David Lammy has claimed nearly £7,000 in accountancy expenses

Foreign Secretary made more tax-related claims than any other Cabinet minister

Don't Miss

Most Read

David Lammy claimed almost £7,000 in accountancy expenses over a twelve-year period, according to parliamentary expenses records.

The Foreign Secretary claimed more for accountancy services than any other member of the Cabinet during that time.

He submitted claims relating to help with his tax returns on eleven occasions between 2012 and 2024.

The claims were made under rules set by the Independent Parliamentary Standards Authority, which at the time permitted MPs to expense certain accountancy costs.

TRENDING

Stories

Videos

Your Say

IPSA banned such claims from April this year following a change in HMRC requirements.

From the 2024-25 tax year onwards, MPs are no longer required by HMRC to complete self-assessment tax returns solely because they are Members of Parliament.

As a result, IPSA said it would no longer reimburse costs linked to the preparation of self-assessment tax returns.

Over the twelve-year period, Mr Lammy claimed a total of £6,882 for accountancy services.

In some individual years, his claims reached as much as £936.

In at least two cases, Mr Lammy stated that his expenses claim covered between 60 and 70 per cent of his total accountancy fees.

His final claim was made in 2024, shortly before the ban came into force.

That year, the Deputy Prime Minister sought reimbursement of £278 for professional tax assistance.

