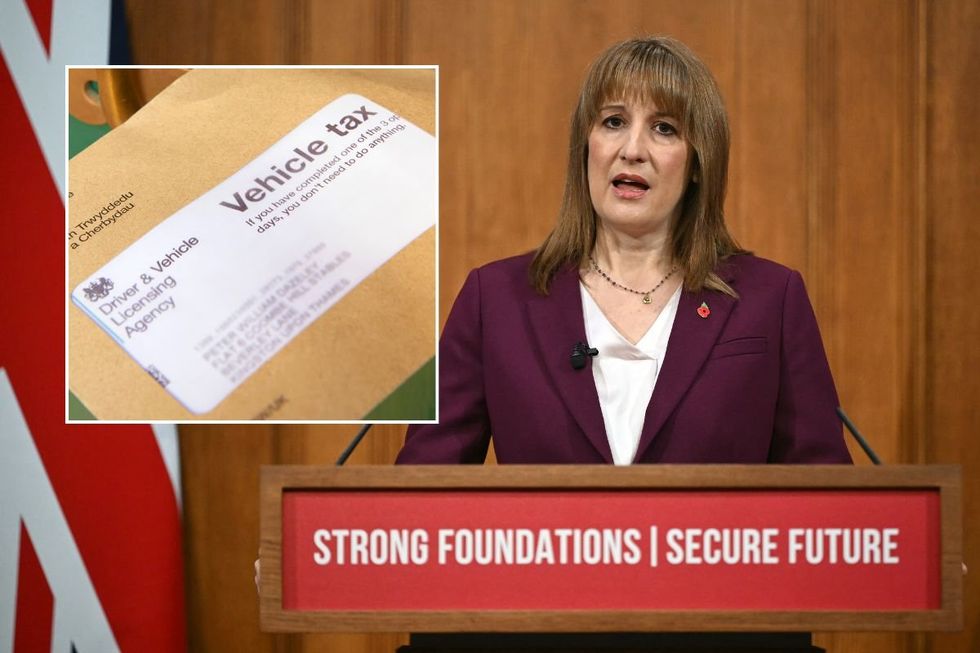

Rachel Reeves blasted over 'muddled' rollout of pay-per-mile car taxes after Labour U-turn

Chancellor Rachel Reeves will deliver the Autumn Budget on November 26

Don't Miss

Most Read

The Chancellor is being urged to provide clarity to millions of motorists across the UK ahead of the Budget next week.

Rachel Reeves will unveil the Government's Autumn Budget on Wednesday, November 26, with many motorists eager to hear updates on pay-per-mile car taxes and fuel duty.

Speaking in the Commons earlier this week, Transport Secretary Heidi Alexander confirmed that the Government was "firmly on the side of drivers".

She added that there were "no proposals to introduce a national pay-per-mile scheme" when pressed on the issue by Charlie Dewhirst MP.

TRENDING

Stories

Videos

Your Say

The Conservative member for Bridlington and The Wolds questioned the "disproportionate impact" that road pricing would have on rural motorists, which he called "another slap in the face".

However, a source close to the Transport Secretary stated that she "misspoke", the PA news agency claimed.

The Labour MP for Swindon South was originally intending to rule out a national road pricing system, which could include tolls and congestion charges.

This followed reports which suggested that the Government was preparing to roll out a pay-per-mile scheme for electric vehicle owners, which would charge them three pence for every mile they drive.

READ MORE: Labour appears to U-turn on pay-per-mile car tax changes just HOURS after ruling out new scheme

Chancellor Rachel Reeves could still unveil new pay-per-mile car taxes

|PA/GETTY

The proposal has been met with strong backlash from the motoring industry, amid fears the pricing structure would hit EV drivers with a £300 annual cost, just months after being hit with new car taxes.

Stuart Masson, editorial director of The Car Expert, said the Chancellor has an opportunity to "start again" after "yet another round of muddled, whack-a-mole politics".

He added: "First, UK motorists need clarity on taxation. There's a lot of noise about EV grants and pay-per-mile systems.

"But you can't bolt a pay-per-mile scheme onto the existing structure and hope it works, especially when, just a couple of months ago, you started throwing hundreds of millions of pounds at car manufacturers in the form of grants on certain new EVs."

LATEST DEVELOPMENTS

The expert noted that a road pricing tax would do more harm than good, especially with many petrol and diesel drivers hesitant to make the switch to electric vehicles.

If they are slapped with pay-per-mile charges, which are reported to be introduced in 2028, following a consultation, motorists could be put off from investing in cleaner vehicles.

While there are now more than 40 eligible vehicles for the Government's £650million Electric Car Grant, pay-per-mile car taxes could impact future sales.

More than 20,000 drivers have made use of the grants, which help them save either £1,500 or £3,750.

The Ford Puma Gen-E is one of four vehicles eligible for the £3,750 Electric Car Grant incentive

| FORDFour vehicles - the Citroen e-C5 Aircross Long Range, Ford E-Tourneo Courier, Ford Puma Gen-E and the Nissan Leaf - are eligible for the maximum grant.

A DfT spokesperson told GB News: "Fuel duty covers petrol and diesel, but there's no equivalent for electric vehicles.

"We want a fairer system for all drivers whilst backing the transition to electric vehicles, which is why we have invested £4billion in support, including grants to cut upfront costs by up to £3,750 per eligible vehicle.

"Just as it is right to seek a tax system that fairly funds roads, infrastructure and public services, we will look at further support measures to make owning electric vehicles more convenient and more affordable."