Pay-per-mile car taxes to impact millions of drivers as Rachel Reeves plots 'war on motorists' in Budget

The introduction of new car taxes could raise more than £1billion for the Treasury by 2031

Don't Miss

Most Read

Chancellor Rachel Reeves is being met with strong backlash amid reports that the Government is looking to introduce pay-per-mile car taxes that could impact millions of drivers.

The Chancellor will outline the Government's spending plans on November 26, which could include a 3p per mile charge for electric vehicle owners.

While the scheme is not expected to be introduced until 2028, following a consultation, drivers could be slapped with an additional charge of £250.

This is being considered as the Government braces for a huge financial hit from a drop in fuel duty receipts, as more petrol and diesel car owners transition to electric vehicles.

TRENDING

Stories

Videos

Your Say

Road pricing measures have frequently been touted as the successor to fuel duty, especially with Labour pushing ahead with its plan to ban the sale of new petrol and diesel vehicles by 2030.

From 2035, only zero emission vehicles will be sold as new, with tens of millions of British drivers potentially facing the prospect of paying by the mile.

Such a scheme has attracted controversy in recent years with concerns that professional drivers and rural motorists could be overcharged given their need to travel further and more frequently.

Speaking to GB News, Shadow Transport Secretary Richard Holden described the pay-per-mile plans as "another Labour tax grab on everyday life".

Chancellor Rachel Reeves could introduce pay-per-mile car taxes in the Budget later this month

|GETTY/PA

The Conservative MP for Basildon and Billericay said: "Britain cannot afford a Government that treats motorists as a cash machine to plug the holes in Rachel Reeves' failed economic plans.

"Families are not an ATM for Rachel Reeves, yet under Labour, everyone who relies on a vehicle is being lined up for another shakedown."

The move will be particularly unpopular with recent converts to electric vehicles, given the introduction of Vehicle Excise Duty (VED) charges earlier this year.

Electric vehicle owners previously benefited from paying zero tax, although green incentives are slowly being removed, as seen by the Congestion Charge price hike in London taking effect next month.

LATEST DEVELOPMENTS

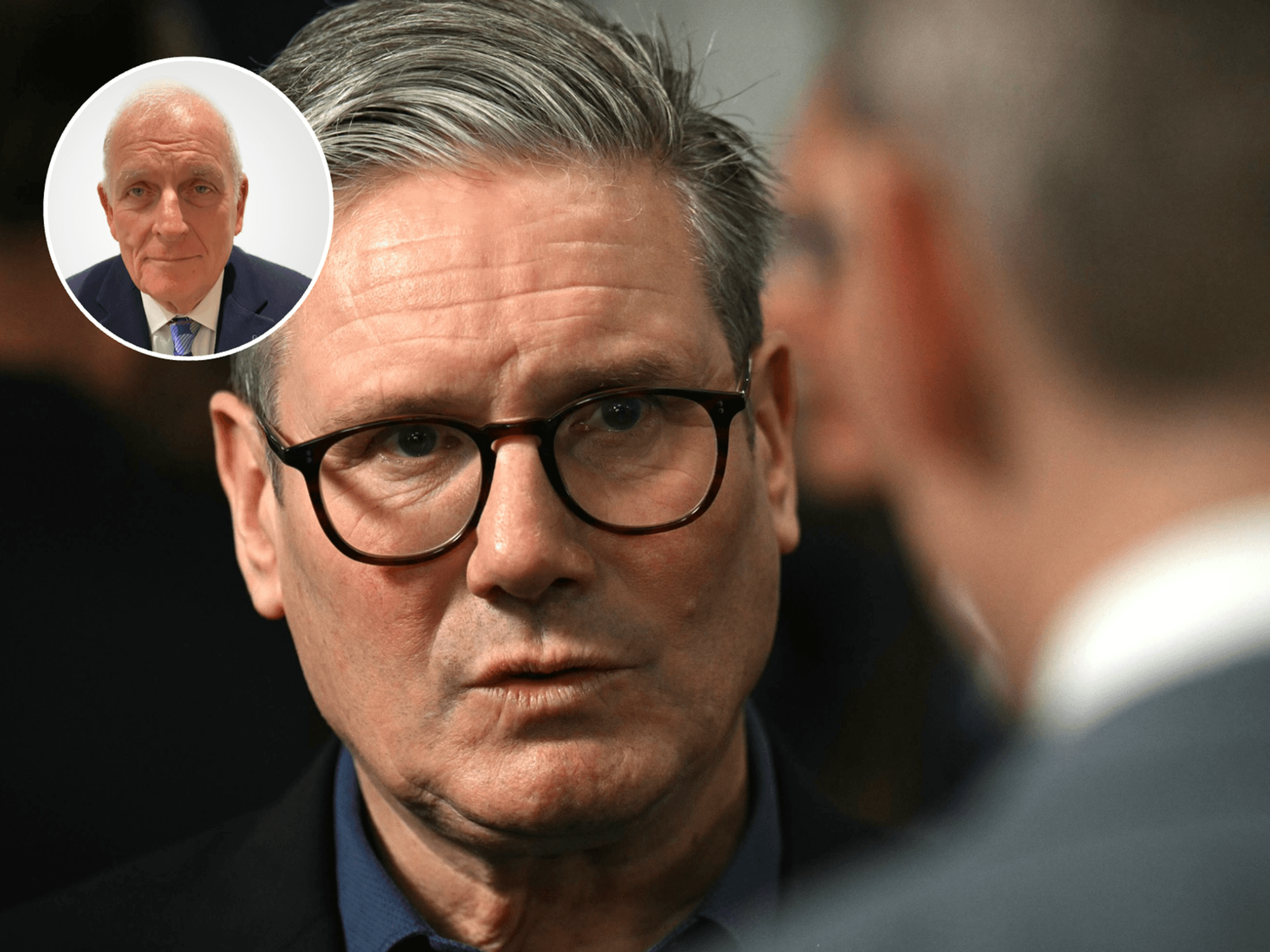

Shadow Transport Secretary Richard Holden warned that Chancellor Rachel Reeves could launch a 'tax grab' | GB NEWS

Shadow Transport Secretary Richard Holden warned that Chancellor Rachel Reeves could launch a 'tax grab' | GB NEWSThe Telegraph reported that EV owners will be asked to estimate the number of miles they drive in a year and pay a fee, with a current rate of 3p per mile being discussed.

If the owner does not travel the number of miles originally estimated, the money will be carried over to the next year. If they travel more than expected, they would be required to pay the difference.

Susan Hall AM explained that she had warned about the prospect of London Mayor Sadiq Khan introducing a pay-per-mile scheme, with the potential for the measures to be introduced nationally.

The Leader of the Conservatives in the London Assembly told GB News that politicians were "waging a war on motorists" and that the Chancellor "wants to price us all off the roads".

Susan Hall has previously warned about the threat of pay-per-mile car taxes

| PA"I feel so sorry for those who bought expensive electric cars thinking their running costs would reduce, only to be hit with pay-per-mile. But make no mistake, it will eventually be applied to us all," Ms Hall noted.

Estimates suggest that the Treasury could raise around £1.8billion by 2031 through the introduction of pay-per-mile car taxes.

Chancellor Rachel Reeves has already warned that the upcoming Autumn Budget will include policies that some people may find unpopular as the Government grapples with a funding black hole.

A Treasury spokesperson said: "The Chancellor makes tax policy decisions at fiscal events. We do not comment on speculation around future changes to tax policy."