Budget 2025: Tax-free cash spared by Rachel Reeves in boost for pensioners BUT Treasury urged to do more

Labour MP Jo White urges Rachel Reeves to spare normal working people from planned tax rises in her upcoming Autumn Budget |

GB News

The Chancellor will not change levies on pension tax-free cash entitlements at the Budget

Don't Miss

Most Read

Latest

Rachel Reeves is expected to spare tax-free entitlements on pension contributions in the Budget on November 26, Treasury officials have confirmed.

The Parliamentary committee has rejected an initial Treasury reply to a petition calling for guarantees protecting tax-free cash and pension relief.

AJ Bell's Pension Tax Lock petition has surpassed 20,000 signatures, marking a major milestone in the campaign for pension stability.

MPs on the committee said the Government’s original statement failed to address the petition’s central request. They have now instructed HM Treasury to provide a full response.

The campaign seeks concrete ministerial assurance that pension tax-free cash allowances and contribution tax relief will remain unchanged for the rest of this Parliament.

TRENDING

Stories

Videos

Your Say

It follows months of speculation over possible changes to retirement saving incentives, which AJ Bell says have eroded confidence in the pension system.

The proposal centres on safeguarding the £268,275 tax-free cash limit that savers can currently withdraw from their pensions.

It also seeks to preserve the existing framework allowing tax relief on contributions at individuals’ marginal rates.

The petition was launched on October 1 and forms part of the firm's wider effort to secure long-term protections for retirement savers.

Rachel Reeves is expected to spare tax-free entitlements on pension contributions in the Budget on November 26

|GETTY

Under the proposed commitment, two key incentives would be protected — the right to withdraw a quarter of pension savings tax-free, and the continuation of tax relief in line with income tax bands.

Tom Selby, AJ Bell’s director of public policy, said reducing the tax-free allowance would have been “a massive own goal from the Chancellor, raising little money and causing uproar from young and old alike”.

He warned such a move could have provoked further industrial action among public sector unions, including senior NHS staff, at a time of ongoing pressure on public services.

“When you save diligently throughout your career you deserve the right to plan ahead without the threat that Government may move the goalposts before you can access your money,” Mr Selby said.

LATEST DEVELOPMENTS

Treasury response has been refused by the Parliamentary committee

| GETTYHe argued that speculation undermines saver confidence and encourages rash financial decisions, contradicting the Government’s goal of promoting growth and improving pension adequacy.

In its initial response on October 22, the Treasury stressed that pension tax relief is “one of the most expensive reliefs in the personal tax system, costing £78billion in 2023/24.”

Officials highlighted that pension contributions remain untaxed during employment and that investment growth is exempt from taxation.

The Government also pointed to its new Pensions Commission, chaired by Baroness Jeannie Drake, Sir Ian Cheshire and Professor Nick Pearce, as proof of its commitment to long-term retirement security.

However, ministers declined to offer specific guarantees on tax-free cash or contribution relief ahead of future Budgets.

The Petitions Committee intervened on November 5, ruling that the Treasury’s response had not answered the petition’s core demand for clear assurances.

Mr Selby said uncertainty had caused many people to delay major life choices, from home improvements to long-planned holidays, amid fears that the Government could change pension rules without warning.

He argued that this hesitation has broader economic consequences, dampening consumer confidence and spending.

