State pension system shake-up looms but 'half of adults unaware' of looming tax raid

Economist Neil Record questions Reform UK’s plans to overhaul council pension funds. |

GB NEWS

Multiple changes to the state pension and tax liabilities are set to come into effect which could impact retirement planning, analysts warn

Don't Miss

Most Read

Britons are being reminded to prepare for a looming shake-up to the pension system but "half of UK adult are unware" of changes which could overhaul retirement plans, according to new research.

A poll of 1,500 British adults by Schroders Personal Wealth found that around 51 per cent of those surveyed were not up to date on what said reforms are or how they will be impacted.

Among the changes included in the shake-up include the state pension age rising next year, pension pots being made liable for inheritance tax (IHT) in 2027 and the hike in age someone can access the tax-free lump sum from the following year.

Between next year and 2028, the state pension age will go up from 66 to 67 for thousands of Britons. The retirement age threshold will jump once more to 68 between 2044 and 2046.

Britons are 'unaware' of looming changes to the state pension

|GETTY

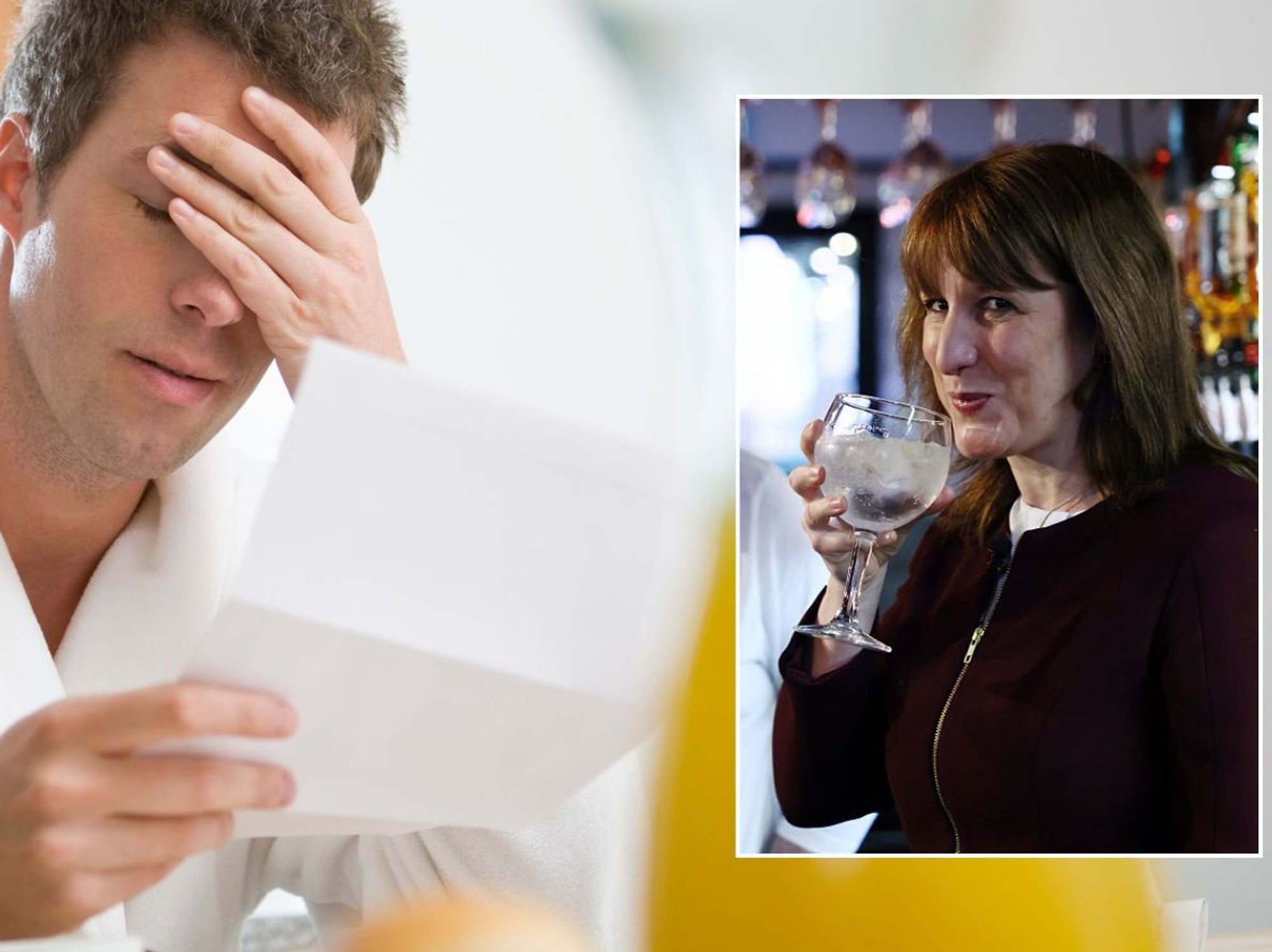

Last October, Chancellor Rachel Reeves confirmed that pension assets would now be included as part of someone's estate for IHT purposes, which will see more people forced to pay the levy.

Inheritance tax is charged on someone's estate, which includes their property, assets and savings, at a rate of 40 per cent if it valued above the £325,000 threshold, rising to £500,000 if properties are passed on.

Beneficiaries of estates could also need to pay income tax on pension proceeds after IHT has been paid, if the pensioner passes away after they turn 75, which could slap additional-rate taxpayers with a 67 per cent tax rate.

As it stands, Britons are able to withdraw 25 per cent of their pension savings from pots once they turn 55, however this will rise to those aged 57 from 2028.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Rachel Reeves's Autumn Budget will fall on November 26 | PA

Rachel Reeves's Autumn Budget will fall on November 26 | PAAccording to Alex Gaita, the director of financial planning at Schroders Personal Wealth, these pending changes to the status quo will be "deeply personal" for those affected.

The retirement expert explained: "They affect when people can stop working, how much they can afford to spend, and what they can leave behind."

