Cost of living crisis: Parents paying 'unprecedented' extra £26k over last two years to raise a child

Patrick Christys grills Keir Starmer and Rachel Reeves over yesterday’s Budget, accusing them of lifting the two child benefit cap ‘just to stave off a backbench rebellion for a few more months.’ |

GB News

Study finds rising expenses outpacing inflation as family budgets come under pressure

Don't Miss

Most Read

British families face average costs of £249,000 to raise a child, new research shows. Moneyfarm's latest analysis indicates this total has increased by £26,000 in only two years.

The findings reflect a wider surge in day-to-day costs for households raising children.

The average lifetime cost of raising a child has risen by £46,000 since 2022, taking the annual amount to £13,830 for each child.

The analysis draws on more than 150 separate child-related expenses.

TRENDING

Stories

Videos

Your Say

Total costs do vary significantly depending on a family's financial circumstances. mParents at the lower end of the spending scale could see outgoings of £161,000, while those at the upper end may face cumulative costs of £426,000.

Families across the UK have been dealing with increasing prices for food, energy and household services throughout the past few years, adding further strain to monthly budgets.

Child-related expenses have climbed by 10.7 per cent over the past two years.

During the same period, the Consumer Price Index (CPI) increased by 6.10 per cent.

British families face average costs of £249,000 to raise a child, new research shows.

|GETTY

The growing gap between family costs and general inflation appears to be influencing wider demographic trends, with England and Wales recording a total fertility rate of 1.41 children per woman in 2025, the lowest level on record.

This shows financial pressures may be playing a significant role in decisions about whether and when to have children.

Households are increasingly having to assess their long-term financial capacity when planning for the future. Among the steepest increases were costs linked to socio-cultural activities.

These expenses rose by 12.36 per cent, reflecting the continued rise in the price of enrichment activities that many parents view as important for their children's development.

LATEST DEVELOPMENTS

You will find more infographics at Statista

You will find more infographics at StatistaThe cost of devices and video games rose sharply between 2023 and 2025. Mid-range technology estimates increased from £5,000 to £6,125, while premium options cost an average of £13,187.

The teenage years continue to be one of the most expensive periods for families. Parents now spend an average of £65,016 during the 15-to-18 age range, compared with £57,082 in 2023.

Digital access remains essential for education and social interaction.

Spending on technology such as laptops, tablets, smartphones and gaming consoles for children aged six to eighteen has risen to £6,125, up from £5,101 in 2023.

Families commonly use platforms such as Netflix, Disney+, Spotify and Sky Kids, but total subscription costs have fallen from £4,003 in 2023 to £3,848.

These changes have also enabled some households to add AI tools, including OpenAI subscriptions, to their monthly spending.

Chris Rudden, head of investment consultants at Moneyfarm, said: "The cost of raising a child has always been a significant commitment, but the pace of increase we're seeing now is unprecedented".

He said the rising figure reflects pressures across multiple areas of family life.

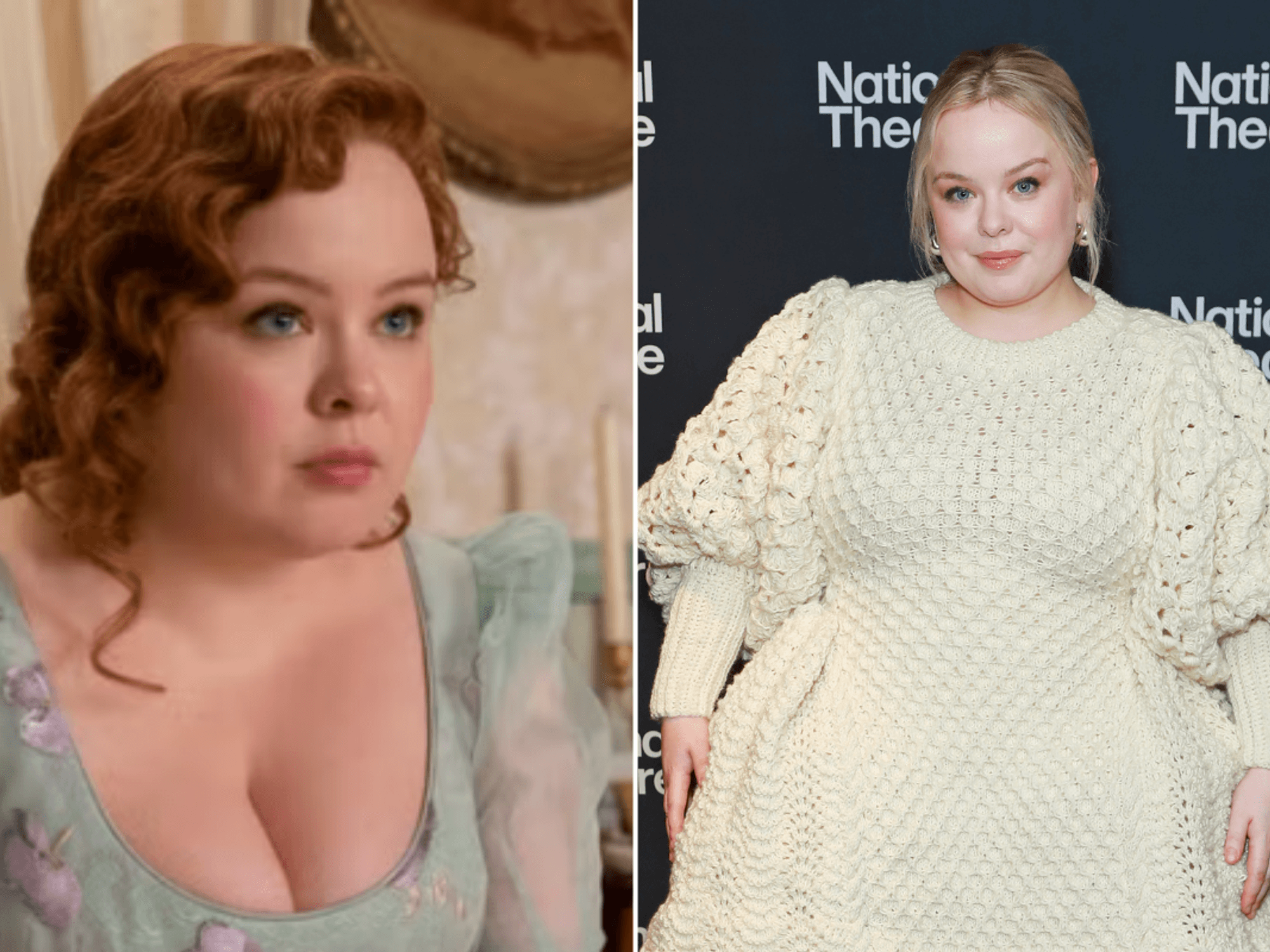

The cost of starting a family appears to be putting off many young people

|GETTY

Mr Rudden said: "With the average cost now at £249,000, up £26,000 in just two years, families are feeling the squeeze from all directions, whether it's food, childcare, tech, or the growing importance of social and cultural activities".

He said that long-term planning may play a larger role for families if costs continue to rise.

"Looking ahead, if current trends continue, families could be facing costs of over £300,000 by the end of the decade, making it more important than ever to plan ahead."

"By starting to save and invest regularly, even modest amounts, parents can help offset these rising costs and give their children the best possible start, while also protecting their own long-term financial security," he added.

More From GB News