Best savings accounts of the week: Savers urged to 'secure guaranteed return' as interest rates hit 7.5%

NatWest and Nationwide Building Society are offering some of the best savings accounts of the week

Don't Miss

Most Read

Britons are being reminded to "secure a guaranteed return" from their savings account before its too late while banks continue to offer interest rates of up to 7.50 per cent.

Analysts from Moneyfactscompare have compiled a list of the best savings accounts for the week beginning September 15, 2025.

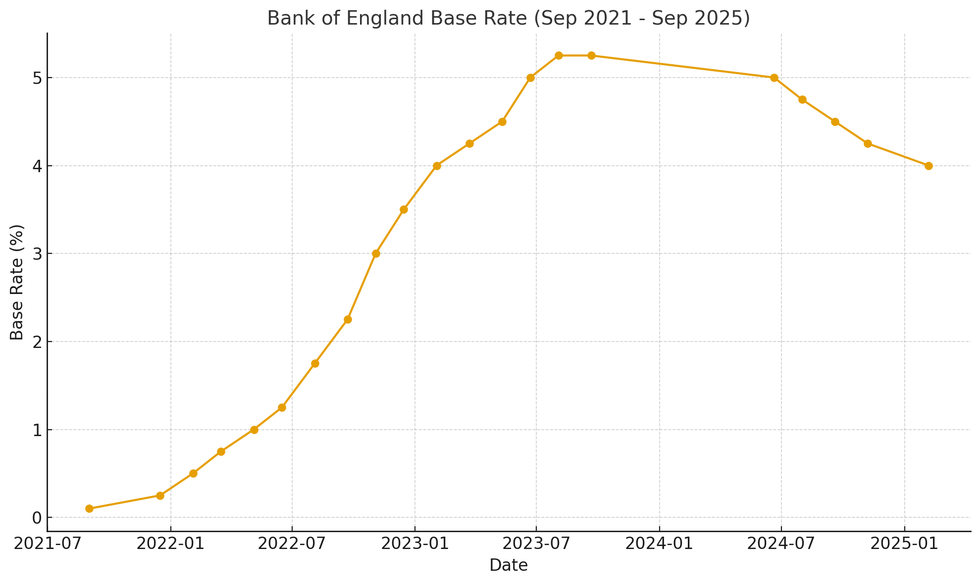

In recent years, savers have enjoyed competitive rates from high street banks and building societies due to the Bank of England's decision to raise the base rate in its fight against inflation.

With the central bank slashing rates to four per cent, those on the hunt for a competitive savings deal are being urged to take action before high return deals withdraw from the market.

What are the best savings accounts of the week? | GETTY

What are the best savings accounts of the week? | GETTY Best regular savings accounts

Here is a full list of the best regular savings currently on offer this week with interest rates attached:

- Principality BS – 7.5 per cent AER / 7.3 per cent Gross

- Zopa – 7.1 per cent AER / 6.9 per cent Gross

- The Co-operative Bank – Seven per cent AER / Gross

- Nationwide BS - 6.50 per cent AER / gross

- Monmouthshire BS – Six per cent AER / Gross

- Darlington BS – Six per cent AER / Gross

- West Brom BS – Six per cent AER / Gross

- Market Harborough BS – 5.8 per cent AER / Gross

- Progressive BS – 5.5 per cent AER / Gross

- NatWest – 5.5 per cent AER / 5.4 per cent Gross.

Best fixed-rate savings accounts

Here is a list of the best savings accounts offering a one-year fixed interest rate:

- Chetwood Bank – 4.5 per cent AER / Gross

- OakNorth Bank – 4.4 per cent AER / Gross

- Birmingham Bank – 4.4 per cent AER / Gross

- JN Bank – 4.43 per cent AER / Gross

- JN Bank - 4.43 per cent AER /Gross

- Atom Bank - 4.40 per cent AER / Gross

- Cynergy Bank - 4.40 per cent AER / Gross

- Tandem Bank – 4.37 per cent AER / Gross

- Habib Bank Zurich plc – 4.36 per cent AER / Gross

- DF Capital - 4.35 per cent AER / Gross

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

How has the Bank of England base rate changed in recent years?

|CHAT GPT

Best cash ISAs

Here is a list of the best cash ISAs with a one year fixed interest rate attached currently on offer:

- Castle Trust Bank – 4.30 per cent AER / Gross

- Tembo Money – 4.27 per cent AER / Gross

- Cynergy Bank - 4.22 per cent AER / Gross

- Vanquis Bank - 4.21 per cent AER / Gross

- Charter Savings Bank – 4.24 per cent AER / Gross

- United Trust Bank - 4.20 per cent AER / Gross

- Close Brothers Savings – 4.2 per cent AER / Gross

- Virgin Money - 4.16 per cent AER / Gross

- Hodge Bank - 4.16 per cent AER / Gross

- Skipton BS - 4.16 per cent AER / Gross.

