Families could save £9,700 in mortgage interest thanks to Black Friday hack

Mortgages Richard Blanco |

GB News

Tool lets families turn shopping into overpayments to cut interest and reduce mortgage terms

Don't Miss

Most Read

With Black Friday approaching, UK households are expected to spend an average of £602 during the sales period.

Over the course of a year, families could earn £268.11 in cashback through regular shopping, which could cut £9,700 in mortgage interest and reduce the term by twelve months.

Financial experts say that same spending could be used to cut mortgage interest and shorten loan terms — without changing how families shop.

Yet used smartly, that same outlay could translate into significant long-term mortgage savings, easing the pressure of higher borrowing costs.

Every pound used to overpay a mortgage reduces the outstanding balance immediately, which in turn cuts the interest charged.

TRENDING

Stories

Videos

Your Say

The principle relies on compound interest. Every pound used to overpay a mortgage reduces the balance immediately, which in turn lowers the interest charged.

Over time, even small contributions can grow into significant savings.

For a typical £250,000 mortgage over 30 years at five per cent, £30 in overpayments could reduce total debt by £103.

Repeated across the year, everyday spending on groceries, clothing, and takeaways could translate into thousands of pounds saved and even reduce the mortgage term by a year.

Households spend an estimated £3,666 on groceries, £1,622 on food at restaurants and takeaways, and £910 on clothing annually.

By redirecting these routine purchases, families can generate cashback that is then used to overpay their mortgage, maximising compound interest benefits.

Weekly grocery spending of £70.50, for example, could earn £2.82 in cashback. Supercharged through compound interest, this could amount to £12.37 in mortgage savings each week.

Similarly, £31.20 spent on takeaways could generate £0.97 cashback, translating to £4.12 in mortgage reductions, while £17.50 on clothing could earn £1.40 cashback, creating £6.21 in savings once supercharged.

British households are gearing up for major spending in the Black Friday sales — yet financial experts caution that many families could be overlooking a smart strategy to stretch their money further

|GETTY

The tool making this process seamless is Sprive, a free app that partners with over 95 UK retailers, including John Lewis, Etsy, Argos and Boots.

Users earn instant cashback when shopping through the app, either online or in-store, which is automatically directed towards mortgage overpayments.

Jinesh Vohra, CEO of Sprive, said: "Compound interest usually works against you. But with Sprive, we are flipping it on its head and making it work for you.

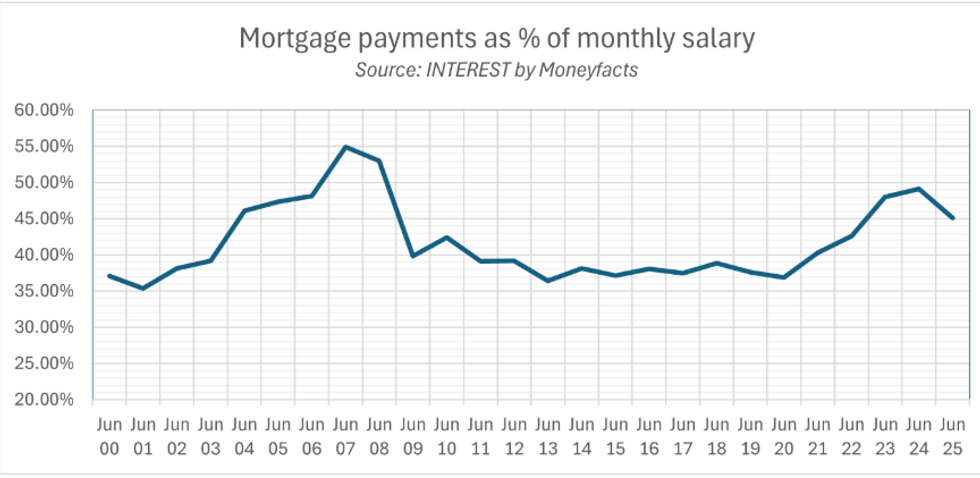

Analysis shows mortgage repayments now swallow nearly half of average earnings | INTEREST BY MONEYFACTS

Analysis shows mortgage repayments now swallow nearly half of average earnings | INTEREST BY MONEYFACTS"Every pound you overpay reduces your balance immediately, meaning less interest from that day forward."

He added: "If your Black Friday spend earns cashback and you overpay that amount on a typical mortgage, that spend could multiply into thousands of pounds in savings over the life of the loan.

"It’s a powerful way to make your spending work for you."

Mr Vohra said the system does not require users to shop differently or spend more.

LATEST DEVELOPMENTS:

Consumers carry on with their usual spending habits, as the app seamlessly redirects rewards behind the scenes

| REUTERSHe said: "Sprive’s cashback feature simply redirects rewards to where they’ll have the greatest impact. This helps people become mortgage-free faster, without changing their lifestyle."

For Black Friday 2025, families could turn the average £602 shopping spree into £30.10 in cashback, which when supercharged could become £133.47 in mortgage savings.

Experts say that year-round use of such cashback tools could produce even more significant results, making ordinary spending a long-term financial strategy.

More From GB News