Pay-per-mile car taxes would bring 'many benefits' with Rachel Reeves under pressure to launch new rules

The Government has previously ruled out introducing road pricing as a replacement for fuel duty

Don't Miss

Most Read

Peers in the House of Lords have warned that road pricing and car tax changes could cause havoc among drivers, including a potential rise in divorces.

Ministers and motoring experts have continually called on the Government to consider introducing road pricing options to address falling revenue from fuel duty.

As the UK approaches the 2030 ban on the sale of new petrol and diesel vehicles, the Government must account for a dramatic drop in people paying for fuel, since many will be switching to electric vehicles.

Think tanks, including the Tony Blair Institute for Global Change, have warned that the funding black hole for the Government could exceed £30billion in the coming years.

Do you have a story you'd like to share? Get in touch by emailing motoring@gbnews.uk

With the rush to address the funding issues, road pricing, including a pay-per-mile scheme, could become a popular option for the Government to maintain funding for roads.

The Commons Transport Select Committee urged the Treasury and the Department for Transport to discuss the viability of road pricing.

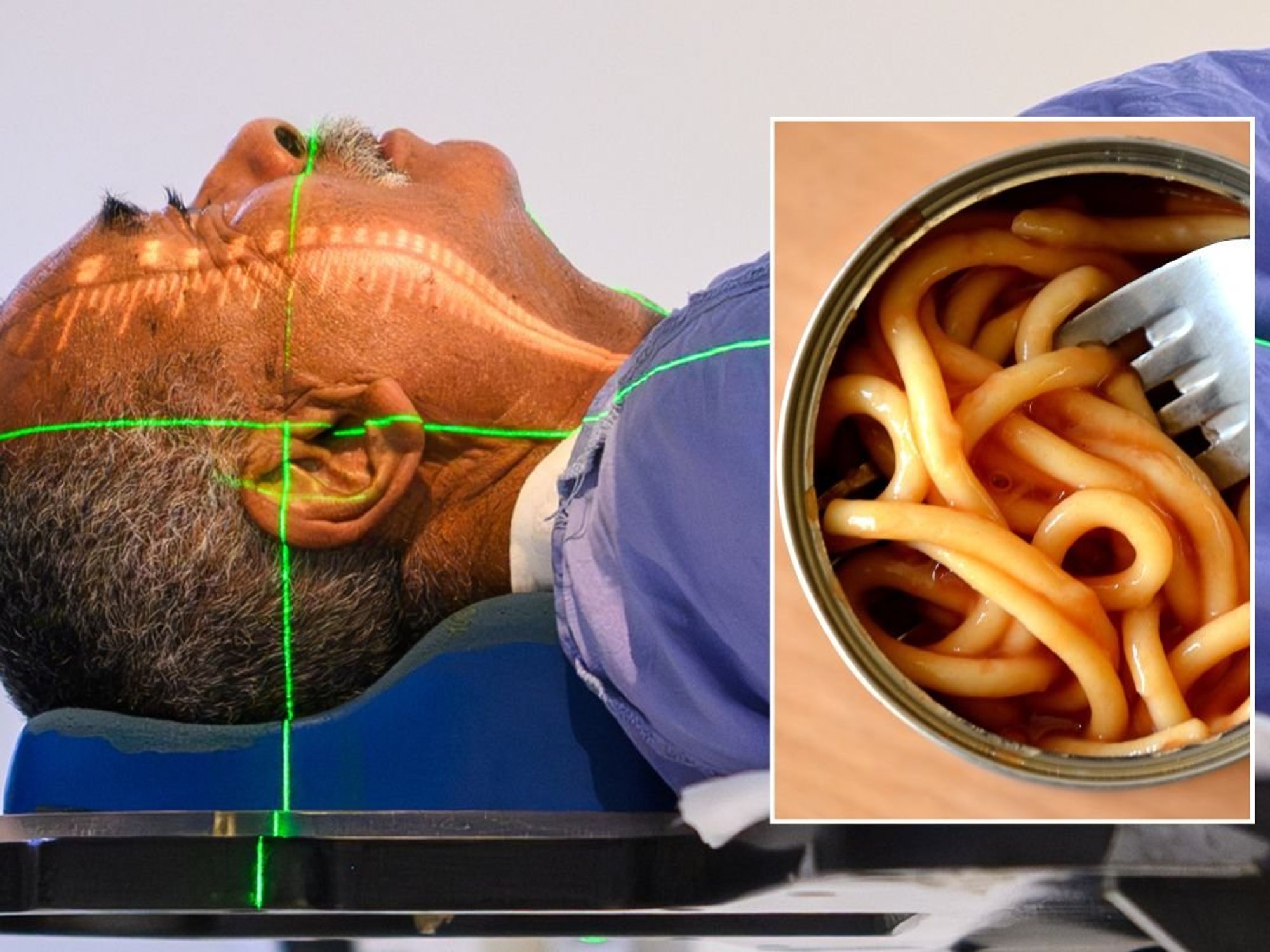

However, MPs said there was no "viable alternative" to a road pricing system, which would likely introduce technology to track vehicle movement and charge drivers based on how much they travel.

Speaking during a question on road pricing in the House of Lords, crossbencher the Earl of Errol highlighted that there was a "huge privacy issue" with such a plan.

The Government is facing renewed calls to introduce road pricing

|PA/GETTY

The independent peer added: "If, maybe in a marriage, someone can see where their other half has been going when they are not around, it could well cause a major rise in the divorce rate and other things."

In response, Treasury Minister Lord Livermore said it was an "interesting question", but reiterated that the Government had no plans to introduce road pricing.

Speaking previously to GB News, an HM Treasury spokesperson said: “We have no plans to introduce road pricing.

"We are committed to supporting our automotive sector as we transition to electric vehicles in order to meet our legally binding climate targets."

Lord Young of Cookham said that road pricing could be the most suitable answer for the Government as revenue from fuel duty plummets.

Experts have suggested that a form of pay-per-mile road pricing could have certain exemptions for drivers, including those who live in rural areas or motorists who drive as part of their profession.

Lord Young noted that a road pricing system could ease congestion on roads around the country and allow more people to use the railways.

Despite this, Lord Livermore emphasised that any scheme must ensure "fiscal stability", motoring remains affordable and the decarbonisation of transport is supported.

Fuel duty receipts are set to drop in the coming years as more people switch to electric vehicles

| PAHe added that the Government was already taking steps to raise money from vehicles, with electric cars now required to pay Vehicle Excise Duty (VED), which is expected to raise an additional £1.6 billion every year by the end of the Parliament.

Former BBC chief Lord Birt responded, saying: "When I worked at No 10, I led a team, which had Treasury representation, that looked at road-user charging alongside other transport issues.

"Does the minister accept that a flexible system of road-user charging could bring many benefits, such as an allocation of free mileage for the less well-off, rates set to incentivise decarbonisation and dynamic pricing to reduce peak-time congestion?"

Chancellor Rachel Reeves could revisit the topic of road pricing during the Autumn Statement, which she is set to deliver on November 26, 2025.