Here is a full list of the best cash ISAs with a variable interest rate attached currently on offer:

- Principality BS – 4.4 per cent AER / Gross

- Plum – 4.37 per cent AER / 4.32 per cent Gross

- Cynergy Bank – 4.35 per cent AER / Gross

- Harpenden BS - 4.31 per cent AER / Gross

- Family Building Society – 4.3 per cent AER / Gross

- Aldermore - 4.30 per cent AER / Gross

- Marsden BS - 4.30 per cent AER / Gross

- Charter Savings Bank - 4.26 per cent AER / Gross

- Aldermore - 4.25 per cent AER / Gross

- Aldermore - 4.25 per cent AER / Gross.

MEMBERSHIP:

- Labour accused of rigging debate over Chagos surrender by smuggling in 'killer' clause: 'This is NO democracy

- 'Nigel Farage secures crushing victory with FOUR election wins as the Prime Minister is mired in chaos

- Our new Home Secretary's record on crime should be in the welcome pack for small boat arrivals - Carole Malone

- POLL OF THE DAY: Are Britain's schools doing enough to preserve the memory of our Battle of Britain heroes? VOTE NOW

- EXPOSED: Keir Starmer humiliated on eve of Donald Trump visit as bombshell letter threatens 'surrender' deal

Best easy-access accounts

Here is a full list of the best easy access savings accounts without a bonus attached:

- Cahoot – Five per cent AER / Gross

- Cahoot – 4.4 per cent AER / Gross

- Snoop – 4.3 per cent AER / 4.2 per cent Gross

- Harpenden BS - 4.31 per cent AER / Gross

- Spring - 4.30 per cent AER / 4.22 per cent Gross

- United Trust Bank - 4.30 per cent AER / Gross

- Vida Savings – 4.38 per cent AER / Gross

- Charter Savings Bank – 4.31 per cent AER / Gross

- Family Savings Bank - 4.25 per cent AER / Gross

- Penrith BS - 4.21 per cent AER / Gross

- Secure Trust Bank - 4.20 per cent AER / 4.12 per cent Gross.

Here is a full list of the best easy access accounts with a bonus attached:

- Chip - 4.80 per cent AER / 4.70 per cent Gross

- Chase – 4.75 per cent AER / 4.65 per cent Gross

- Sidekick - 4.48 per cent AER / 4.43 per cent Gross

- Shawbrook Bank - 4.30 per cent / 4.22 per cent Gross

- Principality BS – 4.45 per cent AER / Gross

- Oxbury Bank – 4.36 per cent AER / 4.28 per cent Gross

- Nottingham BS – 4.35 per cent AER / Gross

- Chip – 4.07 per cent AER / four per cent Gross

- Skipton BS – 4.12 per cent AER / Gross

- Tesco Bank – 4.1 per cent AER / Gross

- Post Office Money – 3.95 per cent AER / Gross.

LATEST DEVELOPMENTS:

Are you missing out on competitive savings interest rates?

| GETTYRachel Springall, Finance Expert at Moneyfactscompare, said: "Savers looking to secure a guaranteed return on their cash will be delighted to see some much-welcomed competition across fixed rate bonds in the top rate tables over the past week.

"Several challenger banks made rate hikes which has led to a new market-leading rates, across varying terms, such as with Birmingham Bank which pays 4.44% AER on its two-year fixed bond.

"Picking the right savings account does come down to someone’s individual circumstances, and aside from chasing the top rates, it’s important to ensure they stay within their Personal Savings Allowance (PSA) and take advantage of their ISA allowance to protect their hard-earned cash from tax.

"As is ever evident, loyalty does not pay, so it is vital for savers to proactively review and switch their savings pots. Some of the best rates on the market come from challenger banks and mutuals, which should not be overlooked. It’s wise for savers to take some time out to sign up to rate alerts or newsletters to keep in the know."

More From GB News