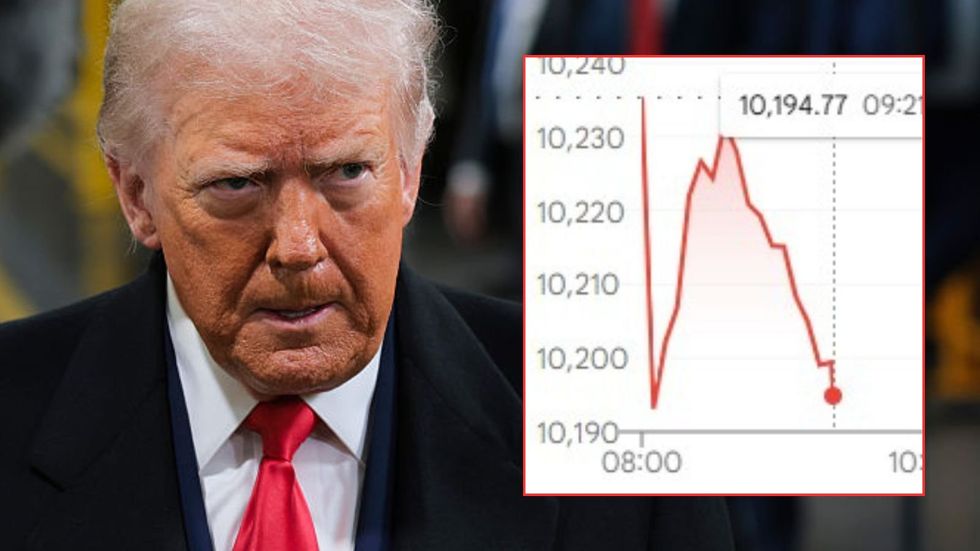

The stock market has been volatile since Trump returned to office | Reuters

The stock market has been volatile since Trump returned to office | Reuters"Financial markets have been subjected to a barrage of heavy-hitting decisions by Trump during his second term, with endless twists and turns. A new tougher stance on tariffs towards parts of Europe in Trump’s quest to own Greenland turns up the heat to max.

"Businesses and investors had just started to become comfortable with the new tariff landscape, accepting that supply chains had to evolve, and that goods and services now cost more.

"Anyone who thought Liberation Day was shocking is now gasping with their jaw on the floor when looking at what Trump has brought to the agenda in 2026. Trump’s more aggressive stance since the New Year would suggest he’s determined to get what he wants, and that now looks like global domination rather than simply reshaping the US.

"Going hostile against Europe had the potential to cause considerable upset on financial markets. While we’ve seen a red day for European shares in general, it’s not panic time."