Rachel Reeves told pay-per-mile car tax plan is 'self-defeating' ahead of huge Budget decision

The Chancellor has split opinions with rumoured plans to launch new car taxes for electric vehicles

Don't Miss

Most Read

Experts continue to assess rumoured plans for the Government to introduce pay-per-mile car taxes on electric vehicles ahead of the Autumn Budget later this month.

Chancellor Rachel Reeves is expected to introduce a pay-per-mile scheme for electric cars in the Budget, with EV owners facing a cost of 3p per mile.

The charge is expected to cost the average electric vehicle driver around £250 extra per year, as the Government looks to make up for losses from reduced fuel income.

As more drivers turn their backs on petrol and diesel vehicles, revenue from fuel duty will fall dramatically, leaving the Government with a £25billion black hole.

TRENDING

Stories

Videos

Your Say

The new pay-per-mile charges, which were first reported by The Telegraph, would see electric car owners pay around £12 more if driving from London to Edinburgh, or £2 extra between Liverpool and Leeds.

Professor ManMohan Sodhi, Professor of Operations and Supply Chain Management at Bayes Business School (City St George's, University of London, acknowledged that taxes were needed, noting that they were "rational".

He said: "Fuel duty on petrol and diesel brings the Government £24.4billion, which it would lose if all drivers were to switch to electric.

"Another justification is that pure EVs, even plug-in hybrids, are much heavier and damage roads more than petrol or diesel cars.

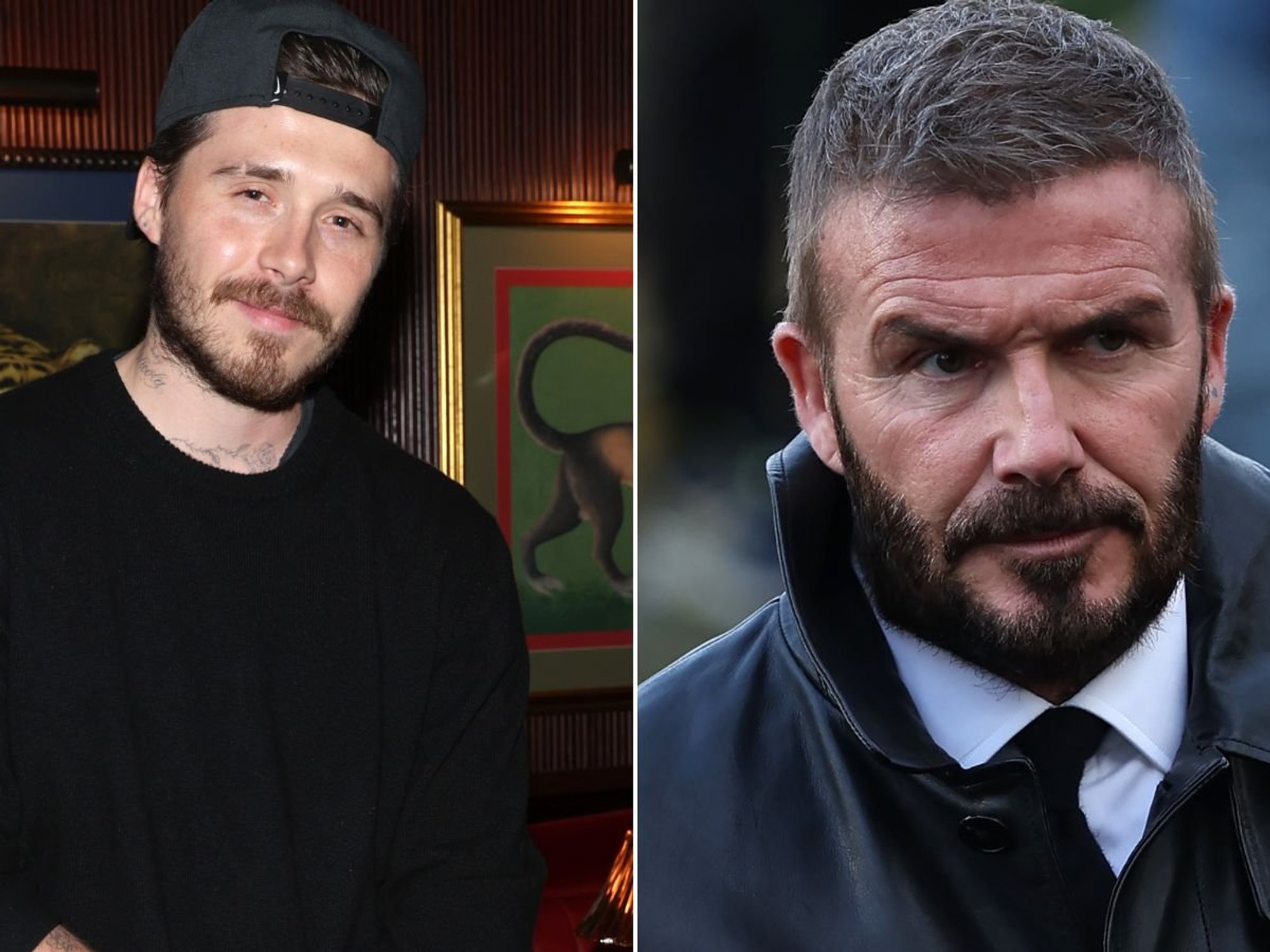

Rachel Reeves' decision to introduce pay-per-mile car taxes later this month could be deeply unpopular

|REUTERS/GETTY

"In addition, petrol and diesel car drivers already pay about 7p per mile in tax, so 3p per mile for EV drivers is not unreasonable."

However, Professor Sodhi acknowledged how "politically fraught" the situation is since drivers could develop a negative perception of electric vehicles given the additional tax.

He suggested that black boxes could be used in cars to monitor the number of miles driven, which could even be tied to car insurance policies, given their widespread use in telematics.

The Government has yet to provide a confirmation or any details about the pay-per-mile car tax measures, although drivers will be hoping for clarity as soon as possible.

LATEST DEVELOPMENTS

James Court, head of policy at Octopus Electric Vehicles, said EV drivers should pay - but only when the time is right.

He said it was too soon to launch such a tax scheme, since many drivers are still considering ditching their petrol and diesel vehicles in favour of electric cars.

The expert highlighted how electric cars only represent four per cent of cars on roads, with any tax levied on EVs raising a "minimal amount" until more are on the road.

"As we've seen in other countries, introducing a charge now would stifle the growth we've seen over the past years, and be self-defeating," Mr Court said.

Chancellor Rachel Reeves will unveil her autumn budget on November 26 | PA

Chancellor Rachel Reeves will unveil her autumn budget on November 26 | PAHe called for the Government to instead focus on measures that would be fair for electric car owners, without impacting the uptake of cleaner vehicles.

Chancellor Rachel Reeves is expected to unveil more details of the pay-per-mile plans and other financial decisions during the Autumn Budget on Wednesday, November 26.

A Government spokesperson said a "fairer system" of motoring taxation was needed for all drivers, while still supporting the switch to cleaner vehicles.

They added: "Just as it is right to seek a tax system that fairly funds roads, infrastructure and public services, we will look at further support measures to make owning electric vehicles more convenient and more affordable."