Rachel Reeves's Budget set for 'biggest tax haul since 1970s' as Treasury seeks £45billion to plug gap

'As we expected, taxes are going to go up!' Nigel Farage issues worrying verdict ahead of Budget |

GB News

Senior economist Maxime Darmet says Autumn Budget will test fiscal credibility as businesses hope for VAT cuts on energy bills

Don't Miss

Most Read

Chancellor Rachel Reeves faces one of the most difficult fiscal balancing acts in decades when she delivers her Autumn Budget on November 26.

Economists say she must raise between £35billion and £45billion by 2029-30 while trying to avoid stifling growth or unsettling markets.

Maxime Darmet, Senior Economist at Allianz Trade, said the task was “to keep the target of a balanced current budget by 2029-30 without harming GDP growth, raising inflation, or shaking financial markets.”

He added that this year’s exercise would match last year’s £41.5billion tax haul and together form “the biggest back-to-back tax collection since Denis Healey’s Budgets in 1974-76", which was worth more than 2 per cent of GDP.”

TRENDING

Stories

Videos

Your Say

Mr Darmet said major spending cuts were “unlikely for practical and political reasons.”

He pointed out that Ms Reeves had already been “forced into a policy U-turn on social benefit cuts after strong backlash from left-leaning Labour MPs earlier this year.”

“The Chancellor has promised ‘no return to austerity’, meaning no major spending cuts,” he said.

“Tax increases will therefore carry the weight of fiscal consolidation.”

Around two-thirds of the expected tax burden, roughly £22billion, are predicted to fall on households.

He said the focus would be on “higher earners, wealthy individuals, landlords, pensioners and owners of expensive properties.”

Possible measures include rises in personal income tax, higher property levies and increased inheritance tax.

Rachel Reeves faces toughest fiscal test in decades

|GETTY

Mr Darmet said VAT hikes were “off the table” as they would be inflationary in the current economic climate.

He also warned that the property market could be hit hardest, predicting “house prices and transaction volumes could both suffer.

“In the UK, tax announcements are usually spread over several years, but around 80 per cent are frontloaded,” he said.

He predicted roughly £30 billion of tax hikes will come into force between late 2025 and early 2026.

The remainder will include “stealth measures” such as freezing personal tax thresholds until 2029.

The economist described the likely Budget as “deflationary overall,” which could allow the Bank of England to lower interest rates sooner than markets expect.