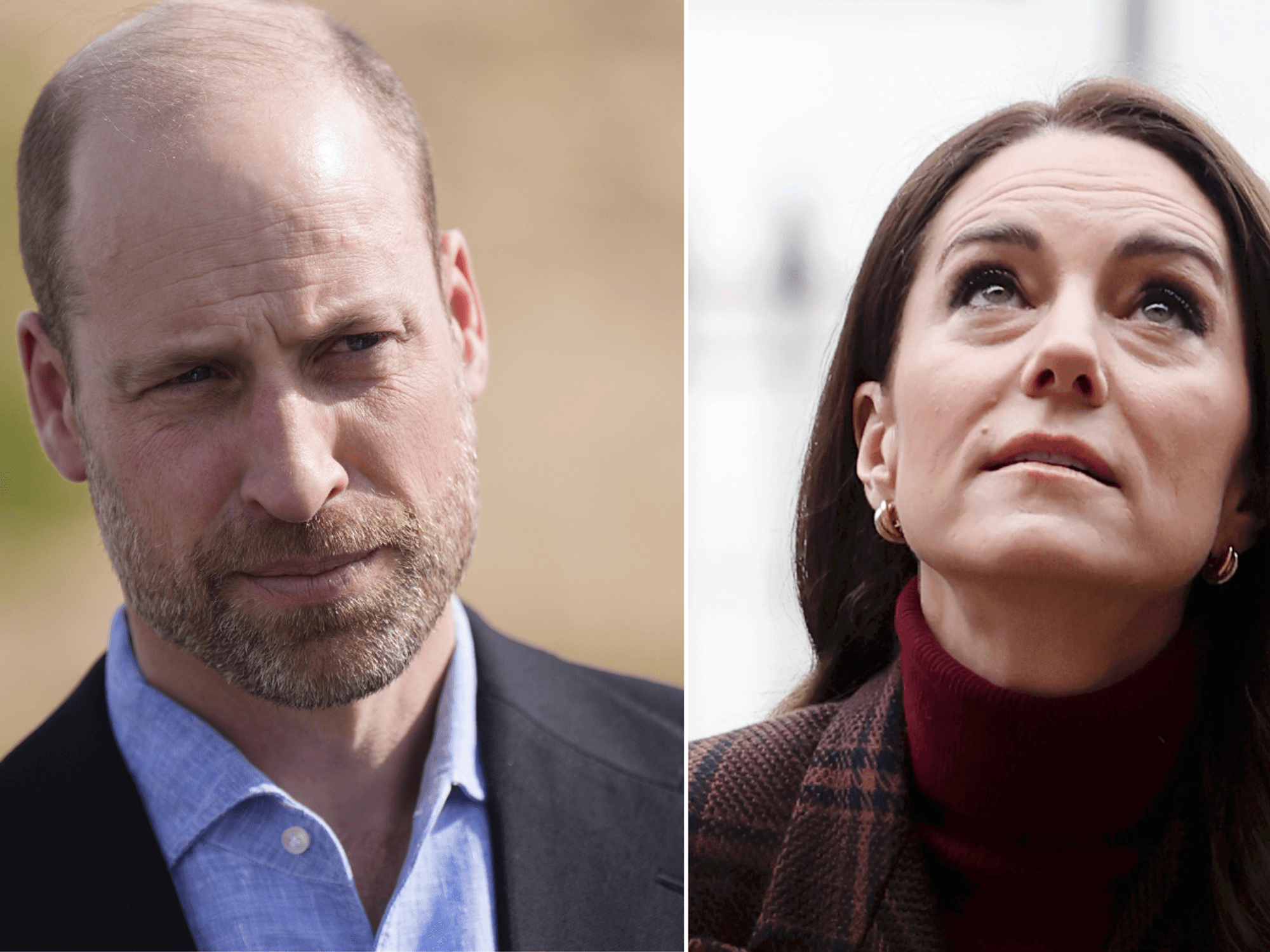

He claimed more on it than any other Cabinet member in that period

|GETTY

Only one other Cabinet minister submitted a similar claim in 2024.

Pat McFadden, the Secretary of State for Work and Pensions, claimed £125 for accountancy costs that year.

A spokesman for Mr Lammy said all claims were made and published in line with IPSA rules that were in force at the time.

The spokesman said there had been no breach of expenses regulations.

The revelations prompted criticism from the TaxPayers’ Alliance.

John O’Connell, chief executive of the group, said: "Taxpayers up and down the country are finding the tax burden ever more burdensome with successive chancellors raising rates, freezing thresholds and layering on complexity.

"With the Government being the worst culprit of this, he should be considering how this will look to his constituents."

LATEST DEVELOPMENTS

Rachel Reeves announcing the extension on the freeze on income tax thresholds until the 2030-31 tax year

| PARLIAMENTThe comments come amid warnings that the UK tax burden is on course to reach record levels.

The Office for Budget Responsibility (OBR) has projected that taxes will amount to 38 per cent of national income by 2030.

Chancellor Rachel Reeves has extended the freeze on income tax thresholds until the 2030-31 tax year.

The policy increases the number of people paying higher rates of tax as wages rise through inflation.

Independent tax consultant David Whiscombe said MPs should not have expected taxpayers to cover accountancy costs.

Mr Whiscombe said: "I'm sure that many MPs with income and gains from non-parliamentary sources have complicated tax affairs which warrant taking professional advice.

"But that has never been a reason, in my view, to expect the cost to be funded by the public."

Mr Whiscombe said holding a parliamentary seat alone did not create sufficient complexity to justify the expense.

He said: "In my view, Ipsa's change of practice is justified and overdue."

The National Audit Office (NAO) has previously warned that the UK tax system is becoming increasingly complex.

Ms Reeves herself claimed £1,225 in accountancy expenses between 2014 and 2022 while serving as an MP.

She repaid a claim made in 2023 and has not submitted any further claims since.

Ms Reeves herself claimed £1,225 in accountancy expenses between 2014 and 2022

| PAA spokesman for Mr McFadden confirmed his £125 claim related to accountancy costs for the 2023-24 tax year.

The spokesman said the claim was permitted under IPSA rules at the time.

IPSA had previously allowed MPs to claim accountancy fees connected to parliamentary duties.

However, it did not permit claims for purely personal tax matters.

Announcing the rule change at the start of the current tax year, IPSA said it would no longer accept claims linked to self-assessment tax preparation for 2024-25 or later years.

Millions of workers across the UK are currently completing their own tax returns ahead of the January 31 deadline.

More From GB News