Blow to Donald Trump as interest rate cut REFUSED due to 'economy uncertainty'

The Federal Reserve has yet to cut interest rates since Donald Trump returned to the White House in January

Don't Miss

Most Read

Latest

President Donald Trump has been dealt another blow to carrying out his economic agenda following the latest move from the Federal Reserve.

The US central bank has opted to keep the world's largest economy's base rate at its current level, which is sitting at a range of 4.25 per cent and 4.5 per cent.

In its latest statement, the Fed noted that its looking to achieve "maximum employment" and ease inflation to around two per cent.

However, the Federal Open Market Committee (FOMC) warned that "uncertainty about the economic outlook has increased further".

The US central bank has opted to hold interest rates in the wake of Donald Trump's tariff threats

| GETTYThis latest announcement from the US comes ahead of the Bank of England's own base rate announcement, with the Monetary Policy Committee (MPC) expected to slash the base rate by at least 0.25 percentage points.

Members of the central bank's FOMC unanimously voted to keep the Federal Funds Rate at its current range in a move that will keep the cost of borrowing high.

With this decision, interest rates have been at this level since December of last year after a series of cuts in the second half of 2024.

Despite this hold, the Fed cited a recent gross domestic product (GDP) report which reported that economic growth contracted in first quarter of the year.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Donald Trump has made tariffs the focus of his economic agenda | REUTERS

Donald Trump has made tariffs the focus of his economic agenda | REUTERSThe latest report noted "swings in net exports have affected the data", but found that "recent indicators suggest that economic activity has continued to expand at a solid pace".

Analysts, including AJ Bell's head of financial analysis Danni Hewson, have cited Trump's tariff agenda as creating an inflationary effect.

The current President has pledged sweeping taxes on imports coming into the US, which are widely considered to contribute to inflation; an issue Trump promised to address upon getting into office.

Hewson explained: "Donald Trump’s tariffs have created inflation uncertainty and that has made the central banks’ balancing act even more precarious than normal.

"Tariffs are creating tangible ripples with US motor giant Ford as it announced it’s putting up prices on three of its Mexican-made models sold in the US, sending shares down further.

"Plane maker Boeing’s shares have also been under pressure today amid reports that the EU could impose tariffs on its aircraft if trade talks fizzle out.

LATEST DEVELOPMENTS:

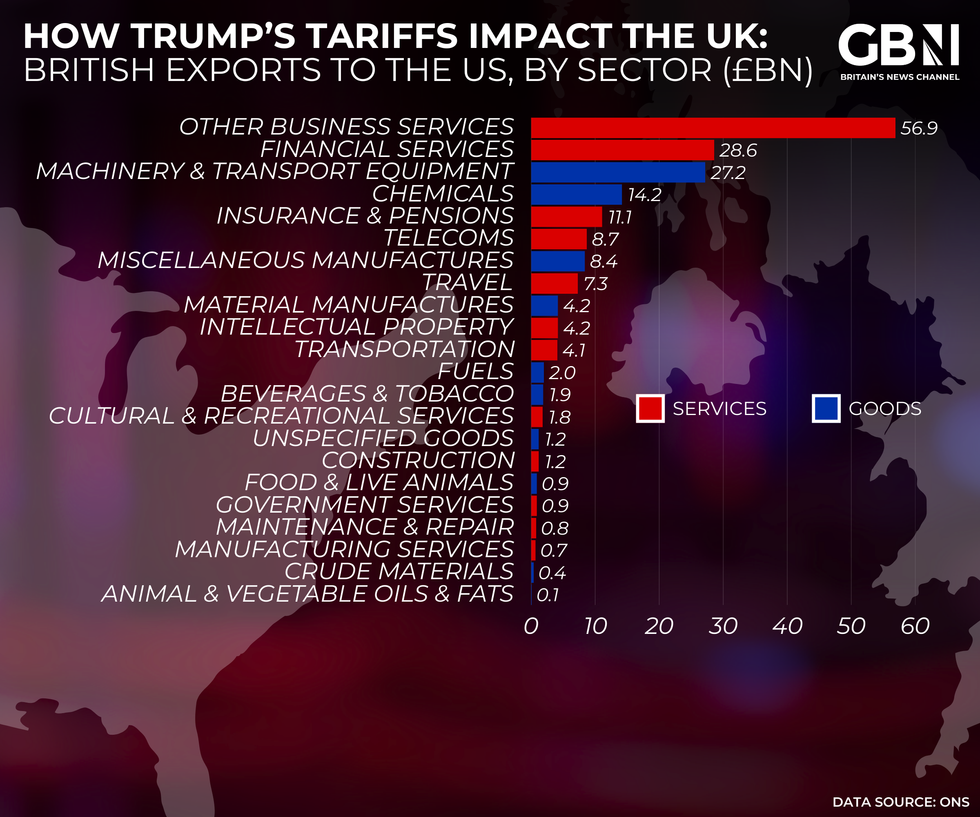

How Trump's tariffs impact the UK | GB NEWS

How Trump's tariffs impact the UK | GB NEWS"The art of the deal can be messy, especially if the whole world is jockeying for a seat at the table.

"Those handling the negotiations know that they will be judged by the people who vote for them – get it wrong and they will answer for it the next time voters have their say."

The Trump administration has put public pressure on Fed chair Jerome Powell to cut interest rates as soon as possible.

Powell has confirmed he will not be pushed out of his role despite the President's statements.