LATEST DEVELOPMENTS

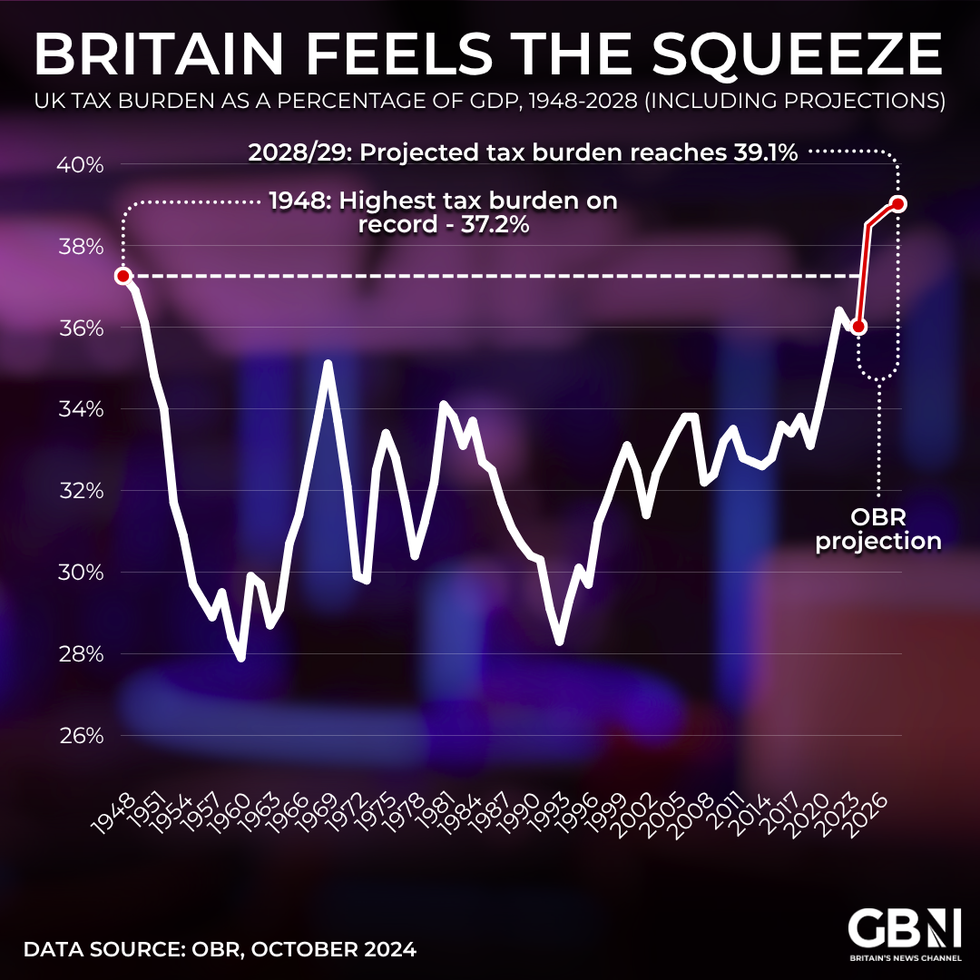

UK tax burden as a percentage of GDP | GB News

UK tax burden as a percentage of GDP | GB NewsEnergy industry experts predict VAT cut and end to windfall tax

Energy sector analysts believe Ms Reeves may pair her tax plans with headline-grabbing energy reforms.

Mark Gamble, Utility Bidder’s Head of Supplier Relations, said the Chancellor is “considering eliminating the 5 per cent VAT charge on electricity bills.”

He said the move would “offer a quick way to reduce costs for consumers and ease cost-of-living pressures.”

For companies, the change would “lower overheads for energy-intensive industries and help protect profit margins.”

The Government has committed to more energy bill support | GETTY

The Government has committed to more energy bill support | GETTY The Chancellor is also thought to be weighing early termination of the energy profits levy.

The temporary tax on oil and gas firms, introduced in May 2022, is currently scheduled to expire in March 2030 but could be scrapped as soon as 2026.

Mr Gamble said: “If the Autumn Budget does deliver a VAT cut on energy bills, alongside scrapping the energy profits levy, this will be a welcome move for many UK businesses—especially SMEs squeezed by rising input costs.”

He said lower VAT “means lower overheads,” while ending the levy “could reduce wholesale energy cost pressures further upstream, which ultimately filters down to end users.”

He added that the proposed Ofgem-backed energy debt relief scheme “signals that the Government is willing to step in when systemic stress threatens household and business finances.”

He said similar support for firms could follow.

“Helping struggling companies manage energy burdens while regulatory changes take effect would show the Government is committed not just to household relief but also to a resilient business ecosystem,” he said.

Markets watching for fiscal credibility

Financial markets are preparing for a volatile reaction to the Budget.

Mr Darmet said investor confidence will depend heavily on “the credibility of the Chancellor’s revenue forecasts.”

He warned that excessive reliance on small or uncertain tax rises “could raise doubts about the feasibility of meeting deficit reduction targets.”

“The overall package will likely depress growth in the short term, but if handled carefully, it could strengthen the UK’s fiscal position,” he said.

Economists say the Budget’s tone will determine whether gilt yields fall or rise in the months ahead.

Any perception of weakened fiscal discipline, they warn, could spark renewed pressure on sterling and government borrowing costs.

More From GB News