Best savings accounts of the week: Britons told to grab 7.5% interest rates before Bank of England decision

Savings rates continue to be high but could be cut after this week's Bank of England decision

Don't Miss

Most Read

Savers are being reminded to take advantage of accounts offering 7.50 per cent interest rates before the Bank of England's base rate decision this week.

As it stands, the central bank has held the cost of borrowing at 4.25 per cent but analysts are betting on a potential rate reduction when the Monetary Policy Committee (MPC) meets late this week.

Bank and building societies customers have enjoyed relatively high savings rates thanks to the Bank's moves to ease inflation.

With the consumer price index (CPI) falling from historic highs, financial institutions are more likely to offer less competitive deals.

Which banks are offering the best savings accounts?

|GETTY

Best regular savings accounts:

Here is a list of the best regular savings accounts currently on offer for the week with interest rates attached, according to Moneyfactscompare:

- Principality BS – 7.50 per cent AER / 7.36 per cent Gross

- Zopa – 7.10 per cent AER / 6.87 per cent Gross

- The Co-operative Bank – Seven per cent AER/Gross

- Nationwide BS – 6.50 per cent AER/Gross

- Melton BS – 6.50 per cent AER/Gross

- Monmouthshire BS – Six per cent AER/Gross

- West Brom BS – Six per cent AER/Gross

- Market Harborough BS – 5.80 per cent AER/Gross

- Skipton BS – 5.75 per cent AER/Gross

- Progressive BS – 5.50 per cent AER/Gross.

Best fixed-rate savings accounts

Here is a list of the best savings accounts offering a one-year fixed interest rate:

- Vanquis Bank - 4.50 per cent AER /Gross

- GB Bank – 4.53 per cent AER/Gross

- LHV Bank – 4.50 per cent AER/Gross

- Zenith Bank (UK) Ltd – 4.47 per cent AER/Gross

- Union Bank of India (UK) Ltd – 4.47 per cent AER/Gross

- Union Bank of India (UK) Ltd – 4.47 per cent AER/Gross

- Oxbury Bank – 4.45 per cent AER/Gross

- StreamBank – 4.41 per cent AER/Gross

- Chetwood Bank - 4.40 per cent AER/Gross

- RCI Bank UK – 4.40 per cent AER/Gross.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Savers have lost money to interest rate cuts and inflation in recent years | GETTY

Savers have lost money to interest rate cuts and inflation in recent years | GETTYBest cash ISAs

Here is a list of the best cash ISAs with a one year fixed interest rate attached currently on offer:

- Cynergy Bank – 4.30 per cent AER/Gross

- Paragon Bank – 4.28 per cent AER / 4.27 per cent Gross

- Tembo Money – 4.27 per cent AER/Gross

- Vanquis Bank – 4.27 per cent AER/Gross

- Charter Savings Bank – 4.27 per cent AER/Gross

- Vida Savings – 4.25 per cent AER/Gross

- Kent Reliance – 4.22 per cent AER/Gross

- Aldermore - 4.20 per cent AER/Gross

- United Trust Bank - 4.20 per cent AER/Gross

- Close Brothers Savings – 4.20 per cent AER/Gross

Here is a full list of the best cash ISAs with a variable interest rate attached currently on offer:

- Plum – 4.86 per cent AER / 4.80 per cent Gross

- Moneybox – 4.80 per cent AER / 4.70 per cent Gross

- Moneybox – 4.65 per cent AER / 4.55 per cent Gross

- Tembo Money – 4.64 AER / 4.54 per cent Gross

- Trading 212 – 4.50 per cent AER / 4.41 per cent Gross

- Charter Savings Bank – 4.40 per cent AER/Gross

- Principality BS – 4.40 per cent AER/Gross

- Aldermore – 4.40 per cent AER/Gross

- Kent Reliance – 4.38 per cent AER/Gross

- Vida Savings – 4.38 per cent AER / 4.29 per cent Gross

Best easy access savings accounts

Here is a full list of the best easy access savings accounts without a bonus attached:

- Cahoot – Five per cent AER/Gross

- Snoop – 4.60 per cent AER / 4.50 per cent Gross

- Atom Bank – 4.60 per cent AER / 4.51 per cent Gross

- Cahoot – 4.55 per cent AER/Gross

- West Brom BS – 4.55 per cent AER/Gross

- Kent Reliance – 4.41 per cent AER/Gross

- Kent Reliance – 4.41 per cent AER/Gross

- Hodge Bank – 4.40 per cent AER / 4.31 per cent Gross

- Newcastle BS - 4.40 per cent AER/Gross

- Vida Savings - 4.38 per cent/Gross.

