DWP to 'force banks to trawl through YOUR account' in Universal Credit benefit fraud clampdown

New DWP powers will allow the Government to access bank accounts as part of the wider crackdown on benefit fraud

Don't Miss

Most Read

Universal Credit claimants are being reminded the Department for Work and Pensions (DWP) could snoop in their bank accounts this year under new powers to clampdown on benefit fraud.

The DWP has gained the authority to scrutinise the bank accounts of benefit recipients following the implementation of powers contained within the Public Authorities (Fraud, Error and Recovery) Bill.

These measures, which only came into effect this year, enable the DWP to issue what are termed Eligibility Verification Notices to financial institutions. The powers form part of the government's broader strategy to tackle benefit fraud and identify incorrect payments made to claimants.

Initially targeting those receiving means-tested support, the scheme could potentially expand to cover additional benefits in future, subject to parliamentary approval through affirmative regulations.

New DWP powers will allow the Government to access bank accounts as part of the wider crackdown on benefit fraud

|GETTY

Three specific benefits fall under the scope of these new verification powers. Universal Credit, Pension Credit, and Employment and Support Allowance have been selected as the initial focus, given that these are the areas where incorrect payments are currently at their highest levels.

The DWP has confirmed that additional benefits may be brought within the scheme's remit at a later stage, though this would require parliamentary consent.

Notably, the state pension has been expressly excluded from these measures. This exclusion is permanent and cannot be altered through subsequent regulations, providing reassurance to pensioners that their accounts will not be subject to such checks.

Under the new framework, banks and financial institutions must respond to Eligibility Verification Notices by providing only strictly limited data. This includes basic account information such as sort codes and account numbers, along with details about account holders including names and dates of birth.

Universal Credit is the primary benefit payment for DWP claimants | GETTY

Universal Credit is the primary benefit payment for DWP claimants | GETTYCrucially, financial institutions are prohibited from sharing transaction histories and could face penalties for disclosing more than permitted.

For Universal Credit recipients specifically, the £16,000 savings threshold remains a key eligibility criterion. Claimants holding capital above this amount become ineligible for the benefit, though certain specified exceptions apply.

The DWP has emphasised that information shared through this process does not presume any wrongdoing on the claimant's part.

According to the Government, it is anticipated that once the system reaches full operational capacity, it will uncover between 50,000 and 100,000 overpayments annually.

Where cases require further examination, the department will conduct any subsequent inquiries or investigations directly.

Officials have stressed that artificial intelligence will play no role in determining outcomes for claimants. A human decision-maker will always be involved when any action might affect benefit awards or eligibility.

The rollout is being conducted gradually, with the DWP adopting a test and learn approach. This phased implementation allows sufficient time for establishing optimal processes before the measure becomes fully operational.

Campaigners, including civil liberties group Big Brother UK, have criticsied the DWP's new powers and warned could lead to "injustices" down the line.

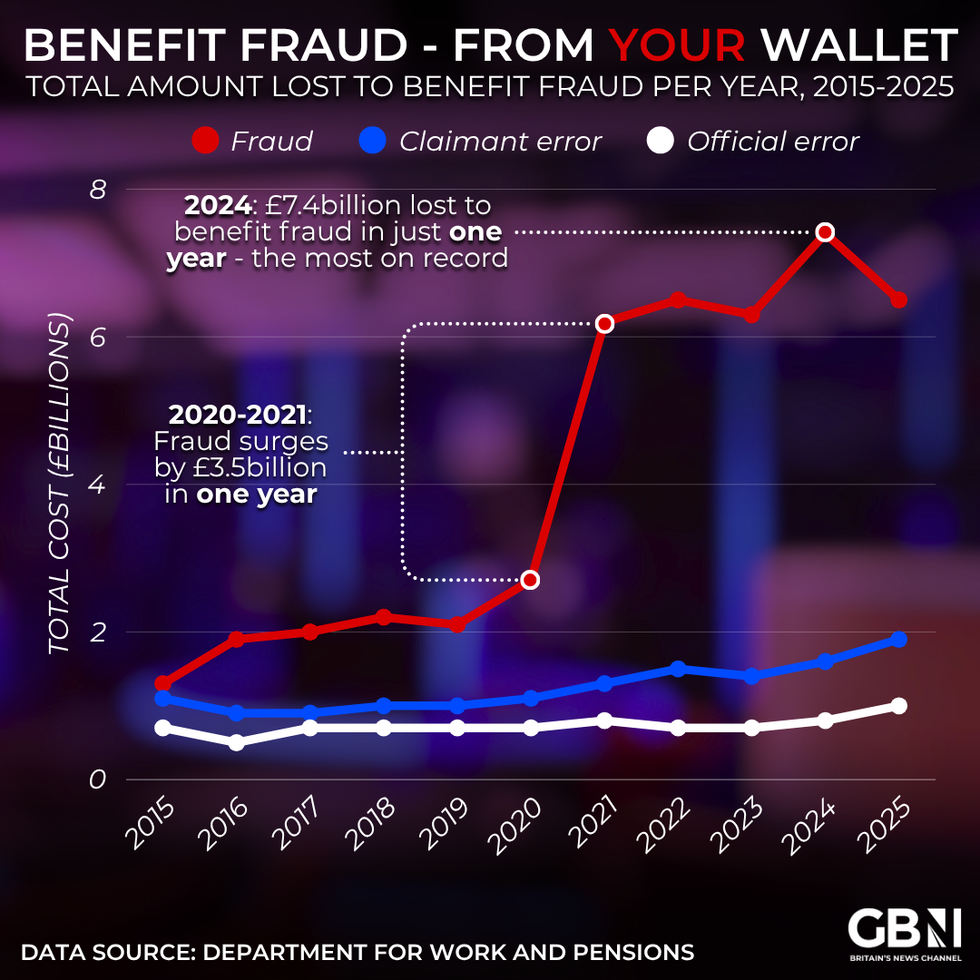

Benefit fraud - from your wallet: Total amount lost to benefit fraud per year | GB NEWS

Benefit fraud - from your wallet: Total amount lost to benefit fraud per year | GB NEWSOn its website, the group shared: "The powers will force banks to trawl through your accounts and report back to the DWP if it appears you have received an overpayment of benefits – whether due to fraud or error – based on secret criteria.

"They risk exposing hundreds of thousands of innocent people to horizon-style injustices and it will be disabled people, carers, older people and those living in poverty who are likely to be disproportionately affected.

"Despite our efforts and your support, we are incredibly disappointed that on 2 December 2025 these Orwellian powers became law."