Notably, only 15 per cent of people polled by the firm were comfortable that they “fully understood” the tax rules around passing on pensions to beneficiaries when they die, planning their finances around the existing HM Revenue and Customs (HMRC) regime.

Furthermore, 29 per cent of survey respondents admitted they were planning to pass part or all of their retirement savings to family members or heirs.

MEMBERSHIP:

- Labour accused of rigging debate over Chagos surrender by smuggling in 'killer' clause: 'This is NO democracy'

- Nigel Farage secures crushing victory with FOUR election wins as the Prime Minister is mired in chaos

- Our new Home Secretary's record on crime should be in the welcome pack for small boat arrivals - Carole Malone

- POLL OF THE DAY: Are Britain's schools doing enough to preserve the memory of our Battle of Britain heroes? VOTE NOW

- EXPOSED: Keir Starmer humiliated on eve of Donald Trump visit as bombshell letter threatens 'surrender' deal

The state pension has become a particular concern in recent months, with the Office for Budget Responsibility (OBR) warning the retirement benefit will cost £10billion more than initially forecsat.

Analysts have called for reform to the state pension with some suggesting the triple lock, the metric used to determine how much payment rates rise every year, is changed.

Under the triple lock, retirement benefit payment rates increase annually by either the rate of inflation, average wage growth or 2.5 per cent; whichever is the highest.

Some analysts have suggested the state pension age should be raised sooner than expected in order to bring down the cost of payments on the public purse.

LATEST DEVELOPMENTS:

What has the impact of the state pension triple lock been on the public's finances | OBR

What has the impact of the state pension triple lock been on the public's finances | OBR Rob Morgan, the chief analyst at investment firm Charles Stanley, told The Financial Times: "The state pension is a particular blind spot, since it’s rather complicated, and people simply don’t believe they need to even consider it until much older.

Citing a recent poll by Charles Stanley, Mr Morgan noted that the average Briton believes 24 years of National Insurance contributions are needed to claim the full, new state pension, when it is in fact 35.

Former pensions minister Sir Steve Webb previously warned that the increase in age when someone can access their pension savings represents a "real cliff edge" for many financially.

He said: "There is no doubt that there are some changes to the pensions landscape where final decisions have been taken, which have a direct effect on consumers, and where public awareness is still at a low level."

More From GB News