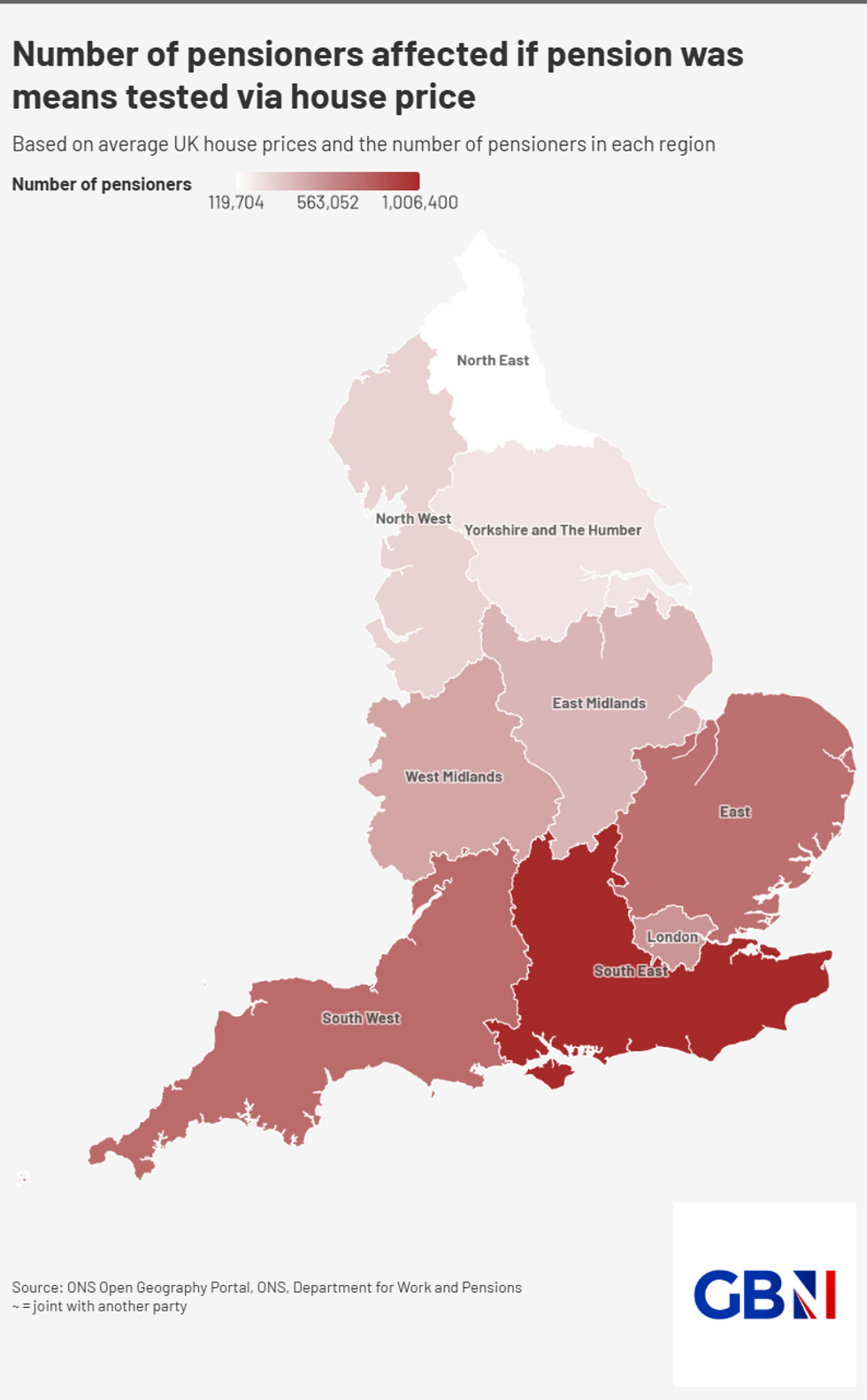

Number of pensioners affected if pension was means tested via house price | GBN

Number of pensioners affected if pension was means tested via house price | GBNConcerns about possible Budget changes to tax-free cash have been particularly acute among public sector workers, especially NHS professionals planning for retirement.

AJ Bell insists that introducing a Pension Tax Lock would carry no cost to the Treasury but would deliver crucial certainty for millions of savers.

The firm maintains that ongoing speculation from Budget to Budget creates an unstable environment for those trying to plan responsibly for the future.

It says pensions form the cornerstone of personal financial responsibility and that only firm Government guarantees can rebuild trust in the system.

More From GB News