‘NOT the case!’ Working parent hits out at Rachel Reeves’s ‘delight’ after setting out ‘regressive’ policy

Labour is introducing VAT on private school fees

Don't Miss

Most Read

Latest

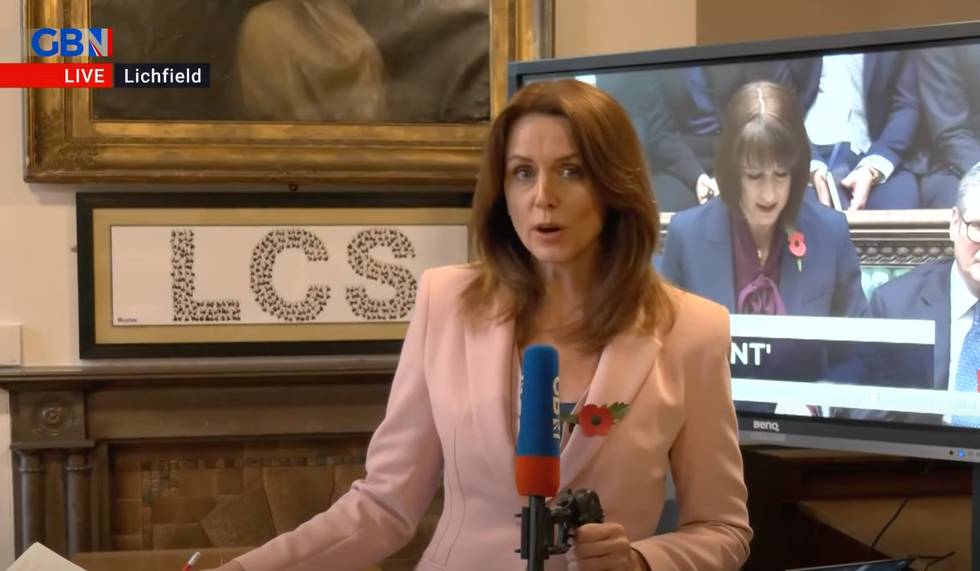

A working mother has criticised Labour's plan to introduce VAT on private school fees, calling it "regressive" during an appearance on GB News.

Amy, whose child attends a private school in Lichfield, expressed concern about the policy's impact on families like hers.

"It feels regressive," she said. "They feel like they're sticking it to the Etonians but they're not. It will affect working parents like myself who have made some sacrifices to give their child an opportunity."

Amy emphasised that her family has made financial sacrifices to afford private education. "We don't have holidays or cars that perhaps wealthier parents have," she explained.

The mother also noted that her family relies on assistance from grandparents and the school itself to manage the costs.

Amy hit out at Rachel Reeves's 'regressive' delivery

|GB NEWS

Chancellor Rachel Reeves has confirmed Labour's plan to introduce VAT on private school fees from January 2025. Speaking during the Budget, Reeves told the Commons: "We will introduce VAT on private school fees from January 2025, and we will shortly introduce legislation to remove their business rates relief from April 2025 too."

The Chancellor added that these changes, along with measures to tackle tax avoidance, would raise over £9 billion to support public services and restore public finances. This exceeds the £8.5 billion initially projected in Labour's manifesto.

Bev Turner spoke from a school in Lichfield

|GB NEWS

The government has decided to start charging 20 per cent VAT on private schools, a move it says will fund its spending commitments. Currently, independent schools are exempt from charging VAT on their fees due to an exemption for the supply of education.

After allowing for input deductions, boarding fees and exemptions for specialist provision, the Institute of Fiscal Studies (IFS) has calculated an effective VAT rate of 15 per cent.

LATEST DEVELOPMENTS

- Petrol and diesel drivers to see major filling station changes next year

- Rachel Reeves announces 'hidden pension benefit' which will boost retirement income for millions

- Sunak in blistering attack on Reeves in brutal parting shot: 'Fiddled the figures!'

The IFS estimates that removing tax exemptions could result in a net gain to public finances of around £1.3 to £1.5 billion per year. This could allow for about a two per cent increase in spending on state schools.

However, the policy is likely to have little impact on reducing inequalities by school attended, according to the IFS.

Rachel Reeves has delivered the Budget

| PAIndependent school leaders warn that covering costs such as VAT and potential national insurance increases could lead to fee hikes of around 20 per cent.

The average private day school currently charges between £3,000 and £5,500 per term, with over a third of pupils receiving fee assistance.

Concerns have been raised about the impact on smaller, specialist schools, including those for children with special educational needs and disabilities (SEND) or religious schools.

These institutions say they have little room in already-squeezed budgets to absorb the additional costs.