Here is a full list of the best easy access accounts with a bonus attached:

- Chase – Five per cent AER / 4.89 per cent Gross

- Oxbury Bank – 4.61 per cent AER / 4.52 per cent Gross

- Principality BS – 4.55 per cent AER/Gross

- Skipton BS – 4.50 per cent AER/Gross

- Cynergy Bank – 4.41 per cent AER/Gross

- Chip – 4.33 per cent AER / 4.25 per cent Gross

- Chip – 4.33 per cent AER / 4.25 per cent Gross

- Tesco Bank – 4.10 per cent AER/Gross

- Nottingham BS – 4.05 per cent AER/Gross

- Marcus by Goldman Sachs® – 4.01 per cent AER / 3.94 per cent Gross

LATEST DEVELOPMENTS:

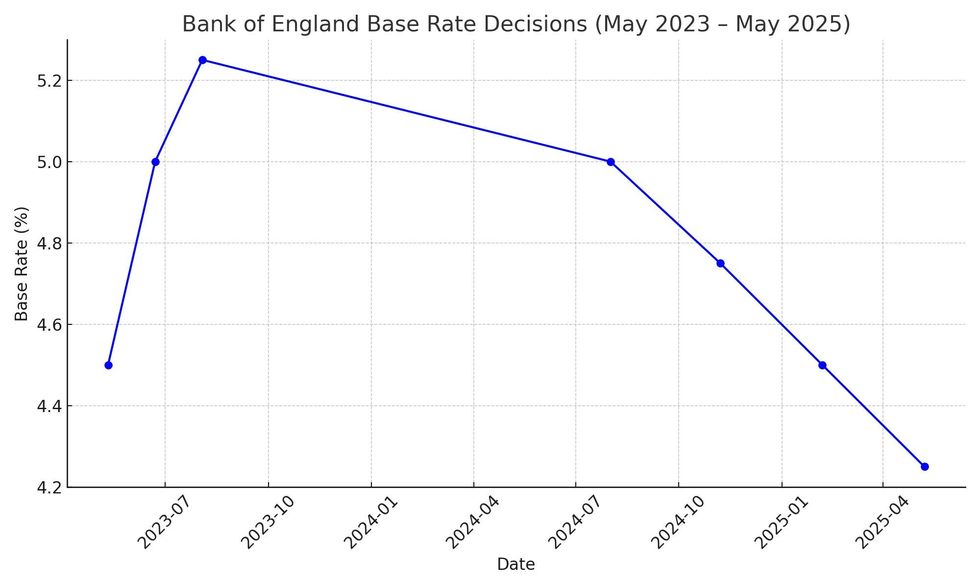

Full list of base rate changes from the Bank of England over the last two years | CHAT GPT

Full list of base rate changes from the Bank of England over the last two years | CHAT GPT Adam French, the head of News at Moneyfactscompare, said: “Savings rates may be about to tumble if the Bank of England’s Monetary Policy Committee decide to cut the base rate this week.

"Some banks may have already priced a cut in, with the market-leading one-year bond falling for the second week in a row, a GB Bank one-year fix was paying 4.58 per cent a couple of weeks ago, but it is now down to 4.50 per cent - tied with Vanquis and LHV Bank as the best one-year fixes available.

"On the flipside, those looking to lock their money away for longer may want to consider JN Bank, which has stormed to the top of the best buy tables for two-, three- and four-year plus bonds.

"Competition continues to heat up in the easy access cash-ISAs market. Both Plum and Moneybox hiked rates to 4.86 per cent and 4.80 per cent, respectively. However, savers should bear in mind that these rates are variable and may fall if the Bank of England does decide to lower the rates.

"With the next base rate decision imminent, now could be as good a time as any to snap up some of the best deals – or risk missing out."

More From GB News