‘Excellent rating’: Bank boosts triple access cash ISA rate to 4.25%

Moneyfacts awards top score as updated ISA offers annual and monthly interest options

Don't Miss

Most Read

An online bank has increased interest on its cash ISA to 4.25 per cent.

The account has received an "excellent" rating from Moneyfacts, positioning it among the stronger products currently available to savers.

Vanquis Bank has increased the interest rate on its Triple Access Cash ISA to 4.25 per cent AER.

The updated version, known as the Triple Access Cash ISA (Issue 3), now sits in a competitive place within the wider savings market.

The rise in the interest rate reflects ongoing activity across the ISA sector, where providers continue to adjust pricing to attract deposits.

The change highlights the importance for savers of comparing ISA products, as interest rates can significantly influence returns over the course of a tax year.

The minimum opening deposit for the Vanquis account is £1,000.

TRENDING

Stories

Videos

Your Say

There is no notice period attached to the product, meaning savers can access their funds without delay.

The maximum permitted balance is £250,000.

The account can be opened and managed online, allowing customers to monitor their savings and make adjustments through digital services.

Transfers in and out are permitted, giving savers flexibility to consolidate funds from other ISA providers when rules allow.

Moneyfacts has awarded the account an “excellent” rating, ranking it among the top savings products

|GETTY

Interest is paid annually on the anniversary of the account opening date, although a monthly interest option is also available.

The structure allows customers to choose between annual compound growth or monthly payments, depending on their preference for income or accumulation.

The account forms part of a category of ISAs designed to offer access alongside competitive rates, although saver behaviour can affect outcomes because some providers apply reduced rates after certain withdrawal levels.

Caitlyn Eastell, spokesperson at Moneyfactscompare.co.uk, commented on the latest changes.

LATEST DEVELOPMENTS

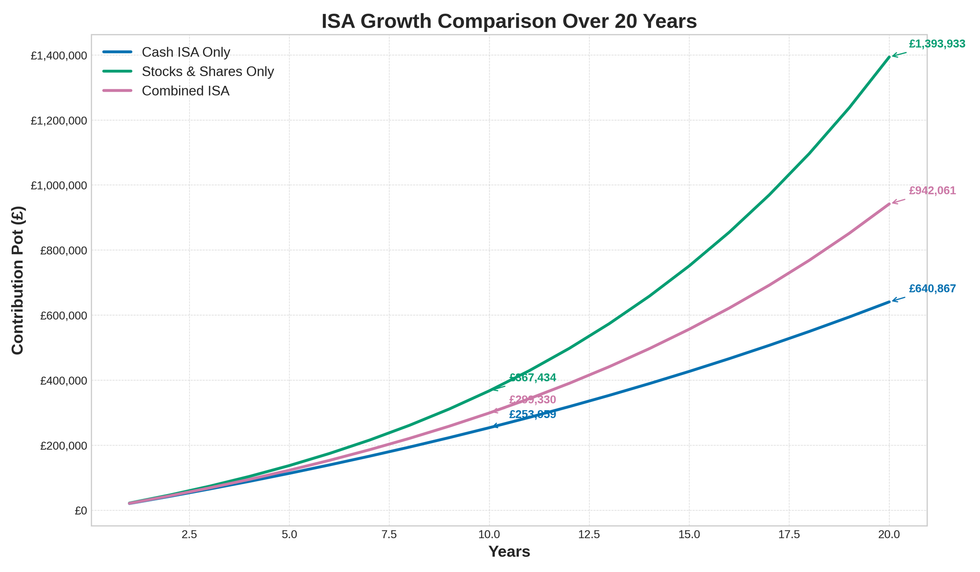

ISA growth comparison over 20 years | Murphy Wealth/Copilot

ISA growth comparison over 20 years | Murphy Wealth/CopilotMs Eastell said: "Vanquis Bank has changed the issue number and increased the rate on its Triple Access Cash ISA".

She said: "The account now pays 4.25 per cent AER on its anniversary, but there is also a monthly interest option for those who may want to boost their income".

Ms Eastell added: "Savers will need to deposit at least £1,000 but they have no restrictions on further additions, which may be a bonus for some".

She said there is a condition savers should be aware of.

Ms Eastell said: "However, it should be noted that the rate drops significantly if savers make four or more withdrawals".

She added: "On assessment, this account takes a competitive position as a 'Best Buy' and receives an Excellent Moneyfacts product rating".

Other products continue to be available for savers comparing options within the ISA market.

Money Saving Expert has highlighted Atom Bank's ISA, which also pays 4.25 per cent AER.

The Atom account requires a minimum opening deposit of £1.

The account allows savers to deposit up to £20,000 per tax year in line with ISA allowance rules.

The product is managed through the bank's app, where customers can track payments and account activity.

Interest is paid monthly, which may appeal to savers who prefer more frequent distributions rather than receiving interest once a year.

Rachel Reeves announced reductions to the cash ISA tax-free allowance from £20,000 to £12,000 in the Budget

| GB NEWSThe account is not a flexible ISA, meaning withdrawals may not be replaced in the same tax year without affecting the annual allowance.

ISA providers across the market continue to adjust their terms and pricing in response to customer demand, regulatory requirements and wider economic conditions, resulting in regular changes to available rates.

Product variations such as access levels, withdrawal limits, deposit requirements and interest payment schedules remain key differentiators for customers assessing which ISA best suits their needs.

More From GB News