The UK regions where you will get most for your money shared - full list of property prices

New research finds the cheapest places to buy

| GETTY/PA

The price of an average home varies greatly across the UK

Don't Miss

Most Read

Latest

Buying a property is one of the most expensive purchases a person will ever make but not all homes are valued the same.

Britons will get more for their money if buying in the north east of England, according to Rightmove data released today.

The Rightmove House Price Index for June 2024 showed house prices have remained largely the same month-on-month, dropping just £21 in June.

This puts the average price of a property in the UK at £375,110. The average house price in the north east, however, sits at around half of that, at £191,996.

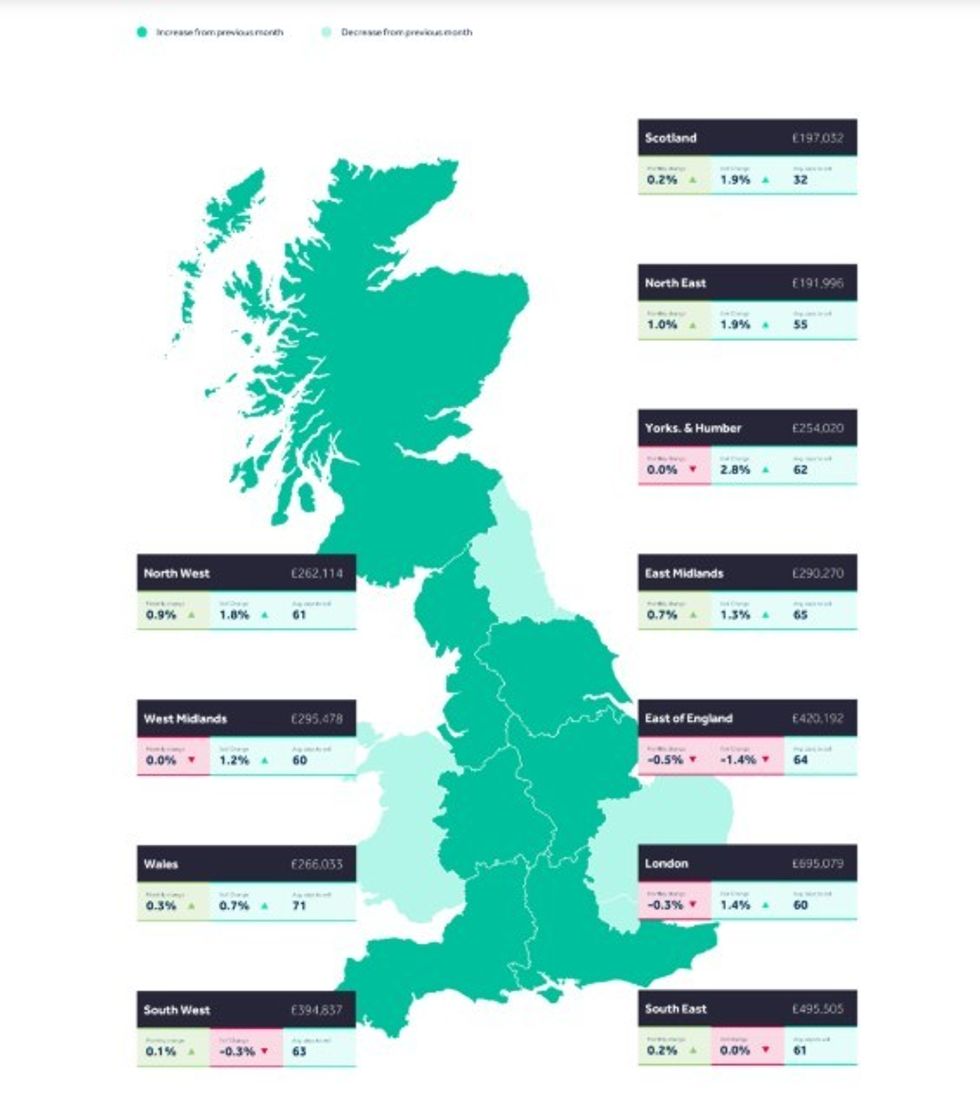

Property prices vary drastically across the UK

| PAProperty price by region (monthly change %)

North East - £191,996 (+1%)

Scotland - £197,032 (+0.2%)

Yorks & Humber - £254,020 (no change)

North West - £262,114 (+0.9%)

Wales - £266,033 (+0.3%)

East Midlands - £290,270 (+0.7%)

West Midlands - £295,478 (no change)

South West - £394,837 (+0.1%)

East of England - £420,192 (-0.5%)

South East - £495,505 (+0.2%)

London - £695,079 (-0.3%)

While property in the north east has the lowest average price, it did see the biggest month-on-month increase. This was at a modest one per cent.

This increase is set to be a common theme as the research found five of the six cheapest regions reached new price records.

Rightmove’s director of property science Tim Bannister said: “It’s always difficult to predict how home movers will react to sudden uncertainty, but looking back through our data, we can see that during previous election campaigns, market activity has remained largely steady.

"This election has followed a similar pattern so far, and the responses from our poll of over 14,000 people also supports the data, with the vast majority of respondents saying they will carry on with their home-moving plans.

LATEST DEVELOPMENTS

Rightmove shared its latest HPI

|RIGHTMOVE

"However, some potential sellers appear to be watching and waiting rather than taking action, evidenced by a dip in the number of new sellers coming to market, particularly at the top-end.

"This is understandable when many of these sellers have more flexibility over when they act, but overall, it appears to be business as usual for the mass market.”

This comes as countryside properties were found to have outpriced urban homes over the last 12 months.

Property in East Cambridgeshire has increased the most where prices have shot up by 10.6 per cent, research by Yopa found, while property prices in London dropped.