Bank England urged to NOT cut interest rates 'too or too fast' as top economist issues inflation warning

GB NEWS

The central bank has raised the base rate in an effort to ease inflationary pressures

Don't Miss

Most Read

Latest

The Bank of England's top economist has cautioned against hasty reductions to borrowing costs while the consumer price index (CPI) rate of inflation remains stubbornly elevated.

Huw Pill indicated that the central bank's policymakers should exercise greater prudence when considering interest rate reductions, warning against moving "too far or too fast".

Speaking in London, Mr Pill acknowledged that whilst further reductions are anticipated over the coming twelve months if economic conditions align with forecasts, the persistence of price pressures demands a measured approach.

His remarks come as inflation sits at 3.8 per cent, substantially exceeding the central bank's two per cent objective.

The Bank of England must be 'cautious' when it comes to interest rate cuts, a central bank policymaker has warned

|GETTY

The economist expressed disappointment at the limited progress in bringing down price growth since rates reached current levels.

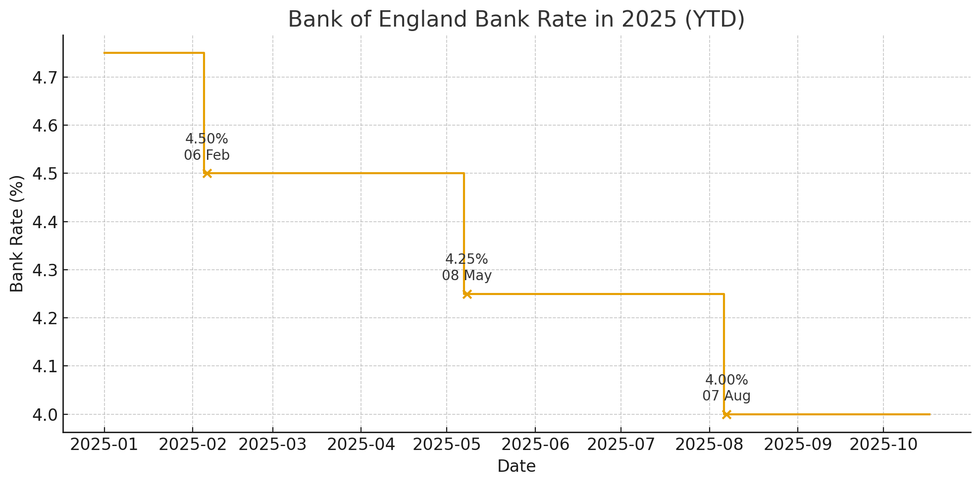

Recently, the Monetary Policy Committee (MPC) opted to maintain the UK's base rate at four per cent during their September meeting, with Mr Pill being among those supporting this decision.

The committee is broadly anticipated to hold this position at their upcoming gathering, which is scheduled to take place on November 6, 2025.

Mr Pill characterised the current stance as a "skip rather than halt" in the normalisation process, suggesting temporary pauses rather than a complete cessation of rate adjustments.

Would you prefer if inflation or interest rates were lower? | GETTY

Would you prefer if inflation or interest rates were lower? | GETTY However, he emphasised that persistent inflationary forces are becoming increasingly concerning.

The economist noted that consumer price inflation has proved more resilient than the Bank's projections since rates reached present levels.

"Given our unambiguous commitment to meeting the two epr cent inflation target, the lack of progress over the past year is obviously disappointing," he stated.

The Bank has announced a reduction in its Quantitative Tightening programme, scaling back from £100billion achieved in the previous year to £70billion targeted for the next twelve months.

Despite this decrease, the maturity structure of the Bank's gilt portfolio will result in an additional £8 billion of gilt sales during the period.

Market participants had largely anticipated this £70 billion figure, according to a Bank survey conducted last month.

AJ Bell investment analyst Laith Khalaf questioned whether the Bank might have adjusted its approach had market expectations been different, given current volatility in gilt markets.

The Bank maintains that its QT programme is not significantly impacting current gilt market conditions, which appear more closely linked to international developments.

LATEST DEVELOPMENTS:

The Bank of England base rate has fallen in recent months

|CHAT GPT

Chancellor Rachel Reeves may find some relief in recent gilt market movements, with 30-year bond yields declining from nearly 5.7 per cent to approximately 5.4 per cenr this month.

These shifts have mirrored similar patterns in US Treasury bonds, following softer American employment data and Federal Reserve rate reductions.

With only one Bank rate decision remaining before November's Budget, the Treasury would welcome more accommodative signals from Threadneedle Street to ease fiscal pressures.