Labour appears to U-turn on pay-per-mile car tax changes just HOURS after ruling out new scheme

The Chancellor is expected to announce new pay-per-mile charges for electric vehicles next week

Don't Miss

Most Read

Latest

Labour appears to have backtracked on comments made earlier by the Transport Secretary, who ruled out the introduction of new pay-per-mile car tax measures.

Earlier today, Transport Secretary Heidi Alexander ruled out any potential "national rollout" of new road pricing car tax measures.

She said: "There are no proposals to introduce a national pay-per-mile scheme. This Government is firmly on the side of drivers, as I've set out already."

However, transport sources speaking to PA now appear to have backtracked on the Transport Secretary's comments.

TRENDING

Stories

Videos

Your Say

A source close to the Labour MP for Swindon South claimed that she "misspoke" and intended to rule out a "national road pricing system".

It followed a question from Conservative MP Charlie Dewhirst, who highlighted the "disproportionate impact" on rural drivers if a pay-per-mile regime were to be introduced.

The MP for Bridlington and The Wolds noted that people living in rural areas have to travel further for services, meaning they would be hit harder by a potential road pricing scheme.

GB News has contacted the Department for Transport for a comment.

Car tax plans have been thrown into chaos ahead of the Chancellor's Budget

|REUTERS/GETTY

Reports have suggested that Chancellor Rachel Reeves was planning to introduce pay-per-mile car taxes and charge electric car owners three pence per mile to drive.

According to estimates, the average driver would face a cost of around £300 a year, in addition to Vehicle Excise Duty charges.

Speaking previously, a Government spokesperson said: "Fuel duty covers petrol and diesel, but there's no equivalent for electric vehicles.

"We want a fairer system for all drivers whilst backing the transition to electric vehicles, which is why we have invested £4billion in support, including grants to cut upfront costs by up to £3,750 per eligible vehicle.

LATEST DEVELOPMENTS

"Just as it is right to seek a tax system that fairly funds roads, infrastructure and public services, we will look at further support measures to make owning electric vehicles more convenient and more affordable."

Road pricing has been a popular suggestion to help the Government raise money from the dwindling fuel duty receipts as more drivers switch to electric cars.

Experts have warned that the Government could potentially lose billions of pounds over the coming years as petrol and diesel drivers transition to cleaner vehicles.

Many have also highlighted the perceived irony that Labour is looking to target drivers with new car tax measures, despite investing £650million to support the Electric Car Grant.

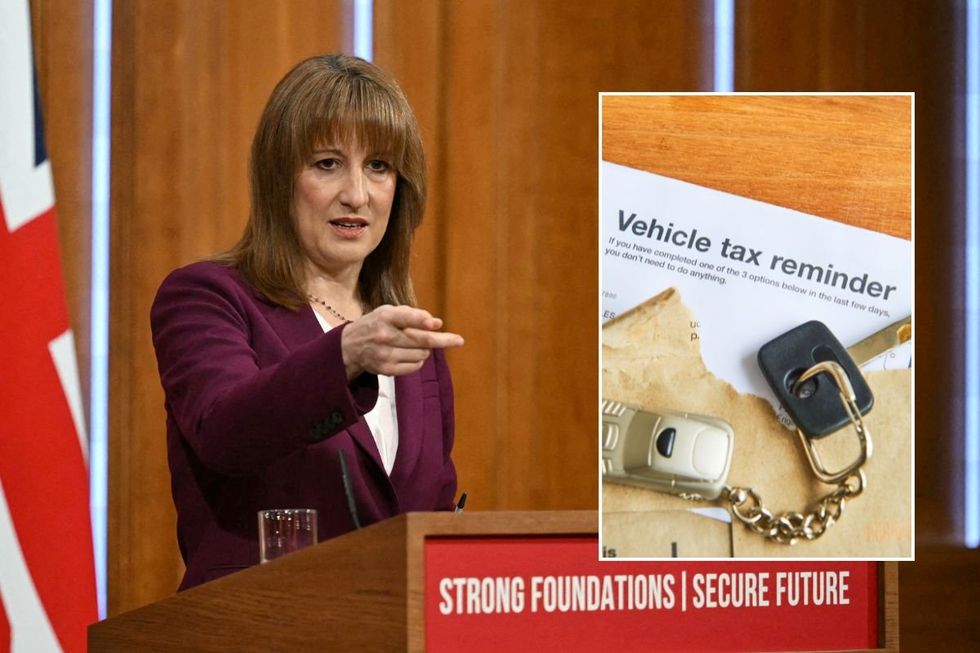

Chancellor Rachel Reeves will unveil the Autumn Budget on November 26 | PA

Chancellor Rachel Reeves will unveil the Autumn Budget on November 26 | PAMore than 35 models are eligible for the EV incentive, which can help drivers save £1,500 or £3,750, depending on the vehicle.

While only a handful of models are included in the upper tier of the EV grant, more than 20,000 motorists have already taken advantage of the cheaper prices.

The Transport Secretary also pointed to the additional investment for motorists, headlined by a staggering £24billion for motorways and local roads.

The Chancellor will make a final decision on pay-per-mile car taxes on Wednesday, November 26.