Major health and beauty chain on the BRINK as high street takes another hit

Is your local Wilko reopening?: Wilko to reopen just 4 months after forced store closures |

GBNEWS

Hundreds of jobs are at risk as a major health and beauty chain races to avert collapse

Don't Miss

Most Read

Another high street name is teetering on the edge, with hundreds of jobs now hanging in the balance.

The health and beauty retailer that has served shoppers for more than 50 years, could fall into administration as soon as next week unless a last-minute buyer can be found.

High street store closures in the UK continue as Bodycare is racing to avert its collapse as early as next week.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

The advisory firm Interpath is scrambling to secure a rescue deal in what could be the latest in a string of high street casualties.

River Island announced 33 store closures after reporting a £32.3 million loss, while Hobbycraft is shutting 18 outlets during a "challenging retail climate."

Analysts warn that as many as 17,350 shops could close in 2025, putting over 200,000 jobs at risk.

Bodycare is owned by Baaj Capital, a family office run by Jas Singh. The group has made several high-profile retail investments, including In The Style and Amscan International.

It also failed in a bid to acquire The Original Factory Shop earlier this year. This crisis for its flagship high street retailer comes despite the chain securing a £7million debt facility just weeks ago in a last-ditch effort to stay afloat.

Bodycare’s retail inventory backed that short-term loan. Despite these efforts, it appears to have merely delayed the fall of the shutters.

Major health and beauty chain on the BRINK as high street takes another hit |

Major health and beauty chain on the BRINK as high street takes another hit | GETTY

Founded in Skelmersdale in 1970 by Graham and Margaret Blackledge, Bodycare built its reputation on offering affordable branded products from household names such as L’Oréal, Nivea and Elizabeth Arden.

A combination of the COVID pandemic and spiralling business costs now appears to have pushed it towards collapse.

The chain was forced to rely on pandemic-era government support through a taxpayer-backed loan to survive, but this failed to shield it from what some experts describe as a perfect storm of rising costs, higher taxes and falling consumer confidence.

The chain was forced to rely on pandemic-era government support through a taxpayer-backed loan to survive

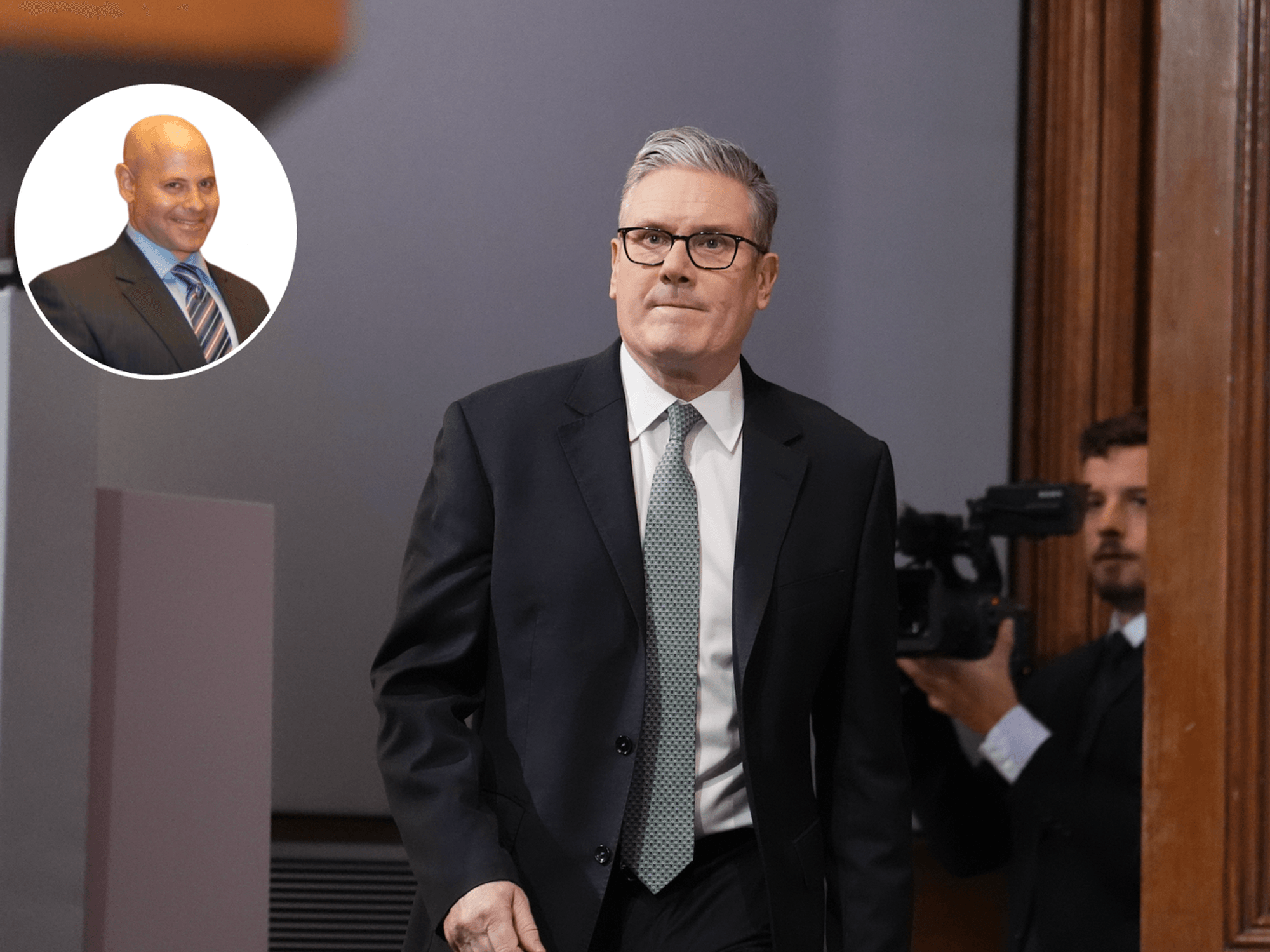

| GETTYRetail veteran Tony Brown, who previously held senior roles at BHS and Beales, is now tasked with steering the business through its darkest hour.

This is not just about one company. It is yet another example of how economic headwinds, government policy and global uncertainty are squeezing the British high street.

The question is: how many more homegrown businesses must fall before action is taken?

**Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.**

Many retailers are coming under growing pressure as the cost of trading soars.

Higher energy bills, rising rents and bigger National Insurance contributions for staff are pushing many retailers to the brink.

At the same time, the convenience of shopping online has driven footfall down, leaving once-bustling high streets struggling to survive.

Many town centres are now paying the price, with rows of shops standing empty and streets that were once lively becoming eerily quiet.

More From GB News